Silver (XAG/USD) is consolidating just above the $42.50 level, its best since September 2011, as the market holds back prior to the pivotal FOMC policy decision. The latest run is resisted around the rim of its rising trend channel while the overbought daily RSI indicates a probable short-term pullback. Any corrective dip, however, should remain contained and provide new buying opportunities, with major support at $42.00 and $41.40. To the upside, a breakout above $42.75 would lead the way for a test of the 2011 high at $43.40 and more importantly extend gains toward the $44.00 zone.

KEY LOOKOUTS

• Silver is ranging above $42.50, holding near its highest 2011 level, as traders remain cautious in anticipation of the FOMC meeting.

• The daily RSI still appears overbought, suggesting the possibility of short-term corrective pullbacks prior to the next bullish leg.

• Support for a break lower is at $42.00 and $41.40; a fall through here could extend the bearish decline to $41.00 and $40.50.

• A continued advance above $42.75 and $43.00 could set the stage for a retest of the 2011 high at $43.40 and a continuation to $44.00–$44.25.

Silver (XAG/USD) is on a bullish consolidation trend above $42.50, its latest high since September 2011, as investors take a wait-and-see approach ahead of the next FOMC policy choice. Although the recent rally is tiring with the daily RSI remaining in the overbought zone, any corrective decline is set to be contained and may provide new buying opportunities. Leveling support around $42.00 and $41.40 should serve to cushion against further losses, and a sustainable break through $42.75 and $43.00 would stage the way for the retesting of the 2011 high at $43.40 and pave the way for further advances towards the $44.00 mark.

Silver (XAG/USD) holds above $42.50, its peak since 2011, as the FOMC decision is awaited. Though overbought levels indicate a short-term correction, sustained support levels indicate dips may see fresh buying. A move above $43.00 could lead to a retest of the 2011 high at $43.40.

• Silver remains above $42.50, its September 2011 peak.

• Price action consolidates in a month-to-date bullish trend channel.

• Overbought daily RSI readings indicate potential short-term pullback or sideways action.

• Major downside support is at $42.00 and $41.40 (channel support + 200-hour SMA).

• Further downturn could hit $41.00 and $40.50–$40.45 levels.

• On the flip side, a breach above $42.75–$43.00 could drive fresh bullish support.

• Potential targets of the upside include the 2011 high at $43.40, then $44.00–$44.25.

Silver (XAG/USD) has gained a lot of market focus because it is trading above $42.50, hitting levels last witnessed in September 2011. The rally indicates increasing investor appetite in safe-haven assets because of heightened uncertainty in global financial markets. As the Federal Reserve’s next policy choice comes into view, investors are being cautious, keeping silver in a state of consolidation while awaiting clearer directions on the course of interest rates and the economy at large.

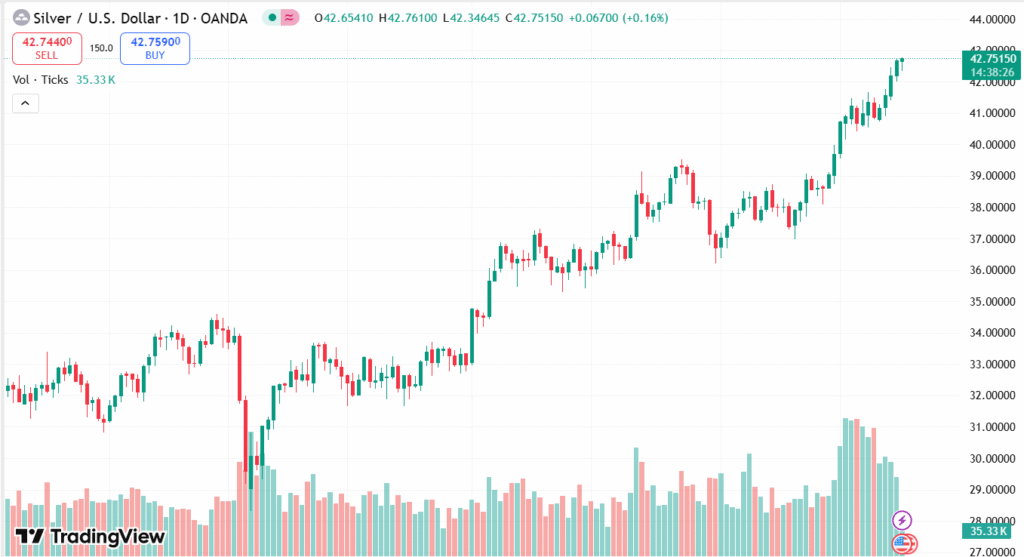

XAG/USD DAILY CHART PRICE

SOURCE: TradingView

The strong performance of the precious metal also underscores its attractiveness as a store of value and an industrial commodity. Increased demand for green energy technology, together with persistent global inflationary forces, continues to underpin the long-term outlook for silver. While investors balance economic risk and central bank action, silver remains the asset to watch, balancing as a hedge against the uncertain and as a force driving industrial growth.

TECHNICAL ANALYSIS

Silver (XAG/USD) is ranging close to the top of its rising channel following a spectacular four-week run, with the daily RSI suggesting overbought levels that will cap near-term upside pressure. Support is registered around $42.00 and $41.40, which can serve as a base for any short-term corrective falls, while resistance levels are in place near $42.75 and the $43.00 psychological level. A prolonged breakout above these barriers could lead to the September 2011 high of $43.40 and extend gains to $44.00–$44.25, while a breakdown from key supports could propel a steeper pullback.

FORECAST

Should Silver (XAG/USD) continue to build on its momentum above $42.50, the break above $42.75 and $43.00 could set the stage for more uplift. The next significant milestone is close to the September 2011 high at $43.40, with more room to move forward into the $44.00–$44.25 zone if bulls intensify. Supportive macroeconomic fundamentals, such as Fed policy relaxation expectations, could offer additional wind to the silver rally.

On the negative side, any such corrective retreat may find initial defense at $42.00, with solid support lower at $41.40, which coincides with the base of the ascending channel and the 200-hour SMA. A clear break through these levels can extend the fall to $41.00, and then to $40.80–$40.50. Short-term corrections are on the cards, but these are more likely to garner fresh buying interest and maintain the overall bullish setup intact.