West Texas Intermediate (WTI) crude prices fell to about $66.35 in early Asian trading on Monday following the latest major production increase by OPEC+ of 547,000 barrels per day in September. The action has fanned fears of a supply glut, particularly following successive monthly increases since April. Furthermore, soft U.S. job numbers have stoked economic slowdown concerns, adding to downward pressure on oil prices. Despite the comfort of some support from the prospect of secondary sanctions against Russian crude, attention now turns to coming data from the American Petroleum Institute (API) for additional guidance.

KEY LOOKOUTS

• The group’s increase in production by 547K bpd for September contributes to current oversupply worry after monthly upticks in a row since April.

• Weaker U.S. employment data is fueling concerns of economic growth slowdown, lowering expectations of oil demand.

• Russian crude’s potential secondary sanctions and Trump’s threat of additional tariffs could affect global oil supply dynamics.

• Market players are waiting for Tuesday’s American Petroleum Institute (API) crude oil inventory figures to pick up fresh demand-supply signals.

WTI crude oil futures dropped sharply to about $66.35 during early Monday trading after OPEC+ announced a new production boost of 547,000 barrels per day for September, further aggravating concerns of a global surplus of oil. It follows consistent output increases over the previous months, further mounting pressure on already vulnerable market sentiment. Conversely, softer-than-expected U.S. jobs numbers have increased fears of an economic slowdown, weighing on demand expectations. While geopolitical uncertainty, such as the specter of U.S. sanctions against Russian crude, could provide limited support, traders are cautious before Friday’s API crude inventory report.

WTI crude dropped to close to $66.35 following OPEC+ sanctioning another large production hike for September. Softer U.S. jobs helped to reinforce demand worries, with traders looking to the API crude stock report for guidance.

• WTI crude dropped to $66.35 in early Asian trading on Monday, reaching multi-month lows.

• OPEC+ said it was raising September output by 547K bpd, following a string of monthly increases starting from April.

• Fears of oversupply intensify as cumulative production gains weigh heavily on market attitudes.

• Soft U.S. jobs data flashes warning of potential economic slowdown, reducing expectations for oil demand.

• Geopolitical tensions persist, with Trump threatening more tariffs and sanctions on Russia.

• Sanctions on Russian crude may cap losses by restraining global supply in spite of increasing output.

• Attention turns to API crude inventory report, out Tuesday, for next potential market driver.

Crude oil markets began the week on alert as OPEC+ officially announced another increment of production, bringing 547,000 barrels per day of supply into the global market for September. This step is the latest in a series of monthly increases in output starting with April, and while they are designed to alleviate supply anxiety, now they increase the risk of oversaturation in the market. The move has prompted broad debate among traders and analysts, particularly as global demand recovery is still fragile. The increasing supply has put further pressure on market players already cautious of wider economic uncertainties.

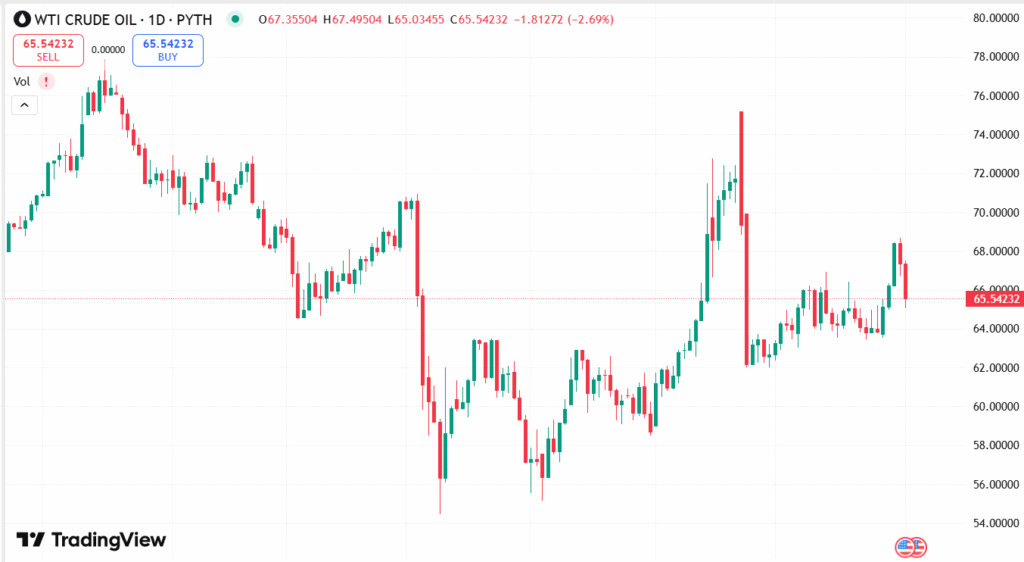

WTI CRUDE OIL DAILY PRICE CHART

SOURCE: TradingView

Meanwhile, disappointing U.S. employment figures have also fuelled the sense of caution, raising doubts over the strength of the world’s biggest economy. Fears of consumer expenditure, industrial production, and energy demand have returned, particularly in the wake of recent tariff moves. Geopolitical strains, meanwhile, continue to linger in the background, as the U.S. has threatened additional sanctions on Russian oil if there is not progress toward ending the Ukraine war. All attention is now trained on the next round of inventory data and any policy remarks that might offer better guidance for oil markets.

TECHNICAL ANALYSIS

WTI crude’s fall below the crucial support level around $67.00 implies growing bearish strength. The price’s move towards $66.35 indicates a potential to extend the downtrend, particularly if it does not recover the 50-day moving average in the near term. Momentum indicators like the RSI are downwards sloping, implying declining buying interest. If the sellers prevail, WTI may test lower levels of around $65.50 or even $64.00, while a bounce above $68.00 would be required to reverse the short-term bearish bias.

FORECAST

Although subject to current pressure, WTI crude may rebound if geopolitical concerns are heightened, especially at the risk of U.S. sanctions against Russian oil exports. These events may limit global supply and drive prices upwards. Besides that, if future inventory reports from the American Petroleum Institute (API) and the Energy Information Administration (EIA) reveal surprise stockpile drawdowns, it would be in favor of a short-term price rebound for oil. A rebound in U.S. economic indicators or a policy reversal by OPEC+ would also be bullish catalysts.

On the flip side, ongoing oversupply fears from OPEC+’s continuation of production hikes remain a major threat. If the slowdown in the U.S. economy intensifies and the prospects for global demand continue to weaken, WTI might drop below key levels of support around $66.00 and move towards the $64.00 level. Moreover, if the next API and EIA releases also show an increase in crude inventories, it would further pressure prices. A further strengthening of the U.S. dollar might also serve as a headwind against oil, capping any hopes for recovery in prices.