Australian Dollar (AUD) is stable at 0.6520 in Tuesday’s Asian session, after three sessions of decline, as US Dollar (USD) gains on optimism about trade again. One of the main points of interest for traders is the return of US-China trade negotiations, which follow days of long-term negotiations in Stockholm and seek to lengthen the current trade truce. In the meantime, the latest US-EU trade agreement, which levies 15% tariffs on most European imports, has also supported the USD. Market participants also await crucial economic data, including Australia’s June labor force and Q2 inflation figures, which the Reserve Bank of Australia (RBA) will closely monitor ahead of any policy decisions. Technical indicators show a weakening momentum for AUD/USD, with the pair trading below the nine-day EMA and the RSI slipping under 50.

KEY LOOKOUTS

• Investors remain focused on the result of restarted trade talks, designed to lengthen the current truce and conclude a comprehensive tariff deal.

• The newly released US-EU agreement, placing 15% tariffs on European products, remains favorable for the US Dollar and might bear down on AUD/USD further.

• The Reserve Bank of Australia will likely make its rate decision based on the forthcoming June labor market data and Q2 CPI releases, both due later this week.

• The US Federal Reserve meeting and press conference in July will be watched closely for any indication of possible rate cuts from September.

Australian Dollar is trading around the 0.6520 level as the US Dollar gains on fresh trade optimism and a new trade agreement between the US and the EU. Market participants wait for the result of US-China trade negotiations that resumed after protracted talks in Stockholm and hope to prolong the existing truce and agree on a long-term pact. Locally, the Reserve Bank of Australia will be watching closely for the June labor force data as well as second-quarter inflation readings, both of which will have an important bearing on its next policy move. In the meantime, the Federal Reserve’s next meeting and any indication of future rate cuts will also be a significant driver of AUD/USD action in the near term.

The Australian Dollar is flat around 0.6520 while the US Dollar gains on optimism about trade. The markets look to US-China trade negotiations and major Australian economic releases. RBA and Fed policy cues will be important for the direction of the pair.

• AUD/USD is around 0.6520, consolidating the previous three losing sessions.

• US Dollar finds support from a newly agreed US-EU trade pact with 15% tariffs on European products.

• US-China trade talks resumed in Stockholm to continue the trade truce and set long-term tariff terms.

• The RBA is paying close attention to June labor force data and Q2 CPI numbers in preparing its policy decisions.

• The Fed will likely keep rates unchanged at the July meeting, with the market looking out for signs of September rate cuts.

• Technicals reveal weakness in AUD/USD as the pair continues to trade below the 9-day EMA and RSI falls below 50.

• Market sentiment continues to remain cautious as traders responded to both global trade news and domestic economic indicators.

The Australian Dollar continues to hold relatively firm as market players turn their attention to upcoming global trade news and major economic indicators. US-China trade talks resumption has garnered much focus, particularly following a prolonged Stockholm meeting of top officials that had the objective of clearing impasses and extending the ongoing trade truce. The talks are coming as early as the August 12 deadline for sealing a comprehensive pact with the US is near, further fueling market expectations. In the meantime, the latest US-EU trade pact has given the US Dollar a leg up, strengthening its position in a number of key currency pairs.

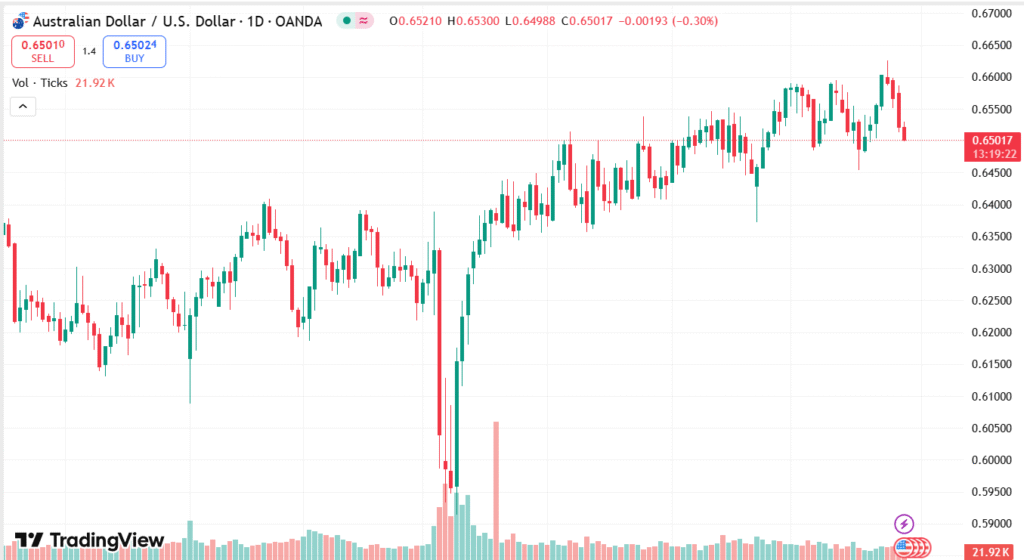

AUD/USD DAILY PRICE CHART

SOURCE: TradingView

Locally, the Reserve Bank of Australia will likely take a close look at the next month’s June labor force report and second-quarter inflation readings before setting any monetary policy. These numbers are said to be important in deciding whether more policy relaxation is needed in the next several months. The market is also waiting for hints from the US Federal Reserve’s July meeting, especially any guidance on possible rate cuts this year. With both global and domestic forces coming together, the future direction of the Australian Dollar will then be reliant on the outcomes of these major events.

TECHNICAL ANALYSIS

AUD/USD currency pair is quoted at 0.6520 and below the nine-day Exponential Moving Average (EMA), which reflects a weakening short-term momentum. The pair is still trading in an upward channel, which is generally a bullish formation; however, the recent fall in the 14-day Relative Strength Index (RSI) below the 50 level reflects growing bearish pressure. This discrepancy between the wider channel support and the short-term indicators suggests possible consolidation or a minor corrective phase unless bullish momentum returns to strength. Market players will be monitoring a strong breakout above the EMA or a breakdown beneath the channel support to establish the next directional bias.

FORECAST

If favorable momentum returns, the AUD/USD currency pair would have a possibility to bounce towards the 0.6560 resistance level if US-China trade negotiations reveal positive developments or if Australia’s future labor force and inflation reports surprise to the upside. A dovish US Federal Reserve turn or evidence of economic strength in Australia can also favor the pair. Crossing above the nine-day EMA and showing renewed momentum in the RSI would also confirm a bull reversal.

Downside risks, however, remain should US Dollar strength continue under trade optimism and calm Fed policy indications. AUD/USD then could find it difficult to sustain current positions, and hence might fall to the 0.6480 or even 0.6450 support levels. Poor Australian economic reports or rising global risk aversion could enhance the slide. A further breakdown below the EMA and prolonged RSI weakness would strengthen bearish views in the near term.