Silver prices (XAG/USD) moved above $33.00 per troy ounce, marking gains for the second straight session, as President Donald Trump’s recent tariff threats ignited higher demand for safe-haven assets. Trump’s threat to enforce a 100% tariff on foreign-made films and indications of pharmaceutical tariffs in the weeks to come have contributed to market volatility, prompting investors into precious metals such as silver. In spite of the surging US Dollar in anticipation of the Federal Reserve’s due decision on interest rates, which is expected to remain constant, silver’s upward momentum remains unabated. The recent trade tensions combined with Trump’s pressure on the Federal Reserve for rate cuts have fueled the volatile economic market, further boosting silver’s price rally.

KEY LOOKOUTS

• President Trump’s plan to add new tariffs, such as the 100% tariff on foreign-made films and pharmaceutical tariffs, is fueling the rise in demand for safe-haven assets such as silver, which may continue to drive price actions in the near term.

• The strengthening of the US Dollar, particularly in expectation of the Federal Reserve’s next interest rate decision, may cap silver’s upside because a stronger dollar makes the metal less attractive for foreign purchasers.

• Markets are keeping a close eye on the Federal Reserve’s interest rate stance, with expectations that the Fed will leave rates steady. Any suggestions of future rate reductions or dovish comments from Chairman Jerome Powell may affect silver’s attractiveness as a hedge against economic uncertainty.

• Continuing trade tensions, especially with China, and the possibility of new agreements or negotiations that are stuck could lead to further market volatility, affecting demand for silver and other precious metals.

Silver prices are showing upward momentum, rising above $33.00 per troy ounce, led mainly by President Donald Trump’s new tariff threats. His intentions to impose a 100% tariff on foreign-made movies and future pharmaceutical tariffs have created worries, prompting investors to go for safe-haven assets such as silver. Nevertheless, the rising US Dollar in anticipation of the Federal Reserve’s decision to hold interest rates steady may curb silver’s upside, with a stronger dollar reducing the attractiveness of the metal for foreign consumers. The market is also watching trade negotiations closely, especially with China, as any news may further impact investor sentiment and silver’s price movement. With all these considerations in mind, silver’s performance continues to be very much linked to global economic uncertainties and US monetary policy changes.

Silver prices have surged past $33.00 per ounce on the back of President Trump’s tariff threats, stirring demand for safe-haven currencies. But the appreciation US Dollar and imminent Federal Reserve policy actions may clip further gains, even as persistent trade tensions continue to be a pivotal factor in shaping silver’s direction.

• Silver (XAG/USD) has surged past $33.00 per ounce, extending its rally for the second session in a row.

• President Trump’s recent announcement of new tariffs, including a 100% tariff on foreign-made films and impending pharmaceutical tariffs, has increased market uncertainty and fueled demand for safe-haven assets such as silver.

• The increasing geopolitical risks and trade tensions are pushing investors towards precious metals, particularly silver, as a hedge against market volatility.

• The US Dollar is strengthening, which may cap the price of silver since a strong dollar increases the cost of silver for foreign consumers.

• Markets are looking towards the Federal Reserve decision on interest rates, with the expectation that the Fed will not raise interest rates but will hold rates steady, while words from Chairman Jerome Powell regarding economic conditions may affect silver prices.

• Persistent trade negotiations, especially with China, are contributing to worldwide uncertainty, with any developments either pushing or holding back silver’s price action.

• In spite of the stronger US Dollar, silver’s bull trend is being sustained by continued market fears over economic stability and possible rate reductions by the Federal Reserve.

Silver prices have risen to over $33.00 an ounce as President Donald Trump’s latest tariff threats fueled the metal’s rally. These threats, such as a 100% tariff on imported films and pending pharmaceutical tariffs, have alarmed global markets, leading investors to find shelter in precious metals such as silver. With tensions in trade and geopolitical risks strengthening, silver is perceived as a safe hedge against uncertainty, attracting more attention from investors seeking a solid store of value.

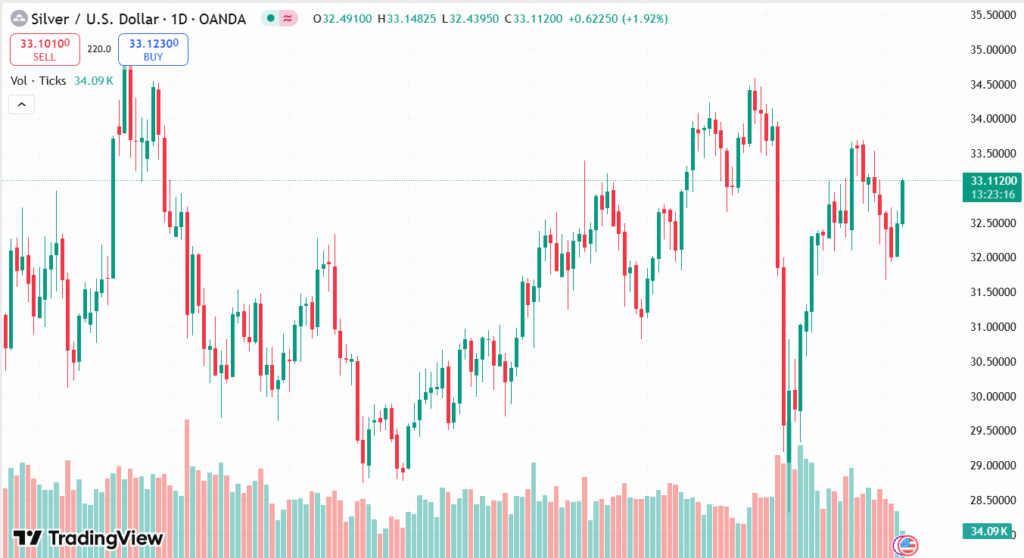

XAG/USD DAILY PRICE CHART

CHART SOURCE: TradingView

The current ambiguity over global trade talks, and especially between China and the United States, has further increased the attractiveness of silver. With President Trump still putting pressure on both the market as well as the Federal Reserve, investors are extremely keen to look for any progress that could mean changes in economic policy. It is this situation that has seen silver pick up a lot of momentum, proving to be a safe haven amid uncertainty.

TECHNICAL ANALYSIS

Silver prices have demonstrated strong bullish momentum, penetrating the $33.00 resistance level, which has acted as a strong barrier in the past. The recent rally indicates positive sentiment, with major support now located at lower price levels, around $32.00 per ounce. Trending higher is the moving averages, confirming the strength of the advance, and Relative Strength Index (RSI) in a neutral to overbought zone, indicating that silver may continue to enjoy bullish sentiment as long as market conditions are favorable. Any reversal beneath the $32.00 support, however, may portend a pullback, necessitating close observation of market conditions and shifts in sentiment.

FORECAST

Silver prices may continue to experience upward momentum if the geopolitical situation remains uncertain, especially with continued trade tensions and President Trump’s threats of tariffs. Demand for safe-haven assets such as silver will probably remain robust as investors look for protection against economic uncertainty. Moreover, if the Federal Reserve continues to be dovish or signals future rate cuts, silver may enjoy lower opportunity costs, further increasing its price. Technical indicators like significant uptrend in moving averages and resistance levels higher than $32.00 indicate that silver can go higher in the near term, potentially testing higher resistance levels higher than $34.00.

On the bearish side, silver may come under pressure if the US Dollar strengthens further, especially leading up to the Federal Reserve policy decision. A weaker dollar might also make silver higher-priced for overseas purchasers, capping its potential upside. If silver breaks below these critical levels of support, including the $32.00 mark, it could trigger a reversal or pullback, with further downside threats looming. Furthermore, if tensions in the global trade situation disappear or economic conditions worldwide improve, demand for safe-haven products like silver will likely be reduced, which could cause prices to fall. Tracking market sentiment and major technical levels will be essential in assessing potential downside risks.