Pound Sterling rallied to about 1.3580 versus the US Dollar as the Greenback lost ground following disappointing US economic data and escalating tariff tensions. US President Trump’s recent move to impose doubled steel and aluminum tariffs at 50% has raised uncertainty, affecting business confidence and labor market confidence in the US. In the meantime, the Bank of England continues to have a conservative, gradual stance towards monetary policy in the face of inflationary worries, underpinning the Pound’s resilience. Enduring trade talks between China and the US and near-term US employment data continue to be major drivers of the GBP/USD pair’s immediate outlook.

KEY LOOKOUTS

• The ramifications of US tariffs on steel and aluminum for economic growth and inflation expectations.

• Bank of England’s monetary policy direction and any interest rate signals amidst inflationary stress.

• Development and progress in US-China trade negotiations that may have an impact on global market sentiment.

• Imminent US Non-Farm Payroll (NFP) data release that may fuel volatility in the GBP/USD currency pair.

The Pound Sterling remains resilient against the US Dollar as the latter is under pressure from poor economic figures and rising trade tensions. The recent increased imposition of US tariffs on steel and aluminum has risen uncertainty in the US market, causing wary business sentiment and weakened manufacturing growth. In the meantime, the Bank of England’s vow to slow and steady monetary growth underpins the strength of the British currency in the face of steady labor conditions and ongoing inflation issues. With pivotal events like the US Non-Farm Payroll report and continued US-China trade negotiations on the horizon, market participants remain vigilant for elements that may continue to impact the GBP/USD exchange rate.

The Pound Sterling is strengthened against the US Dollar on weak US economic statistics and escalating tariff tensions. The Bank of England’s conservative monetary policy also provides further strength to the Pound as markets wait for crucial US employment statistics and trade updates.

• Pound Sterling rises to approximately 1.3580 against the US Dollar on US economic weakness.

• US tariffs on steel and aluminum were doubled to 50%, triggering inflation and economic growth concerns.

• Weak US ADP Employment Change and ISM Manufacturing PMI figures weigh down on the US Dollar.

• Bank of England adopts a gradual and prudent monetary policy in the face of inflation pressures.

• Ongoing US-China trade negotiations create uncertainty in global markets and currencies.

• GBP/USD has vital support close to 1.3434 with bulls being underpinned by technical indicators.

• The upcoming US Non-Farm Payroll release likely to be a market mover for the GBP/USD currency pair.

The Pound Sterling has been strong against the US Dollar in recent times, primarily due to a string of poor economic releases from the US and increasing trade tensions. The US economy has been affected by the move by President Trump to raise tariffs on steel and aluminum imports, resulting in uncertainty for manufacturers and a slowdown in business. The action, which was to stimulate domestic production, has brought worries about potential hikes in inflation and has added to pressure on the Federal Reserve’s policy. While that is happening, the Bank of England has also adopted a conservative strategy, targeting gradual monetary growth as it balances inflationary forces and a steady labor market in the UK.

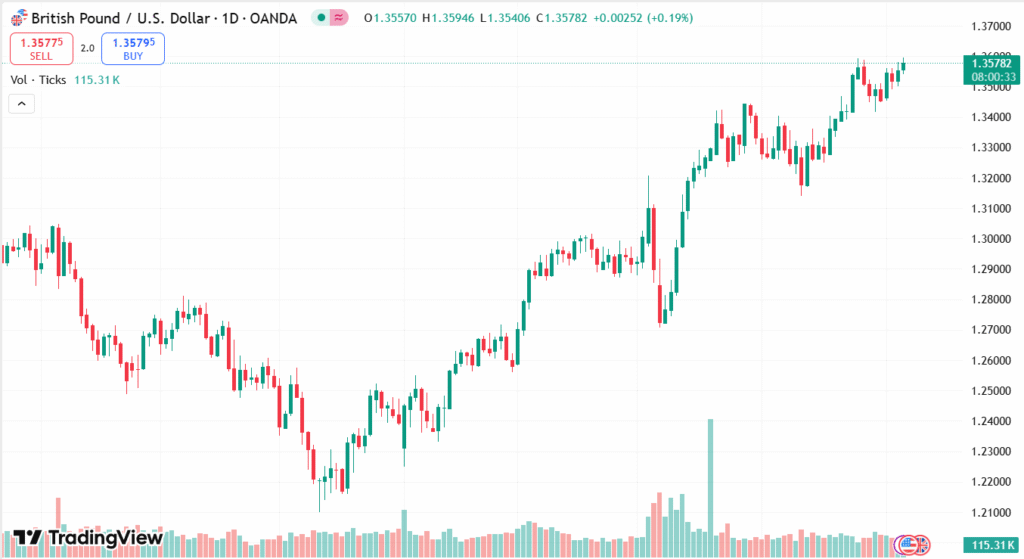

GBP/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Compounding market uncertainty is the US-China trade talks that have continued to go back and forth with each side engaging in aggressive posturing. Whereas President Trump has signaled that a deal will be challenging to achieve, there are indications of resumed talks that give hope of finding a solution. This context, combined with anticipation of future US employment figures, has put the Pound on a firmer footing against the US Dollar. Investors are keenly interested in these events, as they will probably influence the short-term trajectory of the GBP/USD currency pair and sentiment across the economy.

TECHNICAL ANALYSIS

GBP/USD currency pair is exhibiting a strong bullish trend as it hovers around the 1.3580 level, which is being bolstered by the 20-day Exponential Moving Average (EMA) of 1.3443. The Relative Strength Index (RSI) continues to hold above 60, reflecting continuous buying pressure. Major resistance is present at the January 13, 2022 high of 1.3750, which may serve as an obstacle if the pair keeps rising. The flip side, however, is that the 20-day EMA provides good support, ensuring the present rising trend is maintained with improved market sentiment.

FORECAST

The short-term forecast for the Pound Sterling versus the US Dollar is still cautiously positive, with the possibility of further appreciation provided the US economic news continues to disappoint and tariff jitters remain. And if the next US Non-Farm Payroll (NFP) report shows softer-than-expected job growth, the Pound may strengthen further, potentially reaching resistance at 1.3750. Further uncertainty regarding US-China trade negotiations may also support the Pound as investors look for stability in a period of global trade risks.

But the pair might come under downward pressure if the US releases more robust economic data than expected or if trade tensions relax unexpectedly and trigger a rebound in the US Dollar. Any hint from the Bank of England that monetary policy easing might slow down could also weigh on the Pound. The key support points to monitor are the 20-day EMA around 1.3440, which may act as a buffer against falling prices if bearish momentum unfolds.