NZD/USD pair surged to near 0.6050, supported by easing trade tensions between the United States and China, as both sides agreed to resume trade negotiations. The New Zealand Dollar strengthened amid a weaker US Dollar, which faced downward pressure partly due to a technical correction. Meanwhile, robust US jobs data for May, including stronger-than-expected Nonfarm Payrolls and steady unemployment, tempered expectations of aggressive Federal Reserve rate cuts, limiting the Dollar’s downside. Market watchers also noted forecasts from Citigroup predicting several rate cuts later this year and into early 2026, adding complexity to the currency outlook.

KEY LOOKOUTS

• Upcoming trade talks in London between US Treasury Secretary Scott Bessent and Chinese officials, which could further ease or escalate trade tensions.

• The Federal Reserve’s monetary policy decisions, especially any signals about interest rate cuts or holds in the coming months.

• Future US employment reports, including Nonfarm Payrolls and unemployment data, which will influence Fed rate expectations and USD strength.

• Technical price levels around 0.6050 for NZD/USD, which may act as resistance or support depending on market momentum.

The NZD/USD pair has gained momentum amid positive developments in the US-China trade relationship, with high-level meetings set to resume negotiations aimed at resolving ongoing disputes. This diplomatic progress, combined with a softer US Dollar influenced by a technical correction and strong US employment data, has boosted the New Zealand Dollar’s appeal. While the robust labor market data suggests the Federal Reserve may hold interest rates steady in the near term, market expectations for rate cuts later this year keep investors cautious. Overall, the interplay between trade dynamics and monetary policy will be critical in shaping the NZD/USD trajectory in the coming weeks.

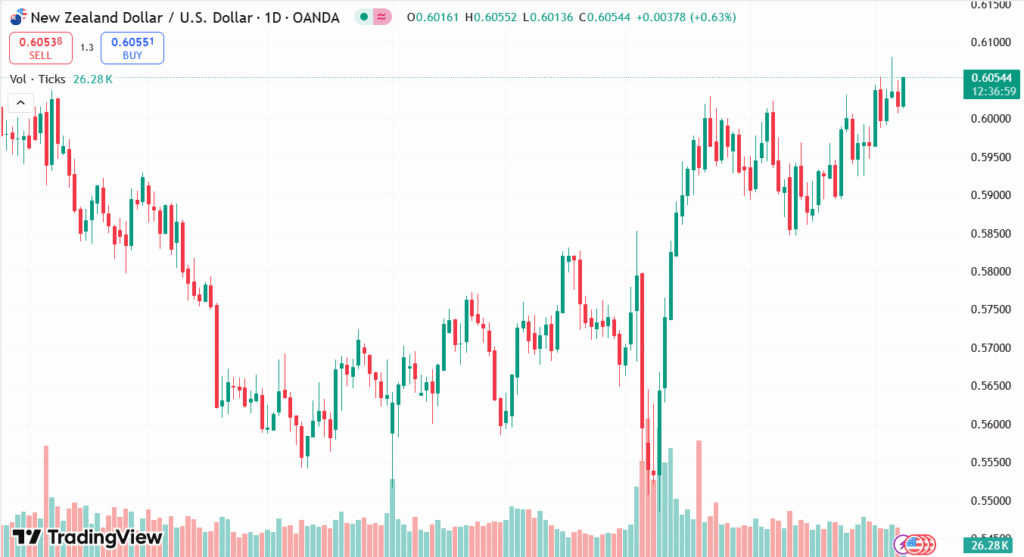

NZD/USD climbed close to 0.6050, supported by easing US-China trade tensions and a weaker US Dollar. Strong US jobs data tempered expectations for immediate Fed rate cuts, keeping the pair’s outlook balanced.

• NZD/USD surged near 0.6050 amid easing US-China trade tensions.

• US Treasury Secretary Scott Bessent is scheduled to meet Chinese officials in London to resume trade talks.

• The New Zealand Dollar strengthened as the US Dollar declined partly due to technical correction.

• Strong US May jobs data, including 139,000 new Nonfarm Payroll jobs, boosted confidence in the US labor market.

• The Unemployment Rate remained steady at 4.2%, with Average Hourly Earnings unchanged at 3.9%.

• Federal Reserve expected to keep rates unchanged in June, but Citigroup forecasts multiple rate cuts starting September 2024.

• Future trade negotiations and US employment data remain key factors influencing NZD/USD direction.

The NZD/USD currency pair has experienced a notable rise, primarily driven by positive developments in the trade relationship between the United States and China. Recent discussions between the two nations have sparked hopes for a resolution to the ongoing trade dispute, with high-level meetings scheduled to continue efforts toward an agreement. This easing of trade tensions has provided significant support to the New Zealand Dollar, reflecting growing investor confidence in the region’s economic outlook.

NZD/USD DAILY PRICE CHART

CHART SOURCE: TradingView

At the same time, the US labor market has demonstrated resilience, with May’s employment figures exceeding expectations. This strength in the job market has contributed to a more cautious stance regarding changes to US monetary policy in the near term. Although the Federal Reserve is widely expected to hold interest rates steady at its upcoming meetings, forecasts of potential rate cuts later this year add an element of uncertainty. Overall, the combination of improved trade relations and a solid US economy is shaping a complex environment for the NZD/USD pair.

TECHNICAL ANALYSIS

NZD/USD’s recent surge toward the 0.6050 level marks a key resistance zone that traders will be watching closely. The pair has recovered from previous losses, supported by bullish momentum and a weakening US Dollar. Moving averages are beginning to align in favor of the bulls, while key support levels near 0.6000 provide a safety net for further upside. However, a sustained break above 0.6050 would be needed to confirm continued strength, whereas failure to hold above this level could see the pair retreat to lower support zones. Technical indicators suggest cautious optimism but highlight the importance of monitoring price action around these critical levels.

FORECAST

The near-term outlook for NZD/USD appears cautiously optimistic, with the pair likely to test and potentially break above the 0.6050 resistance level if positive momentum from easing US-China trade tensions continues. Further progress in trade negotiations could boost investor confidence and provide additional support to the New Zealand Dollar. Moreover, if the US Dollar remains under pressure due to softer-than-expected economic data or shifts in Federal Reserve policy expectations, the NZD/USD pair may see further gains.

Conversely, downside risks remain if trade talks falter or if stronger-than-expected US economic data reinforces the case for a more hawkish Federal Reserve stance. In such a scenario, the US Dollar could strengthen, putting pressure on the NZD/USD pair to retreat toward support levels around 0.6000 or lower. Market participants should watch key upcoming data releases and geopolitical developments closely, as these will play a critical role in determining the currency pair’s direction in the medium term.