NZD/USD pair rose above the 0.6000 level, continuing its successive winning rally for the third consecutive session, supported by New Zealand’s stronger-than-anticipated trade surplus and a weak US Dollar. New Zealand’s trade surplus increased to NZD1,235 million in May, ahead of market expectations and lifting the Kiwi. At the same time, relaxing Middle Eastern geopolitical tensions and better risk sentiment pressured the safe-haven US Dollar. While Fed Chair Jerome Powell hinted at postponing interest rate reductions, market attention was still on favorable trade headlines and Middle Eastern geopolitical news, providing support to the bull trend in NZD/USD.

KEY LOOKOUTS

• A better-than-anticipated trade surplus of NZD1,235 million for May boosted the Kiwi, indicating strong export performance.

• The USD came under pressure as global risk appetite improved with the Iranian-Israel ceasefire.

• Fed Chair Jerome Powell signaled rate cuts could be pushed back to Q4, injecting caution among USD traders even though there are inflationary worries.

• While tensions were relaxed, uncertainties remain over the sustainability of the ceasefire, keeping markets vigilant for any updates.

NZD/USD currency pair was following its rising trend, breaking above the psychological level of 0.6000 due to favorable economic data and a decrease in geopolitical tensions boosting the New Zealand Dollar. New Zealand’s trade surplus in May was higher than anticipated, at NZD1,235 million, which served to enhance investor sentiment towards the Kiwi. Simultaneously, the US Dollar continued to weaken as a result of decreased safe-haven demand after a cease-fire was announced between Iran and Israel. Ignoring Federal Reserve Chair Jerome Powell’s comments regarding postponing rate cuts till the fourth quarter, overall risk-on sentiment was in favor of the NZD, and hence the pair remained strongly bid in early European trading.

NZD/USD climbed over 0.6000, boosted by New Zealand’s higher-than-anticipated trade surplus and improving global risk appetite. The US Dollar continued to be weak with the calming of Middle East tensions and cautious signals from the Fed about future rate cuts.

• NZD/USD climbed over 0.6000, its third straight session of gains.

• New Zealand’s trade surplus was NZD1,235 million, ahead of the NZD1,060 million anticipated for May.

• The exports rose to NZD7.7 billion, while imports rose to NZD6.4 billion, indicating robust trade activity.

• The US Dollar was under pressure as safe-haven demand eased amid a reported ceasefire between Iran and Israel.

• US Fed Chair Powell hinted that interest rate cuts would be delayed and, most probably, postponed until the fourth quarter.

• Market mood strengthened as geopolitical tensions in the Middle East temporarily subsided.

• Technical indicators indicate further upside in NZD/USD, with resistance around 0.6075 and support at 0.5980.

The New Zealand Dollar picked up momentum following the nation’s announcement of a better-than-projected trade surplus of NZD1,235 million in May. This was due to a resilient economy and good export activity, which reinforced investor appetite. An increase in exports as well as imports reflects a good trade sector, further improving the economic profile of New Zealand. The Kiwi drew purchasing in worldwide currency markets from the positive trend.

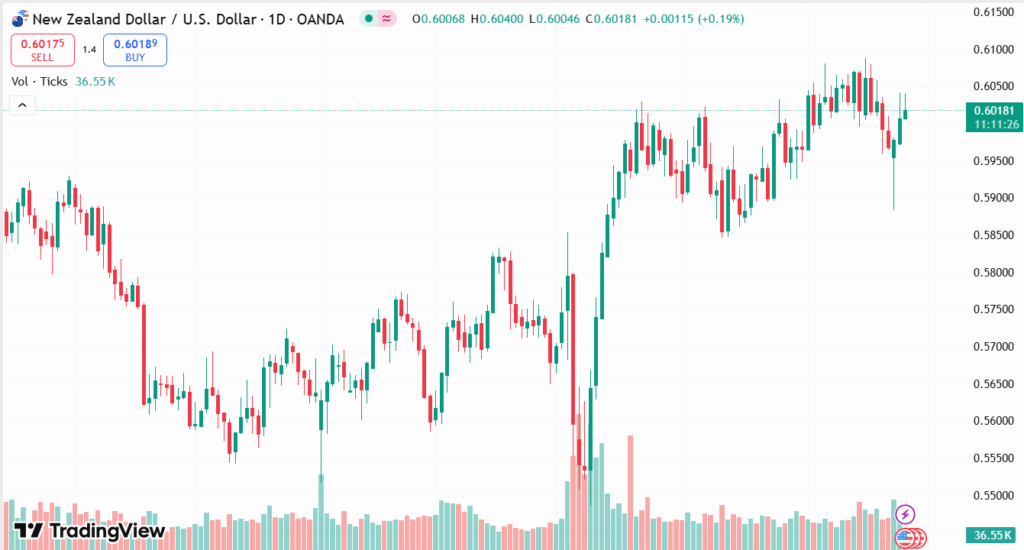

NZD/USD DAILY PRICE CHART

SOURCE: TradingView

On the international front, de-escalation in the Middle East was one reason that had helped to shift market mood, lowering demand for classic safe-haven currencies such as the US Dollar. The Iran-Israel ceasefire announcement, confirmed by US President Donald Trump, served to help calm nerves and promote risk-taking in all markets. In the meantime, Federal Reserve Chairman Jerome Powell’s reserved approach to cutting interest rates signaled policy restraint, but had little to boost the US Dollar while markets were attentive to geopolitical stability and economic news.

TECHNICAL ANALYSIS

NZD/USD is clinging on above the important psychological level of 0.6000, reflecting short-term bullish momentum. The duo is supported by a rising trendline and is trading well above its 20-day and 50-day moving averages, continuing the positive bias. Momentum oscillators such as the Relative Strength Index (RSI) are also pointing higher but below overbought levels, indicating scope for further appreciation. A break above 0.6030 could pave the way to the next hurdle at 0.6075, while support in the immediate vicinity is at 0.5980.

FORECAST

If positive risk sentiment continues and the economic momentum of New Zealand keeps going strong, NZD/USD can continue its rally to 0.6075, which is the next significant resistance level. If a break and close above 0.6075 are achieved, the road will be open for a rally to the 0.6120–0.6150 zone, supported by ongoing Kiwi-buying on trade reports and subsequent USD weakness from delayed easing by the Fed.

Alternatively, if geopolitical tensions flare up or US economic figures surprise on the higher side—leading to a turnaround in the US Dollar—NZD/USD would retreat towards the 0.5980 support level. A break below 0.5980 would risk further pullbacks to 0.5930 and possibly to the 0.5900 level, where buyers may come in to protect the psychological floor.