Australian Dollar (AUD) declined against the US Dollar (USD) for the third straight session as the US Dollar picked up pace prior to the Federal Reserve’s FOMC Minutes. In spite of Australia’s strong inflation figures, the AUD came under pressure following the Reserve Bank of Australia’s rate cut last week and speculation of more easing. In contrast, increased US consumer confidence and positive US Treasury yields helped to propel the Greenback. Still, unease regarding the US fiscal deficit and trade tensions introduces volatility into the outlook. Technically, the AUD/USD pair is sitting below its nine-day EMA, signalling short-term weakness, but inside an uptrending channel, allowing scope for possible recovery.

KEY LOOKOUTS

• Traders will be very keen to observe the Federal Reserve’s most recent policy meeting minutes to read about upcoming interest rate actions and the US economic picture, which will have a major bearing on the USD and AUD/USD quote.

• Expectations of additional Reserve Bank of Australia rate decreases will direct sentiment in the markets, potentially limiting the Australian Dollar’s advance even with good inflation statistics.

• Increasing US budget deficits and credit rating downgrades could exert pressure on the US Dollar in the medium term, putting uncertainty into currency markets.

• Unfoldings in the Darwin Port lease dispute and more general trade relations could influence investor sentiment towards the Australian Dollar.

Market players are eagerly looking out for the Federal Reserve’s FOMC Minutes release, as any indication on upcoming rate hikes or policy changes would trigger substantial US Dollar volatility and affect the AUD/USD exchange rate. In the meantime, the Reserve Bank of Australia’s recent 25 basis point rate reduction, coupled with impending easing expectations, remains a dampener on the Australian Dollar, even as inflationary numbers have remained solid. Concurrently, persistent worries regarding the burgeoning US fiscal deficit and recent credit downgrade heighten uncertainty in the Greenback’s extended perspective. Furthermore, political tensions on the Australian decision to cancel the Darwin Port lease to a Chinese firm continue to act as a watchword, which may affect risk sentiment and the Australian Dollar’s near-term performance.

Market participants are observing the coming FOMC Minutes for guidance on US monetary policy, which may affect the US Dollar and AUD/USD currency pair. The RBA’s easing bias and US fiscal deficit concerns introduce additional uncertainty, and Australia-China tensions could shape sentiment towards the Australian Dollar.

• The Australian Dollar (AUD) has fallen against the US Dollar (USD) for three successive sessions as US economic data showed improvements.

• Australia’s April Consumer Price Index (CPI) increased 2.4% year-on-year, narrowly higher than forecast, but the RBA’s latest rate cut puts a dampener on AUD’s strength.

• US Dollar receives boost from an increase in the Consumer Confidence Index to 98.0 in May, increasing risk appetite for the Greenback.

• US Treasury yields hold high, aided by dovish global bond market sentiment and Japan’s potential debt issuance reductions.

• The Reserve Bank of Australia is forecast to see rate cuts continue, with markets expecting a 65% probability of a further cut in July.

• US fiscal deficit issues and credit rating downgrades cast doubt on the long-term sustainability of US debt, putting pressure on the USD.

• Geopolitical tensions continue as China objects to Australia cancelling the Darwin Port lease, potentially impacting the AUD outlook.

The Australian Dollar fell against the US Dollar for the third consecutive day as investors responded to more robust US economic information and anticipation of additional US monetary restraint. While Australia’s inflation rate was unchanged at 2.4% year-on-year in April—marginally higher than predicted—the Reserve Bank of Australia recently reduced interest rates and indicated the potential for additional easing in the future. This prognosis has cooled bullish sentiment for the Australian currency. At the same time, the US Dollar accelerated after a sudden increase in US consumer confidence, driven by enhanced optimism in the American economy.

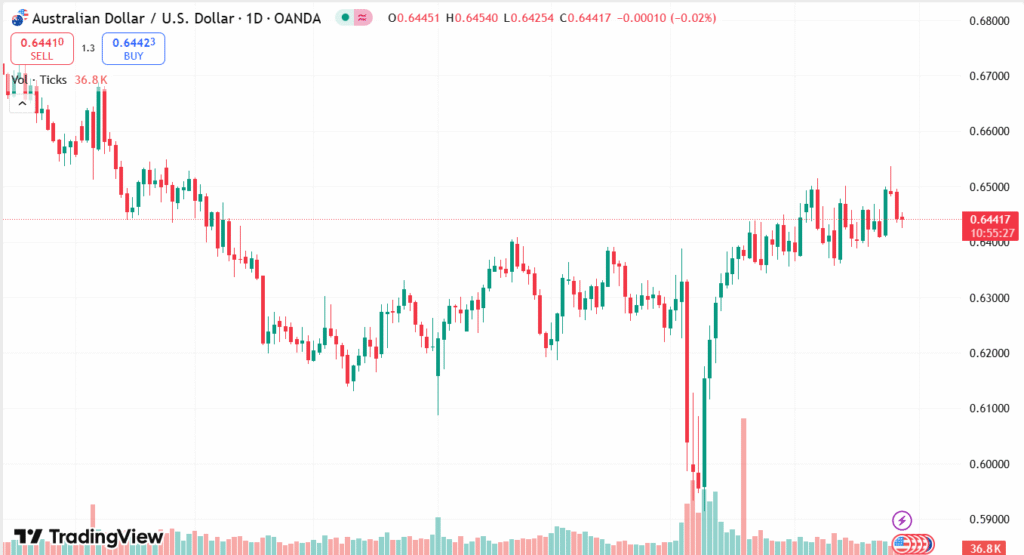

AUD/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Apart from monetary policy fundamentals, worries about the US fiscal deficit and recent credit rating cuts have brought uncertainty to the currency markets. The expanding budget deficit and rising debt levels could burden the US Dollar in the long term. Geopolitically, tensions between China and Australia have risen again, with China condemning Australia’s decision to terminate the lease of Darwin Port to a Chinese entity. This fuels the risk-averse sentiment around the Australian Dollar as international investors consider economic statistics against overall political risk.

TECHNICAL ANALYSIS

AUD/USD pair is trading below its nine-day Exponential Moving Average (EMA), which indicates short-term bearish momentum. Yet it is still in a rising channel formation, which implies that the dominant upward trend is intact. The 14-day Relative Strength Index (RSI) is just above the middle line of 50, reflecting modest bullish pressure even after the decline. Important levels of support to track are at the lower boundary of the rising channel at about 0.6430 and the 50-day EMA at about 0.6380. On the positive side, a breach above the nine-day EMA close to 0.6443 may be the first step toward a recovery towards recent highs of 0.6537 and the upper end of the channel around 0.6620.

FORECAST

The Australian Dollar may have a bounce if it can breach above the nine-day EMA close to 0.6443. This will be expected to signal fresh buying interest and potentially drive the AUD/USD currency pair towards recent six-month highs close to 0.6537. Further risk appetite improvement in the global environment, resolution of trade tensions, or a weaker-than-anticipated US dollar as a result of dovish Federal Reserve cues can further aid the Aussie’s upward momentum. Moreover, even any indication that the Reserve Bank of Australia can stop or decelerate its rate-cutting spree can give confidence in the currency.

To the contrary, the AUD/USD currency pair could be under pressure if it cannot re-take the nine-day EMA and drops below the lower line of the ascending channel at about 0.6430. This would set the stage for additional losses to the 50-day EMA around 0.6380. More US dollar appreciation fueled by strong US economic data or dovish Federal Reserve rhetoric could severely weigh on the Australian Dollar. Additionally, heightened geopolitical tensions between China and Australia or revived global risk aversion may cap any potential recovery and send the pair lower in the short term.