EUR/USD pair has reversed earlier losses, moving back above 1.1420, as investor confidence in the US Dollar wanes amidst ongoing, complex US-China trade negotiations. While positive remarks from President Trump initially offered some USD support, market participants remain cautious, awaiting concrete progress on challenging issues like rare earths and chip exports. Simultaneously, the Euro is finding support from positive Eurozone data, including a significant improvement in the Sentix Investors’ Confidence Index and hawkish comments from ECB officials, along with better-than-expected Italian Industrial Output. The pair is expected to remain within its recent trading range as the market awaits further developments from the trade talks.

KEY LOOKOUTS

• The specifics and timeline of any resolution to the ongoing trade discussions will be crucial, as a breakthrough could boost risk sentiment and the US Dollar, while prolonged impasses could weigh on it.

• Following their recent rate cut, any further signals from the ECB regarding the pace or pause of future monetary policy adjustments, particularly in light of evolving inflation data, will significantly impact the Euro’s trajectory.

• Continued strength in Eurozone economic indicators, such as consumer confidence and industrial output, will be essential to sustain the Euro’s current support. Any signs of weakening could shift sentiment against the currency.

• The release of US Consumer Price Index (CPI) data will be a key determinant for Federal Reserve policy expectations and, consequently, the strength of the US Dollar.

EUR/USD pair is currently experiencing a rebound, trading above 1.1420, driven by a confluence of factors: waning confidence in the USD due to the intricate and drawn-out US-China trade negotiations, coupled with renewed strength in the Eurozone. Though early supportive statements from US President Trump over the trade talks provided some temporary boost to the dollar, the market is still guarded with respect to the complicated issues in question, including rare earths and chip export bans, which require high concession from both parties. Simultaneously, the Euro is gaining traction from favorable economic data, including a notable improvement in the Sentix Investors’ Confidence Index for June, turning positive for the first time in a year, alongside hawkish remarks from ECB officials and better-than-expected Italian Industrial Output figures. As a result, the pair is expected to largely remain confined within its recent trading ranges as investors await definitive outcomes from the ongoing trade discussions.

The EUR/USD has reversed earlier losses, climbing above 1.1420 as waning confidence in the US Dollar, stemming from complex US-China trade talks, converges with growing optimism for the Euro. This Euro strength is fueled by positive Eurozone investor confidence and hawkish comments from ECB officials. The pair is likely to remain range-bound as markets await concrete developments from the trade negotiations.

• The pair has retraced previous losses, moving back above 1.1420.

• Confidence in the US Dollar is declining due to ongoing US-China trade talks.

• While some positive remarks exist, investors are awaiting concrete progress on “thorny issues” in US-China trade.

• The Sentix Investors’ Confidence Index in the Eurozone significantly improved in June, turning positive for the first time in a year.

• Comments from ECB officials (Olli Rehn and Francoise de Villeroy) have reinforced a hawkish stance.

• Italian Industrial Output advanced against expectations, further supporting the Euro.

• The pair remains within recent trading ranges as investors are reluctant to place large directional bets until trade developments become clearer.

The current market environment sees the Euro regaining some ground against the US Dollar, influenced by shifting sentiment around global trade. While initial reports hinted at constructive discussions between the US and China, the complexities of reaching a comprehensive trade agreement appear to be creating some uncertainty, causing a re-evaluation of the US Dollar’s recent strength. Investors are taking a more cautious stance, patiently awaiting clear signals about the path forward for the world’s two largest economies, especially concerning challenging areas like rare earth minerals and technology exports.

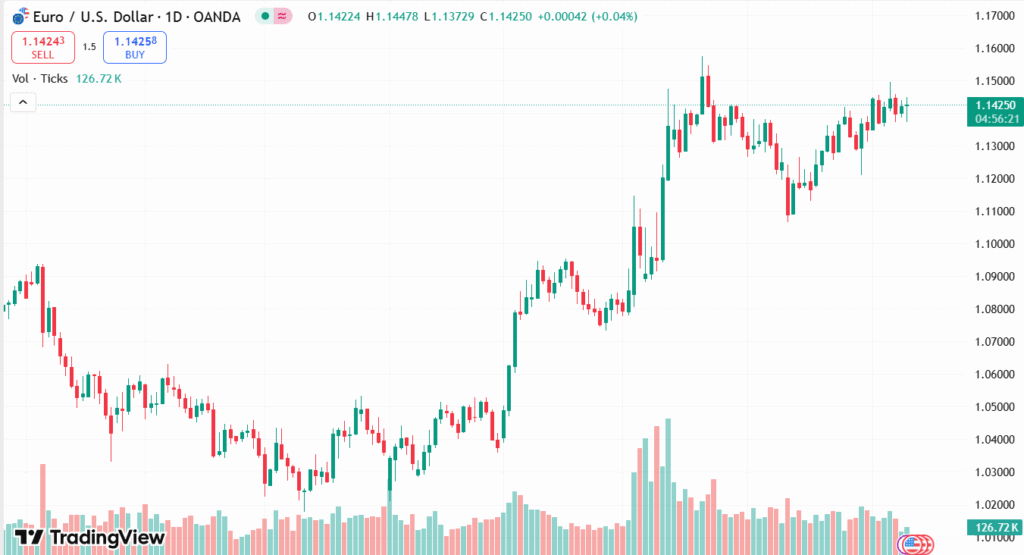

NZD/USD DAILY PRICE CHART

CHART SOURCE: TradingView

In parallel, the Euro is finding its own foundation for support from within its own region. Recent economic data from the Eurozone has shown encouraging signs, notably with a significant improvement in investor confidence. This positive sentiment is further bolstered by statements from European Central Bank officials, indicating a more attentive approach to monetary policy in the future. Combined with solid industrial output figures from Italy, these developments collectively contribute to a more favorable outlook for the Euro at this time.

TECHNICAL ANALYSIS

EUR/USD pair has seen a notable reversal, climbing back above the 1.1420 level and holding within a recent trading range. This consolidation suggests that while bulls have found a footing, they are currently encountering resistance, preventing a clear breakout. The price action indicates a battle between buyers and sellers around these levels, with investors awaiting a decisive catalyst—likely from the ongoing US-China trade talks—to establish a new directional trend. Key support and resistance levels within this range will be closely watched, as a clear break above or below these points could signal the next significant move for the pair.

FORECAST

Euros could continue to rally against the Greenback if a truly meaningful and comprehensive breakthrough in the US-China trade negotiations becomes material. Any deal that leads to a resultant substantially large cut or removal of tariffs is likely to boost the risk appetite at the world level, reduce demand for safe haven USD, and encourage capital flows to more growth-sensitive currency like Euro. Additionally, sustained positive momentum in Eurozone economic data, particularly if inflation figures remain elevated but growth continues to show resilience, could lead the European Central Bank (ECB) to adopt a more hawkish stance than currently anticipated. If the ECB signals fewer rate cuts or even a pause in its easing cycle, this would significantly bolster the Euro.

Conversely, the EUR/USD pair faces downside pressure if the US-China trade talks stall or completely break down. The current “thorny issues” like rare earths and chip exports could prove difficult to resolve, leading to prolonged uncertainty or even an escalation of trade tensions. Such a scenario would likely trigger a flight to safety, strengthening the US Dollar as a traditional safe-haven asset. Furthermore, any signs of weakness in Eurozone economic indicators, or a more dovish pivot from the ECB – perhaps in response to persistent low inflation or a renewed slowdown in growth – could lead to further Euro depreciation. The market will also closely monitor upcoming US economic data, especially inflation figures, as stronger-than-expected readings could solidify expectations for the Federal Reserve to maintain higher interest rates for longer, further supporting the USD.