Gold prices keep on falling as a relaxation of US-China trade tensions and shrinking hopes of aggressive Federal Reserve rate cuts cut down the demand for the safe-haven asset. The temporary agreement on trade and evidence of economic resilience in the US has lifted Treasury yields, further pressuring non-yielding gold. In spite of recurring geopolitical tensions and a weaker sentiment in equity markets, XAU/USD touched its lowest mark since early April, breaching important technical levels of support. Investors now eye the forthcoming US Producer Price Index data and Federal Reserve Chair Jerome Powell’s speeches for new cues, as gold’s outlook stays firmly bearish.

KEY LOOKOUTS

• Due for release later today, the PPI will provide clues on inflation trends and impact the Fed’s monetary policy direction going forward, affecting gold prices.

• Traders will be attentive to Powell’s remarks for hints on the rate cut path, which may influence market sentiment and determine USD and gold price direction.

• Increasing yields are still putting pressure on non-yielding assets such as gold. A sustained rally might help amplify bearish momentum in XAU/USD.

• Escalating tensions in the Middle East and actions in the Ukraine-Russia conflict might provide minimal support to gold, but so far, these have not been adequate to turn around the current selling sentiment.

Market participants must closely monitor a few important factors driving gold prices in the short term. The release of upcoming US Producer Price Index (PPI) numbers and a speech by Federal Reserve Chairman Jerome Powell are slated to provide fresh views on inflation and monetary policy that could markedly shift market mood. Moreover, a continued up move in US Treasury yields has kept non-yielding assets such as gold firmly in the dovish camp. Although geopolitical threats, such as tensions in the Middle East and the Ukraine-Russia conflict, continue to exist, they have not so far been contributing positively to gold prices amidst prevailing macroeconomic forces.

Gold prices are still under pressure as declining US-China trade tensions and lowered Fed rate cut hopes push investors out of safe-haven assets. Upcoming US PPI and speech by the Fed Chair Powell are major events that could dictate the next direction in XAU/USD. Higher bond yields and technical breakdowns also add to the bearish scenario.

• Gold prices fell to $3,135, the lowest since April 10, under persistent selling pressure.

• US-China trade optimism cut safe-haven demand, as a 90-day tariff ceasefire put recessionary fears aside.

• Fed rate cut expectations have fallen, and markets are now pricing in just about 50 basis points of easing this year.

• Increasing US Treasury yields continue to pressure gold, which does not pay any yield and loses attractiveness in a rising rate environment.

• Middle East and Ukrainian geopolitical tensions remain but have not managed to trigger a significant gold price rebound.

• Technical levels of importance were broken, such as the $3,200 level and the 61.8% Fibonacci retracement, indicating further potential downside.

• Market attention turns to US PPI numbers and Fed Chair Powell’s speech, which may be the next directional driver for XAU/USD.

Gold prices are under persistent pressure as overall market sentiment moves out of safe-haven assets. The recent de-escalation of US-China trade tensions has gone a long way in damping investor worries of a global slowdown. A temporary tariff truce for 90 days and encouraging signs from both governments have helped instill confidence again, leading to a shift towards risk assets and away from gold. Meanwhile, more robust-than-anticipated US economic data have prompted traders to temper expectations of aggressive Federal Reserve interest rate cuts, diminishing gold’s attractiveness in the present climate.

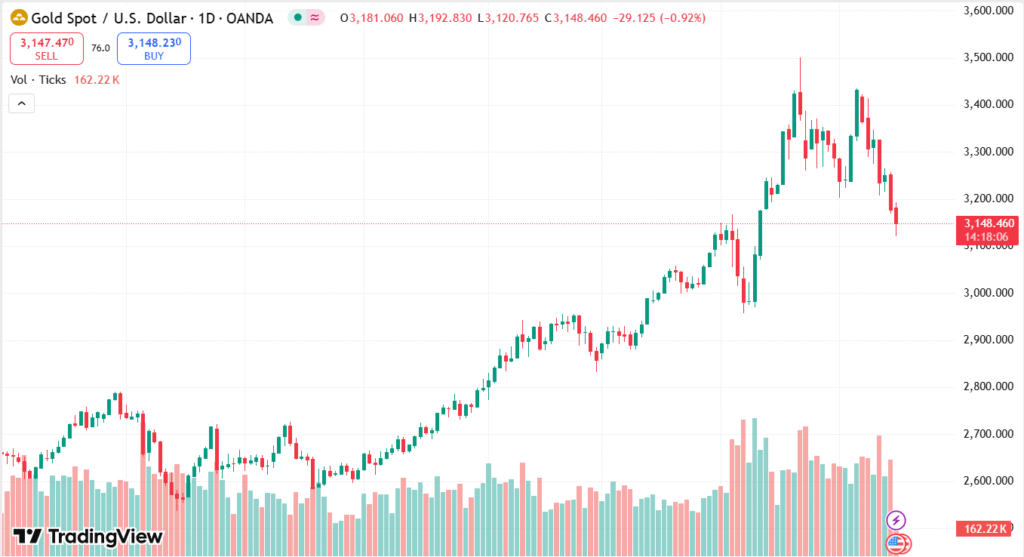

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Apart from the better trade prospects, words from a number of Federal Reserve officials indicate a conservative, wait-and-see stance on future rate actions. They recognized advancements in moving inflation towards the 2% level and stressed more data before adjusting policy further. Although geopolitical tensions — such as those in the Middle East and Eastern Europe — are still in focus, they have had modest effects on investors’ behavior recently. All attention is therefore focused on future US economic data and Federal Reserve commentary, which might influence the prospects for both monetary policy and demand for gold in the coming weeks.

TECHNICAL ANALYSIS

Gold has fallen below important support levels and this signifies a prolongation of the downtrend. The decline below the $3,200 level and the 61.8% Fibonacci retracement of April’s upswing signifies that selling pressure is building. Daily chart oscillators are also becoming negative, supporting the likelihood of continued downside. Intraday support is at the $3,135–$3,133 range, and a clean break below this level would allow access to the $3,100 target and beyond towards $3,060. Upwardly, any rebounding attempts will continue to meet resistance around $3,170, stronger around $3,200 and $3,230, which should limit gains unless sentiment shifts.

FORECAST

If gold can recapture momentum, a rally may first aim at the $3,170 resistance level, then a possible retest of the $3,200 level. A breakout above this level may set the stage for a further bounce towards $3,230, which is situated at the 50% Fibonacci retracement level. A close above this level may spark renewed buying interest, driving gold towards $3,265 and potentially the $3,300 psychological level. But any positive is likely to be received with suspicion unless dovish Federal Reserve rhetoric is firmly in place or global risk aversion sharply worsens.

To the downside, further selling pressure may push gold beneath near-term support at $3,135–$3,133. A firm break here would most probably hasten the fall toward the $3,100 level. If bearish momentum continues, the next significant support is at $3,060, a threshold that may prove to be a firmer bottom unless wider economic or geopolitical factors bring renewed stress. With the existing bearish technical configuration and macroeconomic headwinds in place, risk remains skewed to the downside absent some catalyst over the near term in the form of data or Fed commentary shifting market expectations.