Australian Dollar (AUD) continues to drive upwards against US Dollar (USD) as it is supported by optimism in the US-China trade negotiations and relief measures from People’s Bank of China (PBoC). The AUD/USD pair consolidated gains for the third consecutive session on President Trump’s call for an immediate interest rate cut by the US Federal Reserve and better risk sentiment. Australia’s PMI data revealed private sector expansion was modest, and manufacturing rebounded to a 12-month high. As US Treasury yields decline and the Dollar Index (DXY) weakens, technical indicators suggest a potential bullish trend for the AUD/USD pair, targeting resistance near 0.6300 within an ascending channel pattern.

KEY LOOKOUTS

• Optimism over US-China trade talks, fueled by Trump’s remarks and discussions with Xi Jinping, boosts the Australian Dollar as markets anticipate a potential resolution.

• Australia’s manufacturing PMI rises to a 12-month high, rebounding, yet the services sector slows down slightly, showing a mixed performance for the private sectors that drive the AUD.

• Trump’s suggestion of immediate rate cuts and next week’s FOMC event keep markets highly sensitive to USD performance in reaction to any eventual policy changes.

• The ascending channel continues holding the pair above 0.6300 as resistance and within key support levels at 0.6230, which also drives short-term bullish momentum.

The AUD is still on the rampage against the USD, mainly driven by hopes of a revived US-China trade deal, in conjunction with supportive measures from the PBoC. President Trump’s comments about having no intention to increase tariffs and urging the US Federal Reserve to lower interest rates right now have improved risk appetite and pushed the DXY down. The PMI data for Australia also favors the AUD as manufacturing recorded a 12-month high and indicated a sign of recovery despite the slight slowdown in the services sector. The technical analysis of the AUD/USD pair is trading within an ascending channel with resistance at 0.6300 and key support near 0.6230, indicating a continuation of the bullish trend.

The Australian Dollar moved higher against the US Dollar as optimism around US-China trade talks and favorable PBoC measures boosted market sentiment. Meanwhile, strong data from Australian PMI and low US Treasury yields supported the surge in AUD/USD.

• President Trump’s favorable comments on China trade talks enhanced market sentiment; hence, positive comments on that front supported the appreciation of the Australian Dollar against the US Dollar.

• People’s Bank of China maintained interest rates at 2.00% and also increased money supply via medium-term lending facility, to 200 billion Yuan, helping increase market confidence.

• Australian manufacturing PMI hit a 12-month high at 49.8 percent. That’s because, while its services sector grows slowly, manufacturing shows stabilization signals that contributed to strength in the currency of AUD.

• Trump pushed the US Federal Reserve to act on an immediate rate cut, which pressured the US Dollar and helped risk sentiment in global markets.

• The DXY broke below 107.00 as US Treasury yields weakened further, which further supported the upward momentum of the AUD/USD.

• The AUD/USD is trading within an ascending channel. Key resistance lies at 0.6300 while support levels lie at 0.6230, indicating a bullish potential.

• Traders are all eyes on US S&P Global PMI and Michigan Consumer Sentiment Index for further cues.

Australian Dollar gained additional strength versus US Dollar, as US-China trade talks continue to come in the form of positively toned mixtures with a current injection of People’s Bank of China (PBoC) measures. President Trump’s statement that he does not want to tax China and appeals to the Federal Reserve to cut interest rates now have helped improve risk tone around the world and pushed the US Dollar Index (DXY) lower. Economic data from Australia supported this further where the manufacturing PMI jumped a high 12 months back at 49.8, indicating a pick-up. But growth in the services sector cooled off a tad, which otherwise has been seen brimming with optimism.

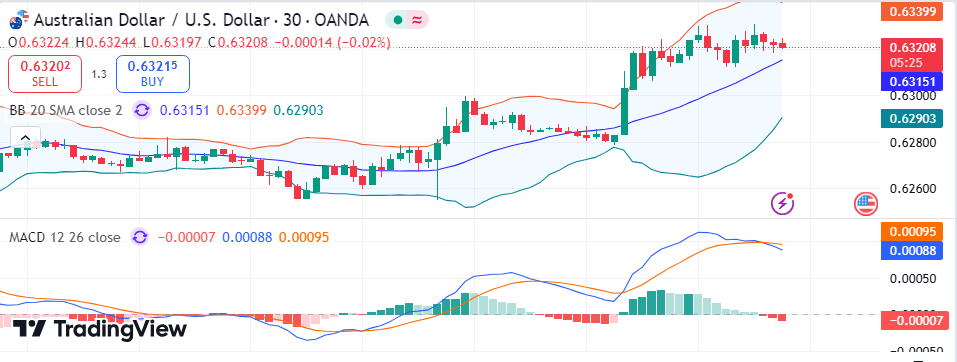

AUD/USD Daily Price Chart

Source: TradingView Prepared By ELLYANA

AUD/USD pair continues to trade within an ascending channel. The immediate resistance is at 0.6300, and the support stands at 0.6230. A sustained break above the resistance level could open up the path towards 0.6330 while stronger support stands at 0.6200. The US Federal Reserve’s next meeting, key US PMI data and the Michigan Consumer Sentiment Index, are in store, all of which can create a few more sparks of volatility to possibly guide the way of the pair. All said and done, the AUD/USD maintains a setup to take advantage of a weakening USD and the overall improved appetite for risk.

TECHNICAL ANALYSIS

The AUD/USD pair is trading within a well-defined ascending channel, which shows a short-term bullish trend. Immediate resistance lies at the psychological level of 0.6300, and further upside potential lies at 0.6330, near the upper boundary of the channel. Support levels lie at the nine-day Exponential Moving Average (EMA) at 0.6252 and the 14-day EMA at 0.6244, offering good downside protection. The 14-day RSI stays higher than 50, maintaining a positive sentiment while indicating that momentum is in the buyers’ side. A violation of the support line at the lower boundary of the ascending channel at 0.6230 may reverse the trend. Better support would then be at 0.6200.

FORECAST

More gains for the AUD/USD pair will occur if it is able to penetrate above the psychological resistance at 0.6300. Such a breakout would send the price towards the next target at 0.6330, consistent with the upper side of the ascending channel. Further optimism surrounding US-China trade talks and the PBoC’s accommodative measures should allow this Aussie strength to be sustained. Even if US economic data comes in higher than expected, or dovish comments from the Federal Reserve should weaken the US Dollar further, that would also be a tailwind for the AUD/USD price.

In the negative side, a failure to maintain its surge and close above the 0.6300 level would create a return lower to near-term support at the nine-day EMA at 0.6252 and the 14-day EMA at 0.6244. A break lower than the lower boundary of the ascending channel at 0.6230 could suggest bearish pressure during which the psychological level of 0.6200 will remain a strong support zone. Any negative news on global risk sentiment, including stalling US-China trade talks or an unexpected hawkish signal from the Federal Reserve, could fuel the downward movement.