Gold prices have experienced modest intraday losses on Friday as renewed optimism surrounding the transitory US-China trade truce trimmed safe-haven demand. Nevertheless, the downside is contained as diminishing US economic data fuels the view of additional Federal Reserve rate reductions, which keeps the US Dollar weak and buoying non-yielding assets such as gold. Continuing geopolitical tensions, such as rising violence in Gaza and shaky peace negotiations between Russia and Ukraine, also underpin gold’s support. Technically, gold continues to be range-bound with major resistance at $3,255 and support at $3,177, while investors wait for a clearer directional cue.

KEY LOOKOUTS

• Developments or reversals in the 90-day trade ceasefire could exert a major influence on safe-haven demand and shape gold prices.

• Further Federal rate cuts now market bets on weak US economic data to hold firm, underpinning gold by depressing the USD and Treasury yields.

• Mounting tensions in Gaza and also ambiguous results from Russian-Ukrainian talks for peace could maintain safe-haven interest in gold.

• The key resistance is still at the $3,252–$3,255 area, while support is close to $3,178 and $3,120. A move above either of these levels could decide the next direction.

Gold dealers need to keep a close watch on events on several fronts. The 90-day US-China trade ceasefire still is bearing down on safe-haven demand, but any indication of breakdown would restore bearish sentiment very fast. Meanwhile, dovish hopes from the Federal Reserve, following weaker US inflation and retail numbers, should continue to keep the US Dollar and Treasury yields under stress, supporting non-yielding assets such as gold. Geopolitical threats, especially in Gaza and Eastern Europe, continue to stay high and may trigger fresh demand for security. Technically, gold has to convincingly break above resistance at around $3,255 to make a move towards $3,300 possible, while persistent weakness below $3,177 may leave the metal vulnerable to further declines towards $3,120 and $3,100.

Gold prices are still under pressure from US-China trade optimism but are supported by dovish Fed expectations and escalating geopolitical tensions. Watch resistance at $3,255 and support at $3,177 levels. A breakdown on either side can set up the next short-term trend.

• Gold is seeing modest intraday losses as demand for safe-haven is pressured with US-China trade truce optimism.

• Lower US economic indicators, such as PPI and CPI, have supported expectations of additional Fed rate cuts.

• US Dollar is still weak, as decreasing Treasury yields cap its rally, indirectly favoring gold.

• Geopolitical tensions remain in place, with Gaza conflicts and Russia-Ukraine peace talks at a standstill upholding demand for gold.

• Technical resistance at $3,252–$3,255 needs to be overcome for the prospect of a rally up to $3,300.

• Support at $3,178 is nearest, with a further fall potentially reaching $3,120 and $3,100.

• Market players are hesitant, waiting for firm directional signals as mixed economic indicators and geopolitical tensions prevail.

Gold prices remain under pressure as confidence about the temporary US-China trade ceasefire diminishes the need for safe-haven assets. The 90-day tariff cease-fire agreement calmed fears of an impending global slowdown in economic growth. This improved mood has shifted attention among investors to riskier assets, short-term undermining gold’s attractiveness. Furthermore, hints of breakthroughs in trade negotiations with other major economies such as India, Japan, and South Korea have further strengthened market optimism.

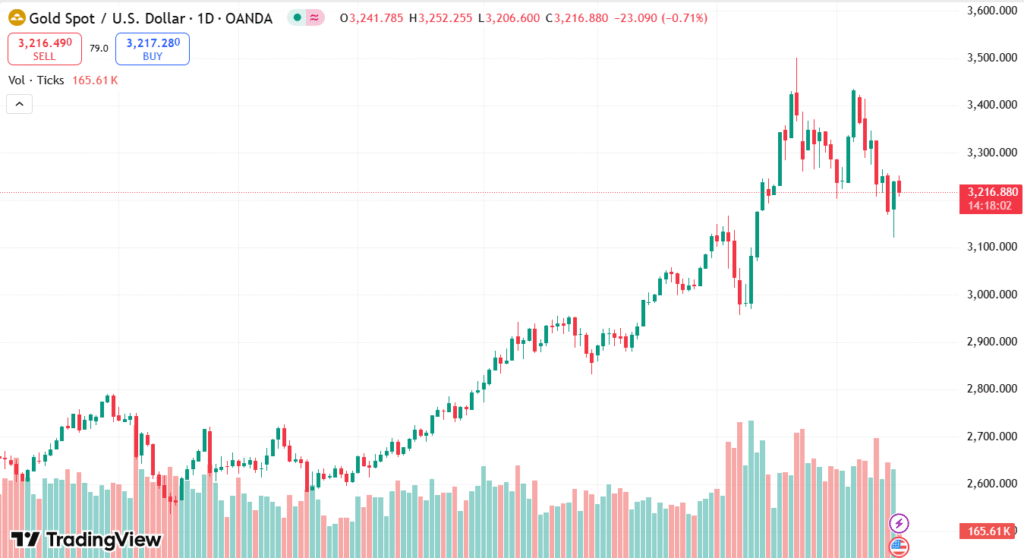

XAU/USD DAILY PRICE CHART

CHART SOURCE: TradingView

This notwithstanding, a number of underlying factors continue to underpin gold’s hedge function. Ongoing geopolitical tensions, led by the deepening Gaza conflict and the frozen Russia-Ukraine peace talks, keep global uncertainty high. Meanwhile, softer-than-anticipated US economic figures have made the argument for additional cuts in interest rates by the Federal Reserve even more compelling. This has depressed the US Dollar and Treasury yields, indirectly buttressing gold’s appeal on the bigger market platform.

TECHNICAL ANALYSIS

Gold’s latest attempt at rebounding failed at the doorstep of a critical resistance band of $3,252–$3,255, a sign of insufficient bullish pressure. The momentum indicators on the daily graph still show weakness, reflecting caution among the traders. On the downside, a break below the $3,200 price level may trigger selling pressure, with support potentially found around the $3,178–$3,177 zone. A persistent push past the zone of resistance is required to validate a change in attitude and set the stage for a more pronounced bull trend.

FORECAST

Gold can rebound with a bullish trend if tensions on the geopolitical front continue to rise or if the next round of US economic news keeps indicating a weakening economy. A continued dovish stance from the Federal Reserve, coupled with declining Treasury yields and a softer US Dollar, might propel renewed demand for non-yielding yellow metal. If investor appetites revert to safe-haven assets, gold might experience steady gains if market uncertainty continues to be high owing to international conflicts or stalled worldwide negotiations.

Conversely, any substantial advancement in global trade talks—especially a lasting agreement between China and the US—may lessen demand for gold as a protective hedge against uncertainty. Moreover, if US economic statistics surprise the upside, Fed rate cut hopes in the markets might soften, lifting the US Dollar and Treasuries, thereby putting a dampener on gold prices, particularly in the absence of instant geopolitical shocks that could lead to a deeper near-term correction.