AUD/USD exchange rate remains close to the 0.6500 level as sentiment in the markets becomes guarded in the run-up to important US economic releases. Although initial expectations of a US-China trade agreement provided short-term relief to the Australian Dollar, diminishing faith in the permanence of the deal has resumed selling pressure. Meanwhile, a softer US Dollar is capping the downside for the Aussie. Traders now look to the release of US Consumer Price Index (CPI) and a large 10-year Treasury Bond auction, both of which are likely to bring better guidance on the greenback and determine the next direction of the AUD/USD pair.

KEY LOOKOUTS

• Traders are closely monitoring the release of US Consumer Price Index data due out, with hopes of a modest increase in inflation having a potential influence on Federal Reserve policy and USD strength.

• The $39 bln 10-year Treasury auction may tell us about investor faith in US fiscal soundness, with thin demand perhaps adding further pressure on the US Dollar.

• There is still doubt over the long-term viability of the recent US-China trade deal, especially with regards to rare earth metals and tariffs, that may affect risk sentiment and commodity currencies such as the Aussie.

• The pair is probing important psychological support around 0.6500; any drop below this level may unveil additional downside, while holding here may prompt short-term re-covering contingent on US data results.

Australian Dollar traded weakly as dimming hopes for the preliminary US-China trade accord dragged market sentiment lower. While initial news of the agreement to roll back curbs on rare earth metals and lower tariffs initially boosted risk appetite, failure to provide tangible details has caused investors to doubt its sustainability. In the meantime, the US Dollar’s recent retreat has forestalled further losses for the Aussie and kept the AUD/USD pair close to the 0.6500 level. Market players now begin focusing on the next US CPI report and Treasury Bond auction, which are likely to be pivotal in setting the near-term direction of the currency pair.

The AUD/USD currency pair is trading around 0.6500 as markets wait for significant US economic releases. Dwindling faith in the US-China trade agreement has contained the gains in the Aussie, while a soft US Dollar provides some support. The release of US CPI and upcoming Treasury auction should determine the next course.

• AUD/USD trades around 0.6500 in conservative market mood.

• US-China trade deal optimism in early stages gives way to disappointment due to insufficient clear details.

• Soft US Currency keeps the Australian Dollar from its deeper losses.

• US Dollar Index withdraws back below 99.00 following recent highs.

• Traders look for US CPI numbers, which are likely to reveal a slight increase in inflation.

• A $39 bln US Treasury 10-year bond sale can dictate USD sentiment.

• Major support for AUD/USD is at the 0.6500 psychological line.

The Australian Dollar is being driven by changing global sentiment as investors absorb the latest news between China and the US. Both nations are reported to have agreed on a preliminary deal to relax rare metal trade restrictions and reduce some tariffs. Yet with scant official information, markets are holding back on jumping to conclusions about the long-term implications and durability of the deal. This doubt continues to drive investor behavior as they navigate the global dynamics of trade.

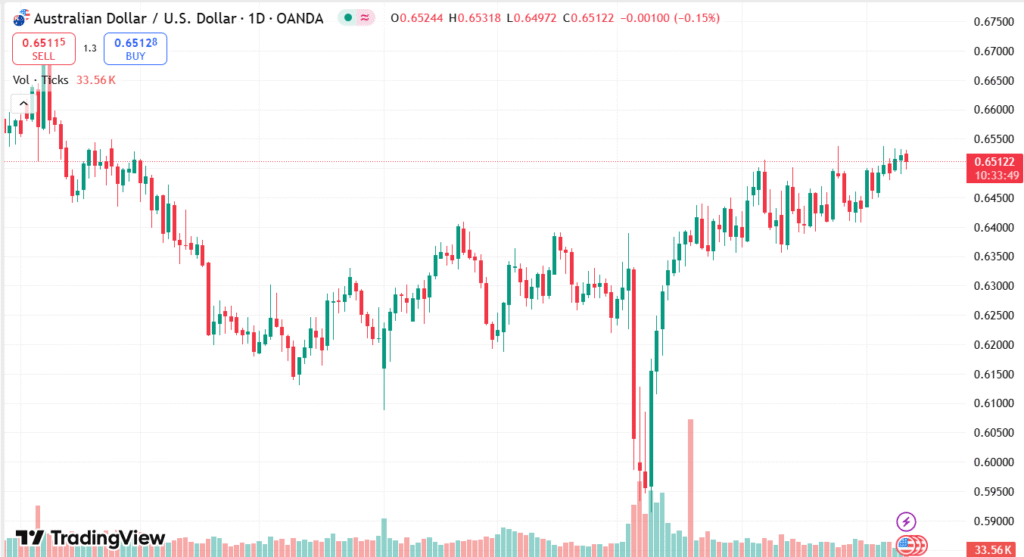

AUD/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Meanwhile, eyes are shifting towards important coming events in the US that can potentially affect global financial markets. The publication of the Consumer Price Index (CPI) will provide valuable information on inflation trends, while the $39 billion auction of the 10-year Treasury bond can indicate investor sentiment towards US fiscal policy. Both events have the potential to move overall market mood and currency valuations, making them vital for traders to watch.

TECHNICAL ANALYSIS

AUD/USD is trading close to the crucial psychological support of 0.6500. A consistent stay above this level might prompt buyers to aim for the immediate resistance near 0.6550, then the 0.6600 zone. On the bearish side, a clear break below 0.6500 might set the scene for lower levels towards 0.6450 and even 0.6400. Technical indicators on the shorter charts indicate a neutral to weak bearish slant, with the traders waiting for more decisive cues from future US data releases.

FORECAST

In the event of the US CPI releasing below market expectations or a muted pick-up, it could ease pressure on the Federal Reserve to tighten further. This would soften the US Dollar, supporting the AUD/USD to rise above the 0.6500 level. Anything positive on the US-China trade deal as well as any further clarification regarding the deal would enhance risk appetite, further supporting the Australian Dollar.

On the other hand, if US inflation figures surprise to the upside, this can stoke anticipation of a more dovish Federal Reserve policy, increasing the attractiveness of the US Dollar and applying downward pressure to AUD/USD. Additionally, poor demand for the US Treasury bond auction can fuel worries about US fiscal health, which could initially bring risk assets such as the Aussie under pressure. But ongoing uncertainty regarding the US-China trade deal would maintain the pair under selling pressure if investor sentiment remains uncertain.