The USD/CHF currency pair fails to hold ground above the psychological mark of 0.9000 as the US Dollar grapples with weakness in holding its recovery. Although the Federal Reserve continues to adhere to keeping interest rates unchanged, the dovish stance of the Swiss National Bank, fueled by weak inflation figures, increases the likelihood of negative interest rates. The US Dollar Index (DXY) fluctuates near the 107.00 level, capping the upside for USD/CHF. The technical indicators indicate declining bullish momentum, with the 14-week RSI dropping from the high bullish zone. A clean break above 0.9244 will open the way for a further rise, while a fall below 0.9000 might initiate a deeper slide towards significant support levels.

KEY LOOKOUTS

• A decisive fall below this level may cause further weakness, testing the crucial support levels at 0.8958 and 0.8900.

• The Federal Reserve’s choice to keep interest rates between 4.25%-4.50% favors the US Dollar but caps its upside potential.

• Weak CPI data feeds speculation of possible negative interest rates, weakening the Swiss Franc and influencing USD/CHF’s direction.

• A move above the October 2023 high may leave the way open towards the significant resistance levels of 0.9300 and 0.9342.

The USD/CHF currency pair is at a crossroads with the inability of the currency to hold on to levels above the psychological mark of 0.9000. The steady monetary policy by the Federal Reserve defends the US Dollar, but a decline in the momentum in the Dollar Index (DXY) keeps gains on a leash. While this, coupled with the dovish tone from the Swiss National Bank, fuel rumors of negative interest rates that might further soften the Swiss Franc, the pair is technically due a strong breakout above 0.9244 to continue its rally towards 0.9300 and beyond. A fall below 0.9000 may see it slide further to significant support levels of 0.8958 and 0.8900.

USD/CHF has difficulty staying above 0.9000 as the US Dollar is met with resistance and the dovish stance of the Swiss National Bank causes the Franc to weaken. Further gains may be triggered by a breakout above 0.9244, and a fall below 0.9000 can cause a deeper correction.

• The pair cannot hold gains above this psychological level as the US Dollar runs out of steam.

• Keeping interest rates at 4.25%-4.50% by the Federal Reserve favors the Dollar but caps upside.

• Soft inflation numbers add to speculation that the SNB could start negative interest rates, which would weaken the Swiss Franc.

• The DXY is unable to hold above 107.00 levels, which affect the short-term price action of the USD/CHF pair.

• A breakout above this level may signal more advancements to 0.9300 and 0.9342 levels.

• A fall below 0.9000 may initiate further weakness, challenging support at 0.8958 and 0.8900.

• The 14-week RSI is in the neutral zone, indicating that bearish momentum in USD/CHF is waning.

The USD/CHF currency pair is struggling to hold above the important psychological level of 0.9000, as the US Dollar cannot hold its advance. Though the Federal Reserve has reaffirmed its policy of maintaining interest rates unchanged at 4.25%-4.50%, the US Dollar Index (DXY) is still unstable near 107.00, capping the rally for USD/CHF. The market sentiment has also been affected by fear of future trade policies under former US President Donald Trump, and thus there is uncertainty in currency movements. At the same time, on the Swiss side, also fueling rumor has been soft inflation data that the Swiss National Bank (SNB) might drive interest rates into negative numbers in order to avoid prolonged deflation, which could weaken the Swiss Franc further in the short term.

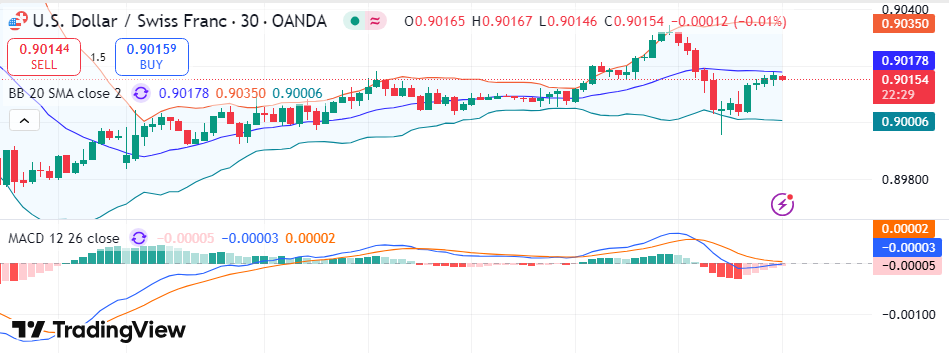

USD/CHF Daily Price Chart

TradingView Prepared by ELLYANA

The USD/CHF currency pair cannot maintain above the psychological mark of 0.9000 as the US Dollar is confronted with resistance in the face of a volatile DXY and stable Federal Reserve policy. In contrast, poor Swiss inflation figures have increased speculation that the Swiss National Bank (SNB) may drive interest rates into negative territory, further weakening the Swiss Franc.

TECHNICAL ANALYSIS

USD/CHF is in the process of consolidating, with major resistance at 0.9244 serving as a critical breakout level for additional gains up to 0.9300 and 0.9342. The 20-week Exponential Moving Average (EMA) around 0.8947 is rising, reflecting long-term bullish inclination. Yet, the 14-week Relative Strength Index (RSI) has fallen from the bullish area of 60.00-80.00 into the neutral area of 40.00-60.00, reflecting the loss of upside momentum. If the pair is unable to hold at 0.9000, it may force a downside motion towards major support levels of 0.8958 and 0.8900. A strong break above 0.9244 or below 0.9000 will set the next major trend for USD/CHF.

FORECAST

The USD/CHF pair has the potential to move up if it can break above the major resistance level of 0.9244. A clean breakout above this level may initiate a rally towards the subsequent resistance levels of 0.9300 and 0.9342. The 20-week Exponential Moving Average (EMA) still remains in an upward slope, which is an indication of a long-term bull trend. Moreover, if the Federal Reserve continues to adopt a stable interest rate policy while US economic fundamentals continue to remain robust, the US Dollar can again strengthen, driving USD/CHF upward. Any indication of additional monetary tightening or hawkish remarks from the Fed can serve as a trigger for a sustained bullish trend.

On the bearish side, a breakdown below the psychological support of 0.9000 can indicate a more severe correction in the pair. A break below this point can leave USD/CHF vulnerable to further losses, with important support points at 0.8958 and 0.8900. The 14-week Relative Strength Index (RSI) has dropped out of its bullish zone, signaling declining momentum, which will put further pressure on the pair downwards. Further, if the Swiss National Bank (SNB) does not undertake aggressive rate reductions and the Swiss Franc rises due to risk-off sentiment across the globe, USD/CHF can experience selling pressure. Any surprise US monetary policy developments or softer economic figures would also be a drag on the pair, prompting a possible downside move.