NZD/USD currency pair bounced back to trade around 0.6040 in early European morning on Thursday, driven by the weakness of the US Dollar due to increasing uncertainty surrounding US tariff policies. US Dollar Index (DXY) fell to a seven-week low at about 98.30 after President Donald Trump announced plans to send formal letters to trading partners detailing ultimate trade deals and tariff rates, focusing on those not negotiating in good faith. As the New Zealand Dollar rose against the Greenback, it lagged the other currencies on concerns the US-China trade truce was unsustainable, with China committing to provide rare earth elements and magnets, while the US would slap much higher tariffs in retaliation.

KEY LOOKOUTS

• President Trump’s decision to submit final trade terms to trading partners is being closely followed by markets, and it could affect global trade and currency movements.

• The DXY’s decline to a seven-week low at about 98.30 continues to shape NZD/USD, with more weakness potentially propping up the Kiwi.

• There are still concerns about the long-term sustainability of the US-China deal, particularly considering the disparity in tariff levels and trade concessions.

• China’s commitment to supply rare earths and magnets could ease some industrial pressures but may also signal deeper geopolitical complexities.

NZD/USD pair regained strength and climbed to near 0.6040 as the US Dollar weakened amid rising uncertainty over the United States’ tariff policy. President Trump’s pledge to unilaterally send the last trade deals to non-cooperating trading partners has contributed to market unease, sending the US Dollar Index to a seven-week low near 98.30. Although the New Zealand Dollar found refuge against the Greenback, doubts surrounding the longevity of the US-China trade ceasefire persist, particularly as the agreement significantly tilts US tariff rates and China commits to providing rare earths and magnets.

NZD/USD rose close to 0.6040 as the US Dollar struggled in the wake of heightened uncertainty surrounding US tariff policy. President Trump’s move to send concluding trade terms to partners put pressure on the Greenback, with uncertainty still surrounding how long-lasting the US-China trade accord will be. The China supply of rare earths brings some solace but injects uncertainty into long-term trade stability.

• NZD/USD appreciates around 0.6040 as the US Dollar loses strength in early European session trading.

• US Dollar Index (DXY) falls to a seven-week low around 98.30, indicating growing pressure on the Greenback.

• President Trump reveals intentions to submit final trade deals to partners who are not negotiating in good faith.

• Market uncertainty increases about the future direction of US tariff policies and possible world trade tensions.

• China commits to exporting rare earths and magnets, offering industrial inputs vital for US industry.

• Imbalance in tariffs is worrisome, with 55% tariffs imposed by the US against 10% from China, which could put strain on the trade truce.

• NZD finds support from USD but trails against other major currencies owing to ongoing trade concerns.

The latest updates on US trade policy have been closely followed by global markets. President Donald Trump’s move to proceed with submitting final trade deals to countries not in active talks adds an extra layer of uncertainty to global trade relations. By suggesting fixed terms and tariffs rates without additional negotiations, the US government is indicating a harder line that could actually redefine global trade policies. This step has sent investors into contemplation mode as they determine the potential long-term effects of such one-sided action.

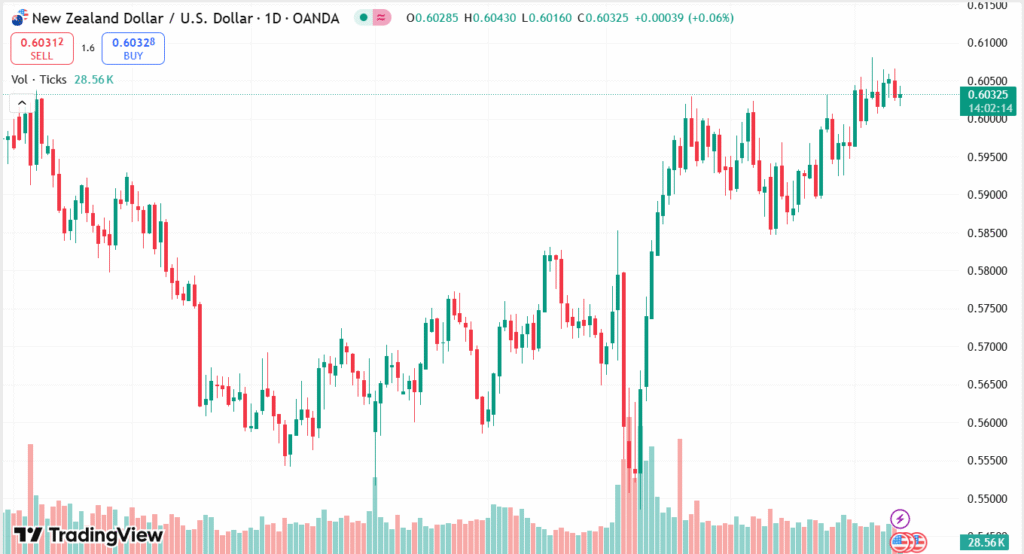

NZD/USD DAILY PRICE CHART

CHART SOURCE: TradingView

At the same time, the deal between the US and China, where China agreed to provide rare earth elements and magnets, points to the strategic significance of key resources in trade discussions. Trump’s remarks also emphasized the continued educational and cultural exchanges, with Chinese students still taking up study in the US. While the significant imbalance in tariff levels — with the US charging much higher tariffs — has created concerns over the longevity of this deal and the wider implications for future US-China relations, the changing circumstances continue to shape market mood and global economic expectations.

TECHNICAL ANALYSIS

NZD/USD is stabilizing after the early losses, with the pair near a critical resistance level around 0.6040. If the pair holds above this level, it could open the way for further upside towards the next resistance at 0.6070-0.6100. To the downside, initial support is at 0.6000, followed by firmer support around 0.5970, which has worked as a pivot zone in the past. Momentum indicators such as RSI and MACD point to a neutral to marginally bullish bias, however, traders are being cautious with constant trade developments.

FORECAST

If the NZD/USD currency pair is able to hold firm on its upward momentum above the level of 0.6040, it should try to test the subsequent resistance areas of 0.6070 and 0.6100. A continued break above these levels would encourage additional buying pressure and may drive the pair up to the region of 0.6150. Positive news on global trade talks or additional strength in the US Dollar could also contribute to further upside traction.

On the flip side, in case the pair is not able to hold above 0.6040, it could come under fresh selling pressure. The first support comes at the 0.6000 psychological mark, followed by more robust support near 0.5970. A fall below these levels would indicate more severe losses, potentially until the 0.5920 level. Any adverse news on trade tensions or better US economic data will bear upon the pair.