West Texas Intermediate (WTI) crude oil prices stay close to $60 per barrel following a steep 4% gain, supported by softening trade tensions between large global economies. Favorable news like a trade breakthrough agreement between the US and UK and a scheduled meeting between US and Chinese officials have helped buoy oil market sentiment. Prices are, however, under pressure from OPEC+ indicating potential production hikes, and US sanctions against Chinese refiners creating additional uncertainty. Though geopolitical developments are enhancing optimism in the near term, supply-side risks remain a challenge for sustained gains in oil prices.

KEY LOOKOUTS

• Markets will be keenly observing the May 10 encounter between US Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng for any indication of forward movement on trade tensions that could impact global oil demand.

• The oil market is still wary of OPEC+ cues to raise output, which may put a lid on additional price rises despite recent positive momentum.

• Lowered tariffs between UK and US may help drive higher economic activity and energy demand and provide some positives for oil prices.

• Disruptions by sanctions to the operations of two Chinese refiners on the importation of Iranian crude can affect local supply chains and introduce volatility in global oil supplies.

WTI crude oil prices are settling around the $60 level, underpinned by relaxing global trade tensions and positive developments like the US-UK trade deal and impending US-China negotiations. These diplomatic moves have lifted market sentiment and hopes for firmer global oil demand. Yet, there are headwinds too, with OPEC+ indicating plans to increase production, which may cap further price appreciation. Also, US sanctions on lesser Chinese refiners for buying Iranian crude bring in new geopolitical uncertainty that can hamper supply chains and inject risk into the oil market outlook.

WTI crude is around $60 as relaxed US-China and US-UK trade tensions are improving market mood. But the possibility of more OPEC+ production and US sanctions on Chinese refiners can create downside risks.

• WTI crude stabilizes at around $60 following a near 4% rally on the back of declining trade tensions.

• US-China and US-UK trade news has enhanced global demand sentiment.

• Potential oil market outlook could be impacted by upcoming US-China meeting on May 10 in Switzerland.

• US-UK trade agreement involves lower tariffs, underpinning potential economic and energy demand growth.

• OPEC+ signals plans to increase production, which may cap further oil price gains.

• US sanctions on two Chinese refiners for buying Iranian crude are disrupting supply chains.

• OPEC output slightly declined in April, offset by lower production in Libya, Venezuela, and Iraq.

Global oil markets are experiencing a shift in sentiment as diplomatic efforts between major economies show signs of progress. One of the major drivers of the optimism is the de-escalation of the trade tension between China and the United States, represented by a forthcoming meeting between US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng in Switzerland. In the meantime, a fresh US-UK trade deal represents an important step, as the two nations agreed to lower tariffs on vital imports. These trends are perceived as favorable to global economic stability and energy consumption.

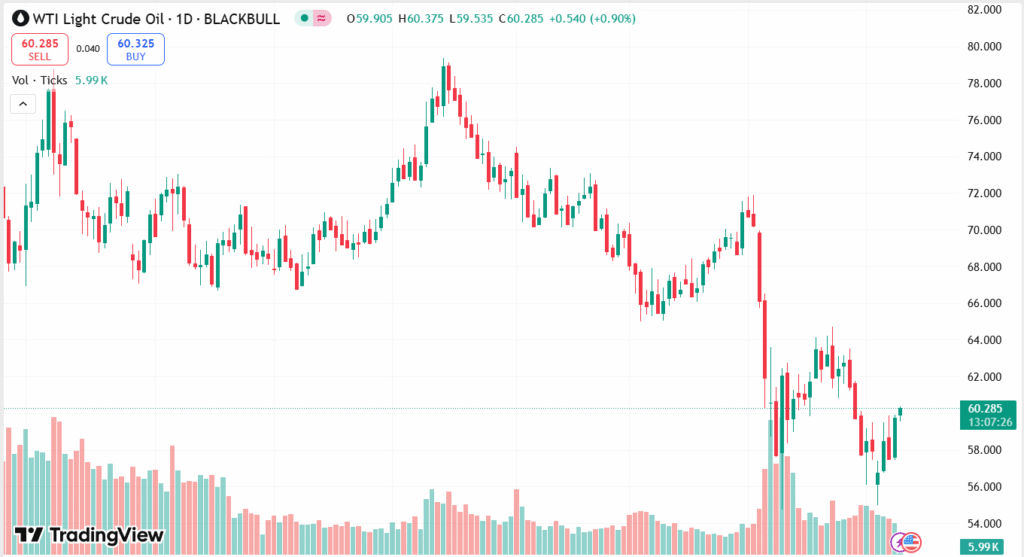

WTI Crude Oil DAILY PRICE CHART

CHART SOURCE: TradingView

Meanwhile, geopolitical forces still shape the oil environment. The United States has sanctioned two smaller Chinese refiners for allegedly buying Iranian crude, halting operations and putting further pressure on Iranian oil exports. Simultaneously, talks inside OPEC+ regarding future production strategies continue, with member nations balancing supply management under evolving global circumstances. These developments only mirror the wider dynamic of diplomacy, trade, and policymaking decisions that set the course of the oil industry today.

TECHNICAL ANALYSIS

WTI crude oil is exhibiting signs of consolidation around the $60.00 level following a sharp bullish session in the last trading session. The price is currently trading above major short-term moving averages, indicating ongoing buying interest, while momentum indicators such as RSI are in neutral-to-positive levels, showing scope for further gains if supported by underlying factors. But a breakdown in maintaining support at $59.50 could lead to a pullback, and a breakdown above $60.50 sustained might indicate further follow-through in the uptrend.

FORECAST

WTI crude oil is likely to experience increased upward momentum if diplomatic gains among key economies persist, especially in the form of successful trade negotiations between the US and China. A persistent recovery in global economic sentiment can fuel demand recovery, providing impetus for increasing oil prices. Also, any hesitation or unwillingness within OPEC+ to raise planned production can reduce supply, and as a result, can push the price higher than the level of $60.50 resistance. A breakthrough above this zone can send the price higher to the $62–$63 region in the near term.

To the negative, oil prices are still at risk to supply-side pressures, particularly if OPEC+ intends to pursue planned output increases. Higher output could result in a market that’s oversupplied, pushing prices down. Moreover, any delay in trade negotiations or increased geopolitical tensions—e.g., heightened US sanctions or interruptions to oil flows—can erode market confidence. Technically, should WTI close below the $59.00 support, it can lead to a further correction towards the $57.50–$58.00 range.