Gold prices sharply retreated by almost 5% from their all-time high of $3,500 after a shift in market sentiment following a more dovish tone from U.S. President Donald Trump on the country’s trade relationships with China and in favor of Federal Reserve Chair Jerome Powell. Trump’s comments, which suggested lower tariffs and no near-term Fed changes, sparked a risk-on rally in stocks and bonds, prompting profit-taking in the safe-haven metal. Even with the decline, analysts say gold is still in a robust long-term trend, underpinned by ongoing central bank purchases and global economic uncertainty. Technicals indicate further consolidation is likely, with key support levels closely monitored by traders.

KEY LOOKOUTS

• Look for gold price support at $3,282 and $3,167 — a breakdown below these levels may initiate deeper corrections in the near term.

• Monitor additional comments from President Trump and U.S. policymakers, as shifting rhetoric on trade and interest rates may continue to shape investor attitudes.

• Ongoing central bank gold buying to hedge currency fluctuations and diversify reserves continues as a main bullish influence for the metal.

• Gold’s RSI has pulled back from the overbought zone; a move back towards the 50 level may indicate stabilization, while a rebound might indicate reviving buying interest.

As gold backs away from its all-time peak of $3,500, investors are intently studying crucial support levels and market indicators for what comes next. The metal’s steep correction was fueled by President Trump’s diluted rhetoric on China trade tariffs and strong backing of Fed Chair Jerome Powell, which generated optimism in risk assets and prompted profit-taking in gold. Even with this pullback, gold’s long-term bullish trend is intact, underpinned by continued central bank buying and global economic uncertainty. Traders are now looking to technical levels of $3,282 and $3,167 for possible rebounds, while market sentiment remains dependent on U.S. political and economic events.

Gold prices retreated sharply from their $3,500 high after President Trump relaxed his tone on China and supported Fed Chair Powell. The reversal ignited risk-on mood, creating profit-taking in gold. The important support levels at $3,282 and $3,167 are now under focus.

• Gold price declined close to 5% from an all-time high of $3,500 due to profit-taking and changing market sentiment.

• President Trump eased the rhetoric on Chinese trade tariffs and affirmed Jerome Powell will stay on as Fed Chairman, soothing market jitters.

• The switch set off an equities and bond rally that curbed the demand for havens such as gold.

• Important support lines are $3,282 and $3,167, and resistance at levels around $3,415 and $3,464.

• Strength Index (RSI) fell from its overbought zone, leaving space for another round of correction or stabilization.

• Even with the decline, central banks remain buyers of gold as a means to hedge against financial and currency risk.

• The next direction for gold will depend on further clarity from U.S. leadership and from economic conditions around the world, which may influence gold’s direction.

Gold prices are weighed down after the change of tone among U.S. President Donald Trump, who adopted a softer approach to China’s trade relations and reiterated his backing of Federal Reserve Chair Jerome Powell. These remarks reassured investors and led to a return to riskier assets such as equities and bonds, cutting the near-term attractiveness of safe-haven assets like gold. The market interpreted Trump’s remarks as a step away from aggressive trade tactics, signaling a potential thaw in U.S.-China tensions, which had previously fueled strong demand for gold as a protective hedge.

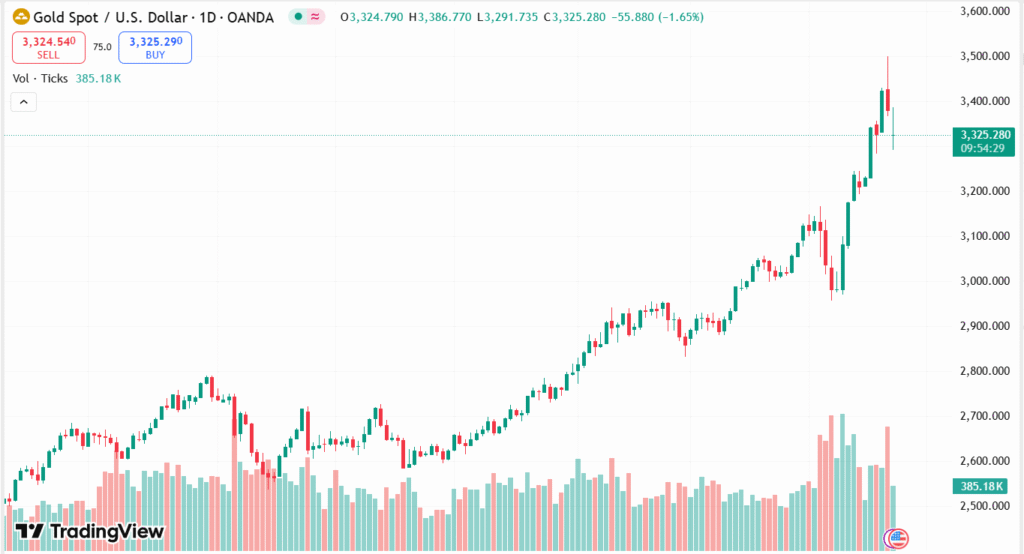

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Despite the recent sell-off, the broader sentiment around gold remains largely positive due to continued global uncertainty and geopolitical risks. Most investors continue to see gold as a long-term store of value, particularly during periods of political uncertainty and changing economic policies. Central banks are also showing keen interest in gold as they try to diversify out of conventional paper currencies. Although the short-term story is changing, gold’s function as a good hedge against volatility and uncertainty continues to underpin its attractiveness in diversified portfolios.

TECHNICAL ANALYSIS

Gold is undergoing a healthy correction after a rapid $500 rally over just eight trading days, with the Relative Strength Index (RSI) cooling from overbought territory to around 63, indicating potential for further downside toward the neutral 50 level. The immediate support zone lies at $3,282, coinciding with the April 17 low, while deeper support is seen at $3,167 — a key pivot from early April. On the plus side, resistance is at $3,415, the daily Pivot Point, then comes $3,464, which would take a strong turn-around to test. This technical configuration points to a pause or consolidation phase, and market players are likely to be waiting for renewed buying interest at lower levels or clearer macro signals before the next move.

FORECAST

Even with the recent retreat, gold’s long-term prognosis is still bullish, driven by continued global uncertainty, central bank hoarding, and lingering inflationary fears. Should risk sentiment again deteriorate—sparked by geopolitical tensions, weakening economic statistics, or renewed fears over U.S.-China trade—gold may experience a rally. A breach of the near-term resistance at $3,415 would be seen as fresh bullish momentum, likely propelling prices back toward the all-time high at $3,500. Additional gains would be triggered by central banks stepping up gold buying or dovish cues coming out of the Federal Reserve, boosting demand for safe-haven assets.

In the short run, gold can continue to be pressured by investors turning to risk assets in the wake of easing trade tensions and stable U.S. monetary policy. Technically, a breakdown below present support at $3,282 sets the stage for a more profound correction towards $3,167, a pivotal point from earlier in the month. Provided the wider market continues in its risk-on mindset and U.S. economic metrics remain strong, gold might experience muted interest, particularly if the dollar remains firm. Sellers should monitor consolidation in this band, as more weakness may come before buyers resurface at better prices.