The AUD/USD exchange rate is stable at a two-month high, trading above the mid-0.6300s, supported by a minor US Dollar weakening and the hawkish bias from the Reserve Bank of Australia (RBA). The technical landscape is bullish, with favorable momentum indicators pointing towards further gains. A move above 0.6400 would propel the pair to 0.6500 and higher, with the next level of support at 0.6330-0.6335. A continued fall below 0.6300 could leave AUD/USD vulnerable to more losses towards the 0.6200 area. Traders are now waiting for the FOMC minutes for new indications on US monetary policy, which may determine the next direction.

KEY LOOKOUTS

• A confident breakout above 0.6400 may add to gains towards 0.6500, aided by strong technical signals and optimistic sentiment.

• This area continues to be an essential buying point, but a fall below 0.6300 may initiate a more severe correction to 0.6200.

• USD volatility may be sparked by the release of FOMC minutes and could steer AUD/USD short-term direction based on interest rate projections.

• The Reserve Bank of Australia’s inflation and monetary policy position might lend further support to AUD, maintaining the pair in a bullish trend.

The AUD/USD currency pair remains in favor with investors as it trades just off a two-month high due to a softer US Dollar and the Reserve Bank of Australia’s hawkish bias. With optimism in tow, the pair continues in a bullish consolidation mode, which points to further upside if it can break above the 0.6400 resistance level. Market sentiment is closely watching the FOMC minutes coming out soon, which may pump new volatility into the USD and determine AUD/USD’s next direction. Meanwhile, support at key levels of 0.6330-0.6300 continues to be the level to watch, with a breakdown below this area potentially triggering a more substantial correction.

The AUD/USD currency pair is strong close to a two-month high on the back of a softer US Dollar and a hawkish RBA outlook. A breakout above 0.6400 can propel further upside, while break-even support at 0.6330-0.6300 remains pivotal for bullish enthusiasm. Market players now expect the FOMC minutes for new directions in USD.

• The pair is stable on the back of a softer USD and a hawkish Reserve Bank of Australia (RBA) policy.

• Sellers look for volatility as the Federal Reserve policy backdrop may affect the USD and guide AUD/USD direction.

• Bullish sentiment favors additional advances, with resistance at 0.6400 and upside potential to 0.6500.

• The 0.6330-0.6300 area is robust support, with a breakdown raising the prospect of 0.6200 or lower.

• Australia’s trade-based economy exposes AUD/USD to global demand and movements in commodity markets.

• Equity market shifts and appetite for risk assets influence the AUD/USD trends.

• Trade relationships, inflation readings, and economic growth factors remain significant in influencing the currency pair’s movement in the future.

The AUD/USD pair is still in focus as investors turn their eyes to major economic events and policy perspectives. The Reserve Bank of Australia’s relatively hawkish stance has supported faith in the Australian Dollar, with markets expecting a consistent approach to monetary policy. Global economic trends, such as changes in inflation and employment trends, are meanwhile having a notable influence on market sentiment. The policy guidance of the US Federal Reserve is still a key driver, with market participants closely monitoring for hints on prospective rate changes that will affect currency flows.

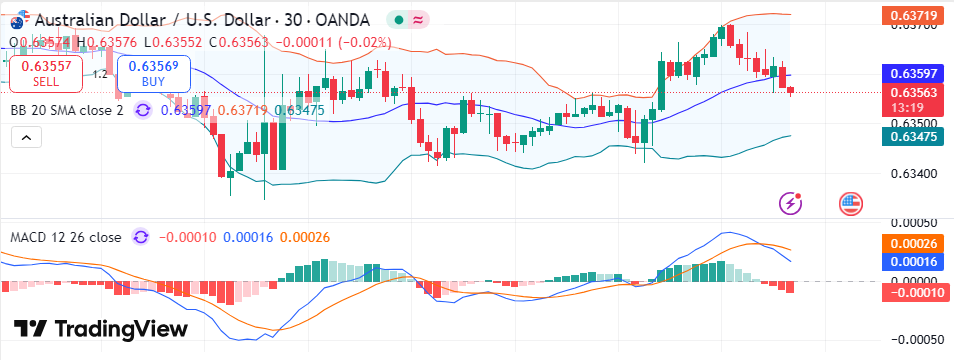

AUD/USD Daily Price Chart

TradingView Prepared by ELLYANA

Apart from central bank policies, more general economic metrics like trade relationships, commodity prices, and overall market risk appetite drive AUD/USD action. Australia’s high trade connection with China and its export-based economy tend to render the currency sensitive to international demand and geopolitical events. Further, investor attitudes toward risk assets also remain active, as moves in equity markets and commodity cycles influence currency positioning. With all this in motion, traders keep a keen eye on macroeconomic trends that will form the direction of AUD/USD’s future.

TECHNICAL ANALYSIS

AUD/USD is bullish, with the pair trading close to a two-month high and in a bullish consolidation mode. Favorable momentum indicators, such as oscillators on the daily chart, indicate that the trend of least resistance is to the higher side. A breakout above 0.6400 could open the doors for further upside, possibly to the 0.6500 psychological level. On the bearish side, important support is at 0.6330-0.6300, where buyers are expected to emerge. A prolonged dip below this level might portend a deeper correction, with additional support at 0.6200. Traders will be keen on price action, especially in reaction to macroeconomic developments and policy signals.

FORECAST

AUD/USD pair is set for additional upside as it is underpinned by a constructive market structure. A breakthrough above the 0.6400 resistance might propel additional gains, taking the pair towards the 0.6500 psychological level. If the momentum persists, the next significant target will be at 0.6555-0.6560, where the 200-day Simple Moving Average (SMA) and a major resistance area coincide. Bullish oscillators on the daily chart indicate that the buyers are in charge, and any pullbacks could be used as a buying opportunity. A continued rally can further reinforce the bullish mood, keeping AUD/USD on a rising path.

On the negative side, major support is at 0.6330-0.6300, and a breakdown below this area may initiate a more severe correction. If bearish pressure mounts, the pair can fall to 0.6265, followed by the 0.6240-0.6235 area. A fall below 0.6200 would signal a change in sentiment, and AUD/USD would be susceptible to a fall to the 0.6145 area, which was a crucial support level in recent trading sessions. Traders need to be careful because volatility can pick up, particularly around significant economic releases and central bank announcements.