Australian Dollar (AUD) is continuing to feel the heat against the US Dollar (USD) as risk appetite is reduced and the Reserve Bank of Australia (RBA) sticks to its cautious approach to monetary easing. The publication of the RBA Meeting Minutes served to emphasize a reluctance to move before seeing more definitive signs of slowing inflation, to temper AUD momentum. Concurrently, overseas uncertainties such as rising US-China trade tensions, speculation regarding the leadership of the Federal Reserve, and conflicting signals surrounding US monetary policy have favored the revival of the US Dollar. With China leaving its Loan Prime Rates steady and economic indicators revealing unequal recovery, the AUD/USD currency pair still hovers around 0.6520, with resistance at the nine-day EMA.

KEY LOOKOUTS

• The market is monitoring closely for hints at the timing and magnitude of possible rate reductions by the Reserve Bank of Australia, particularly under uncertainty surrounding inflation.

• Any news prior to the August 12 deadline regarding the US-China tariff deal could weigh heavily on risk sentiment and affect the AUD.

•USD movements continue to be fueled by ongoing issues surrounding the independence of the Federal Reserve and rate cut hopes.

•Given its status as Australia’s major trading partner, China’s GDP growth, retail sales, and industrial output releases will remain pivotal in determining the direction of AUD.

The Australian Dollar is weaker against the US Dollar as risk-off sentiment in world markets. The July Meeting Minutes from the Reserve Bank of Australia reaffirmed a wait-and-watch strategy towards further cuts in rates, waiting to see clear evidence of falling inflation. At the same time, the US Dollar is supported by safe-haven demand, increased geopolitical tensions, and uncertainty over the policy orientation and leadership stability of the Federal Reserve. With Chinese economic data showing mixed signals and trade tensions with the US remaining, the outlook for the AUD is unclear, which continues to keep the AUD/USD pair muted around the 0.6520 level.

The Australian Dollar is still under pressure on defensive RBA policy cues and world risk aversion. The US Dollar is strong on safe-haven buying and increased uncertainty surrounding Fed leadership and trade war tensions. The AUD/USD currency pair trades at around 0.6520, pinned back by the nine-day EMA.

• The Australian Dollar is still low after the RBA being cautious about rate cuts.

• RBA Meeting Minutes indicate members would rather wait for more certain evidence of slowing inflation.

• US Dollar strengthens in response to safe-haven buying and uncertainty around the Fed.

• US-China trade tensions rise ahead of the August 12 tariff agreement deadline.

• China leaves its Loan Prime Rates unchanged; mixed economic releases put pressure on AUD.

• Speculation surrounding Fed Chair Powell’s future contributes to market uncertainty.

• AUD/USD trades near 0.6520, testing resistance at the nine-day EMA with support around 0.6493.

The Australian Dollar remains under pressure as the Reserve Bank of Australia (RBA) continues to adopt a cautious approach to monetary policy. The central bank’s July Meeting Minutes revealed that most members agreed it would be premature to implement further rate cuts without clear evidence of slowing inflation. This conservative tone indicates a desire for stability and a slow path to economic adjustments. At the same time, international investors are keenly observing Australia’s economic relationships with China, particularly as China’s economic performance remains a sign of uneven recovery.

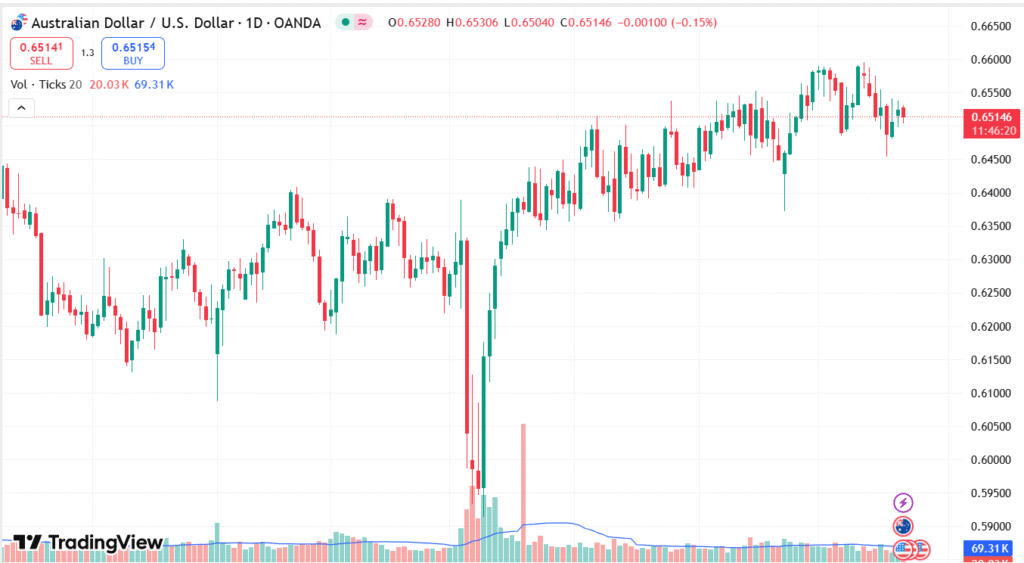

AUD/USD DAILY PRICE CHART

SOURCE: TradingView

Internationally, the US Dollar is being supported by increased risk aversion and speculation regarding the direction and leadership of the Federal Reserve. Increasing confusion surrounding US-China trade negotiations and Washington’s political tensions, such as controversies surrounding Fed Chair Powell’s role, are creating a conservative market climate. Furthermore, conflicting messages from US policymakers concerning interest rate policy are keeping market participants nervous. These international forces, paired with Australia’s domestic policy landscape, are helping to drive the performance of the Australian Dollar in the currency market.

TECHNICAL ANALYSIS

AUD/USD currency pair is trading at 0.6520, just below the nine-day Exponential Moving Average (EMA) of 0.6524 that provides immediate resistance. The pair is currently in an uptrend channel, which also indicates a possible bullish tilt in case it crosses this level. The 14-day Relative Strength Index (RSI) is close to the neutral 50 level, meaning that there is no sufficient momentum in either direction. On the flip side, the 50-day EMA at 0.6493 is the major support level; a clear break below here would set the stage towards the lower limit of the channel at about 0.6470.

FORECAST

If the AUD/USD currency pair is able to close above the short-term resistance at the nine-day EMA level of 0.6524, it may become bullish again on a short-term basis. A closing move above this level could take the pair to the recent high of 0.6595, which appeared on July 11. Any favorable news in international trade negotiations or a change of tone from RBA for a more favorable economic outlook could also go in favor of further upward movement.

To the downside, a failure to stay above 50-day EMA support at 0.6493 may spark more falls. A break below here would tend to target the uptrend channel’s lower edge around 0.6470, with further losses threatening the three-week low of 0.6454. Ongoing risk aversion, weak Chinese economic reports, or unexpectedly strong US reports might press further on the Australian Dollar.