EUR/USD currency pair continues to lose ground for the third day running as fresh US tariff threats and better-than-expected US jobless claims data support the US Dollar at the expense of the Euro. President Trump’s threat of higher tariffs on the EU and other trading partners has soured market sentiment, raising questions on continued trade talks. Meanwhile, a robust US jobs market, as evidenced by better-than-expected jobless claims, has tempered hopes of near-term Federal Reserve rate cuts, also bolstering the greenback. Although EUR/USD posted a weak intraday bounce, the currency pair remains in bearish mode, with critical support targets at the 1.1660–1.1650 band.

KEY LOOKOUTS

• Look out for additional updates or developments in US-EU trade tensions after President Trump’s recent announcement of additional tariffs, which could put a heavy burden on the Euro.

• Persistent resilience in US jobless claims and labor market news could temper expectations for Fed rate cuts, bolstering the USD.

• Disagreement among central bank policymakers may influence sentiment; near-term direction will depend heavily on ECB and Fed policymakers’ comments.

• Be watchful of the 1.1660–1.1650 support level. A strong break below this area may lead to further downside towards the 1.1630 Fibonacci area.

EUR/USD pair remains under pressure due to revived trade tensions and robust US economic statistics, which have strengthened the US Dollar. President Trump’s threat of higher tariffs against the European Union shook markets and put a damper on risk appetite, and surprisingly low US jobless claims further dampened expectations for near-term Fed rate cuts. The Euro is therefore on the back foot, below the 1.1700 mark and continuing its corrective fall from the July 1 high. With support at 1.1660–1.1650 under pressure being the key, the pair is in a crucial test, and any further weakening can expose the pair to deeper losses.

EUR/USD is back under pressure as new US-EU trade tensions and robust US jobless figures support the US Dollar. The pair stays below 1.1700, with key support at 1.1660–1.1650 under focus. Market sentiment is still cautious as diverging central bank signals wait to be clarified.

• EUR/USD is pressured for the third consecutive day due to renewed US-EU trade tensions.

• President Trump’s latest tariff threat targets the European Union, spooking the markets and increasing the concerns of a wider trade war.

• Better-than-anticipated US jobless claims figures supported the US Dollar and decreased the expectations of a Fed rate cut in July.

• Divergent opinions inside the Fed and ECB make monetary policy on both sides of the Atlantic uncertain.

• The Euro has rebounded slightly from intraday lows, but still trades below the important 1.1700 level.

• Technical analysis indicates a bearish trend, with support at 1.1660–1.1650 with possible downside towards 1.1630.

• Market sentiment continues to be guarded, as investors wait for additional trade developments and central bank remarks.

The EUR/USD pair continues to be plagued by fresh geopolitical and economic issues, specifically relating to US-EU trade relations. President Trump’s recent tariff announcement covering wider tariffs, including the European Union, has rekindled fears of a transatlantic trade war. These events have spooked investors and cooled global risk appetite, leading to risk aversion in currency markets. EU officials remain optimistic about securing a deal prior to August 1, indicating continuous diplomatic efforts to de-escalate tensions.

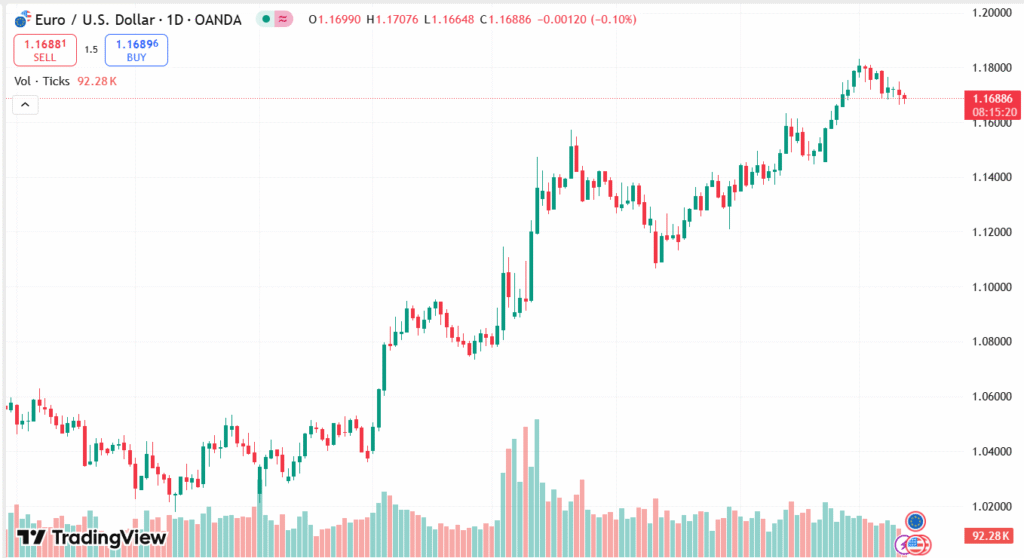

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

At the same time, in the United States, more resilient-than-expected labor market statistics have contributed to the US Dollar’s strength. Unemployment claims unexpectedly fell, supporting perceptions of economic resilience and making the outlook for rate cuts by the Federal Reserve more complicated. The Fed is said to be split, with some policymakers urging policy relaxation amid inflation due to trade, while others are still ambivalent. This disagreement contributes to uncertainty, as markets wait for additional clues from central banks and forthcoming macroeconomic announcements.

TECHNICAL ANALYSIS

EUR/USD remains on a bearish trend, creating a series of lower highs and lower lows ever since it reached its peak of 1.1830 on July 1. The pair is now in a broadening wedge formation, with support bunched at the 1.1660–1.1650 area, corresponding to the recent lows and the channel’s lower boundary. Momentum indicators like the 4-hour RSI continue to trade below the 50 level, reflecting bearish momentum but not oversold, implying scope for further losses. If this crucial support area is broken, the next likely target is close to 1.1630, while resistance still holds at 1.1710 and 1.1750.

FORECAST

If EUR/USD is able to stay above the crucial support zone of 1.1660–1.1650, a short-term turnaround may be possible. A bounce above the 1.1700 level could attract additional buying interest, with near-term resistance at 1.1710. Further out, the 1.1740–1.1750 band, encompassing the top of the present-day wedge pattern, would serve as a robust cap. A decisive break over this level could propel sentiment further to the upside, potentially paving the way towards the 1.1790–1.1830 region.

On the negative side, a clear break below the 1.1650 support level might initiate fresh selling pressure, with the next stop at 1.1630—corresponding to the 50% Fibonacci retracement of the latest rally. If selling pressures continue, the pair may head lower towards the 1.1600 psychological level. Ongoing pressure from trade tensions and strong US economic data might further burden the Euro, strengthening the bearish perspective in the near term.