Australian Dollar (AUD) stabilized on Friday, ending its six-day decline as markets became cautious before the eagerly awaited US Nonfarm Payrolls (NFP) release. The currency was supported after President Trump left Australia off the list of countries subject to new US tariff increases, with a 10% baseline tariff being kept in place that would favor Australian exports. Better-than-expected domestic data, such as retail sales and building permits, offered additional insulation, in spite of lower-than-anticipated inflation and producer prices. Soft Chinese manufacturing numbers, however, topping Australia’s biggest trading partner, placed a cap on gains. Following traders’ expectations of US labor market data and continued global trade news, the AUD/USD pair is stuck in a range, trading around 0.6430.

KEY LOOKOUTS

• There is a wait for US jobs data, which may have an impact on the Fed’s rate perspective and be the driver of USD strength or weakness and hence AUD/USD volatility.

• Australia’s exemption from US tariff increases favors AUD sentiment and makes exports to the US market more competitive.

• Weak Chinese PMI data is a bear risk to the AUD because Australia has significant trade exposure to China.

• AUD/USD is resisted at 0.6487 (9-day EMA) and supported at 0.6421; a break in either direction might decide the short-term trend.

The Australian Dollar remained firm on Friday, buoyed by trade sentiment after the US confirmed that Australia would not be slapped with higher tariffs, maintaining its competitiveness advantage in the US market. Even with persistent vigor in the US Dollar and softer Chinese manufacturing figures, the Aussie gained little respite from improved-than-anticipated local retail sales and building approvals. Investors are still wary of the US Nonfarm Payrolls announcement, which may have a strong bearing on market sentiment and exchange rates. With divided economic indicators and geopolitical intrigue on the table, the AUD/USD pair continues to fluctuate around the 0.6430 level with scarce momentum in either direction.

The Australian Dollar held firm at 0.6430 as market players waited for the US Nonfarm Payrolls data release. Encouragement was provided by firm Australian retail sales and relief from US tariff increases, though poor Chinese manufacturing data capped upside potential.

• AUD/USD held firm at 0.6430, bringing an end to a six-day slide in cautious market sentiment.

• Australia avoided new US tariffs, with a 10% baseline remaining, which is favorable for export competitiveness.

• US Nonfarm Payrolls report is eagerly awaited, with the ability to influence USD strength and move AUD/USD.

• Australia’s Retail Sales increased 1.2% MoM in June, coming in above consensus and reflecting strong consumer spending.

• Building Permits increased 11.9% MoM, the best growth since May 2023.

• China’s Caixin Manufacturing PMI fell to 49.5, indicating contraction and dampening AUD sentiment.

• Technical indicators are bearish, with AUD/USD below the 9-day EMA and RSI at less than 50.

The Australian Dollar gained stability leading into the weekend as traders redirected attention to next week’s US Nonfarm Payrolls release. The currency received mild support from the United States’ move to leave baseline tariffs on Australian imports in place, continuing to provide exporters with access to the US market without other trade restrictions. Australia’s Trade Minister highlighted the benefit this confers on Australian goods, helping lift volumes of exports. Locally, the economy continued to demonstrate resilience, with retail sales increasing more than anticipated in June and building permits registering a strong revival, indicative of strengthened momentum in consumer spending and housing activity.

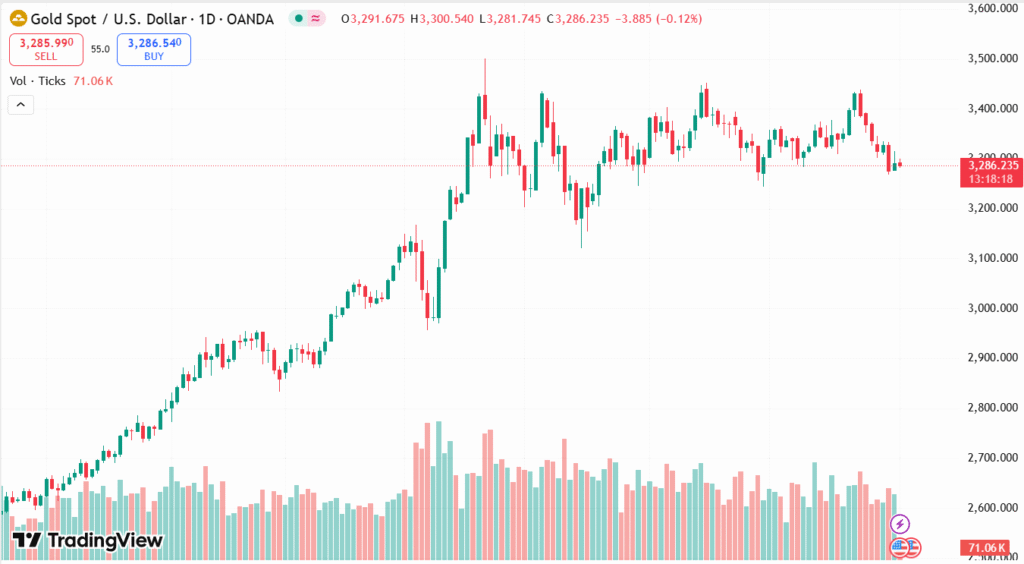

AUD/USD DAILY PRICE CHART

SOURCE: TradingView

Nevertheless, external conditions remain threatening, specifically from China, Australia’s biggest trade partner. China’s Caixin and official PMI both reported weakening manufacturing conditions, emblematic of widespread economic woes. Although China’s government has pledged heightened fiscal stimulus to combat internal headwinds, the slowdown spells anxiety for Australia’s commodity-reliant economy. At the same time, global trade trends continue to be in sharp focus as the US executes new tariff agreements with other nations. The Australian Dollar is still responsive to such cross-border movement, as investors gauge how new policy and economic developments could affect the short-term outlook.

TECHNICAL ANALYSIS

AUD/USD pair still displays a bearish inclination, trading below important moving averages. The 14-day Relative Strength Index (RSI) is below the neutral 50 line, indicating poor momentum. The two are still trading below the 9-day Exponential Moving Average (EMA), which adds to the short-term bearish pressure. The nearest support is at 0.6421, two-month low, with a possible slide towards three-month low of 0.6372 if selling increases. On the other hand, the resistance is around the 9-day EMA at 0.6487 and the 50-day EMA at 0.6495, which must be broken for any indication of recovery.

FORECAST

Should the next US Nonfarm Payrolls release be weaker than anticipated, it might cause a pullback in the US Dollar and provide room for the Australian Dollar to rebound. A break above the 9-day EMA at 0.6487 might convince buyers to drive the pair towards the 50-day EMA at 0.6495. Additional bullish push may continue to drive the rally towards the 0.6625 level, which is the eight-month high, particularly if solid Australian economic data and improving global risk appetite are maintained.

On the other hand, better-than-expected US labor market statistics can spur expectations for a tighter Federal Reserve monetary policy, which will support the US Dollar and bear down on the AUD/USD pair. A clear break below current immediate support at 0.6421 would set the stage for a more substantial drop to 0.6372, the three-month low. Further China’s economic indicators weakening or increased tensions in global trade could further depress AUD sentiment, having the pair in downward motion.