Gold prices continue to trade under selling pressure and are on the cusp of weekly losses, powered largely by the Federal Reserve’s hawkish pause and the stronger US Dollar. Even while backed by supportive drivers like elevated geopolitical tensions in the Middle East and existing trade uncertainties—notably regarding U.S. tariff threats—safe-haven demand for gold has been unable to muster much potency. Although these risks might cap further downside, technicals indicate the possibility of a more severe correction unless there is robust dip-buying. General market sentiment remains cautious as investors balance meager rate cut hopes against rising global risks.

KEY LOOKOUTS

• The Federal Reserve’s inflation hawk and diminished expectations for rate reductions continue to underpin the US Dollar and put gold prices under pressure.

• Increased Iran-Israel conflict, with potential U.S. intervention, would rekindle demand for the gold safe-haven.

• Threatened U.S. tariffs, especially in the pharma space, and Trump’s “liberation day” deadline of July 9 can cause market volatility.

• Monitor significant support levels around $3,323-$3,322 and resistance around $3,375 and $3,400 for short-term directional indications.

Gold prices continue to be underpinned as the Federal Reserve’s hawkish bias supports the US Dollar and reduces the attractiveness of the non-yielding yellow metal. Nevertheless, geopolitical tension in the Middle East and anticipated trade uncertainties, especially surrounding future U.S. tariffs, are helping support gold’s safe-haven appeal. Investors are sitting on the sidelines, weighing scant rate cut hopes against the threat of an escalation of broader conflict in the region. The technical picture also leaves the way open for further decline unless major support levels trigger fresh buying interest.

Gold lingers under pressure from a hawkish Fed and firm US Dollar, on course for weekly losses. Geopolitical tensions and trade uncertainty should cap downside, but technical pressure remains.

• Gold price under strain from Federal Reserve’s hawkish pause.

• US Dollar strengthens, diminishing demand for non-yielding assets such as gold.

• Iran-Israel geopolitical tensions boost safe-haven demand.

• Trade uncertainty rises ahead of the July 9 deadline for U.S. tariffs.

• Fed forecasts two rate cuts by the end of 2025, capping gold potential.

• Technicals signal further downside to the $3,300 support level.

• Resistance at $3,375 and $3,400, with a possible retest of the $3,451 high if mood changes.

Gold prices remain under pressure following the Federal Reserve’s hawkish tone that has supported the US Dollar’s strength. Although the Fed kept interest rates unchanged, it indicated reduced rate cuts in the future, that dulled investor demand for non-yielding assets such as gold. Such a policy sentiment has outshined some market-friendly factors such as persistent geopolitical tensions and trade uncertainties and has held gold on a weaker path during the week.

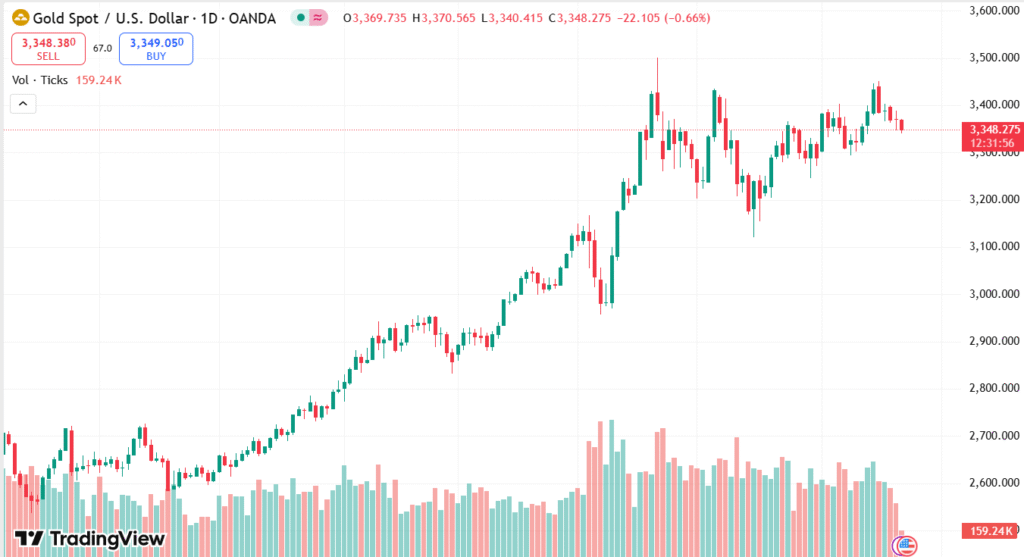

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Concurrently, increasing world risks are providing a counterweight to bearishness. Mounting tensions in the Middle East between Iran and Israel have raised regional stability fears, which could attract investor interest back to safe-haven assets. Furthermore, threatened U.S. tariffs and trade policy changes under the Trump administration are introducing new uncertainty into the markets. These considerations may inspire hedge positioning by investors, as the wider risk environment remains extremely fluid.

TECHNICAL ANALYSIS

XAU/USD has fallen below the 100-period Simple Moving Average (SMA), which indicates short-term weakness. The price is moving towards significant support close to the lower edge of a short-term uptrend channel, at about the $3,323–$3,322 region. Momentum indicators on the daily chart are weakening, while on hourly charts there is increasing bearish momentum, indicating the possibility of further falls. On the other hand, initial resistance is evident at $3,374–$3,375, followed by $3,400; a prolonged break above this level may lead to a retest of the recent high of around $3,451.

FORECAST

If geopolitical tensions do not abate and trade uncertainties further increase, gold will likely recapture its safe-haven status, driving fresh purchasing interest. The sustained break above the $3,375 resistance level would then pave the way for a rise towards the $3,400 psychological mark. Should bullish momentum continue to gather pace, the price would revisit the recent high of $3,451, and even target the all-time high of $3,500 in the near future.

On the negative side, sustained strength in the US Dollar driven by the Federal Reserve’s hawkish policy can continue to put pressure on gold. A break below the $3,323–$3,322 support zone could trigger intensified selling, driving prices towards the $3,300 level. If bearishness persists, the metal can move into a further correction phase, especially if risk mood improves and rate cut hopes are confined.