The Australian Dollar (AUD) retreated from a 10-month high of 0.6676 on Tuesday, as investors considered the forthcoming US Federal Reserve (Fed) meeting and US Retail Sales figures. The AUD had previously risen on hopes after a US-China trade deal on TikTok and solid domestic data, such as a strong trade surplus, solid Q2 GDP, and increasing inflation expectations. In spite of a generally risk-on sentiment in the market, AUD came under pressure from a falling US Dollar (DXY at around 97.20) and continuing speculation regarding Fed rate reductions, with markets pricing in a 25-basis-point cut in the September meeting and possible easing up to 2026. Technical analysis indicates AUD/USD trading in an upward channel, targeting 11-month highs around 0.6700, with support at 0.6621 and 0.6570.

KEY LOOKOUTS

• Traders will monitor the release closely for clues about US consumer expenditure, which will impact Fed policy expectations and USD strength.

• The market is expecting a 25-basis-point cut, but any surprise or description of future easing will affect AUD/USD momentum.

• The pair may challenge 11-month highs around 0.6700, with the initial support at the nine-day EMA (0.6621) and the lower boundary of the rising channel (0.6570).

• Domestic Australian figures and US-China trade trends, as well as general risk appetite, will keep influencing AUD strength.

Australian Dollar (AUD) softened from its 10-month high versus the US Dollar (USD) as markets looked out for major economic indicators, such as US Retail Sales and the Federal Reserve’s forthcoming rate announcement. Although previous advances were aided by a US-China commercial deal on TikTok and robust Australian economic data like a healthy trade surplus and inflation expectations increasing, the AUD was pressured with a weaker US Dollar and continued speculation regarding Fed cuts. Technicals indicate AUD/USD is still within an uptrend channel, targeting possible upside to 0.6700, with lower levels near 0.6621 and 0.6570. In the aggregate, the short-term direction of the currency will depend on global risk appetite and policy actions of both Australia and the US.

The Australian Dollar retreated from a 10-month high versus the US Dollar as investors waited for US Retail Sales and the Fed’s rate cut decision. Gains earlier were buoyed by upbeat Australian economic data and a US-China TikTok agreement. AUD/USD now looks toward resistance around 0.6700, with support near 0.6621.

• The Australian Dollar retreated from a 10-month high of 0.6676 versus the US Dollar.

• Support came from a US-China trade deal on TikTok and robust Australian economic figures.

• The Reserve Bank of Australia (RBA) indicates well-balanced risks and close inflation and consumer spending tracking.

• August US Retail Sales data is a highlight upcoming event impacting the strength of USD.

• Markets expect a 25-basis-point Fed rate cut in September, with further easing possible through 2026.

• AUD/USD is trading within an ascending channel, targeting 11-month highs near 0.6700.

• Immediate support levels are at the nine-day EMA (0.6621) and the channel’s lower boundary (0.6570).

The Australian Dollar (AUD) pulled back from a 10-month peak against the US Dollar (USD) as market players directed attention to coming US economic news and Federal Reserve policy actions. Previous gains were fueled by optimism after a US-China commercial deal to transfer TikTok into US hands and high domestic economic readings in Australia, such as a sound trade surplus, high Q2 GDP growth, and improving consumer inflation expectations. Reserve Bank of Australia (RBA) policymakers stressed the importance of a forward direction in ensuring economic stability and tracking consumer expenditure, noting confidence in maintaining inflation around target.

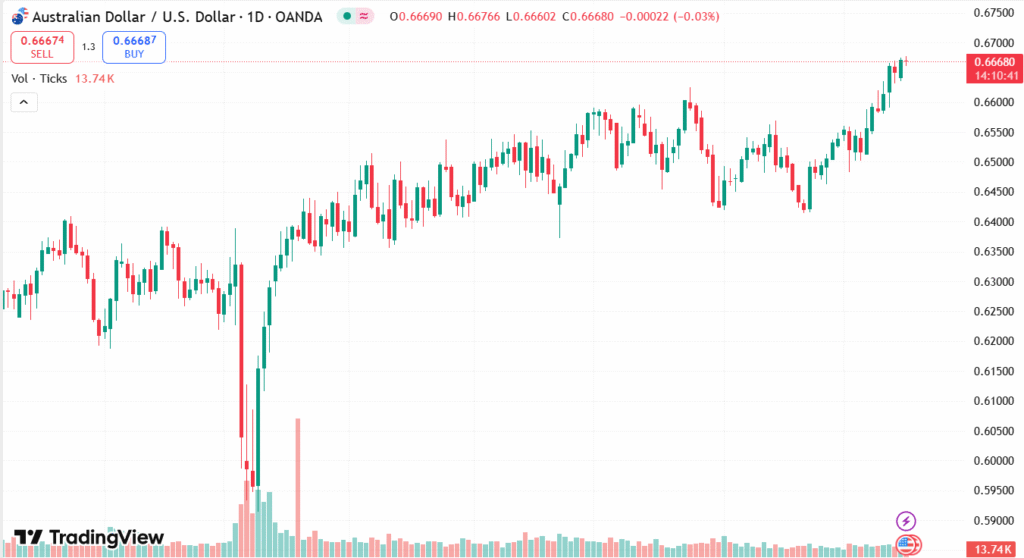

AUD/USD DAILY CHART PRICE

SOURCE: TradingView

Global events and central bank policy continue to shape the AUD’s performance. The US Dollar has remained under pressure in the run-up to the Federal Reserve’s expected rate cut, with the markets factoring in relief measures to buoy economic growth and prevent recessionary risks. In Australia, economic resilience and balanced risks in the outlook have capped expectations of further RBA rate cuts. While that is happening, market participants are watching broader market sentiment, such as trade news, US consumer indicators, and world economic health, which will keep influencing the currency’s near-term direction.

TECHNICAL ANALYSIS

AUD/USD currency pair is moving in a clearly defined upward channel, reflecting a positive market bias. The pair is now sitting above the nine-day Exponential Moving Average (EMA), reflecting high short-term momentum. On the positive side, the pair may aim for the 11-month high of 0.6687, then the channel top around 0.6700. On the negative side, there is initial resistance at the nine-day EMA of 0.6621, then support at the lower edge of the rising channel around 0.6570. A fall through this channel might reverse short-term momentum and lead the pair to the 50-day EMA at 0.6535.

FORECAST

AUD/USD can continue to move higher towards the 11-month high of 0.6687, and then further test the upper resistance of the ascending channel around 0.6700. Encouragement from solid Australian economic data, loss of expectation for additional RBA rate cuts, and global risk-on mood can further propel it higher in the near term.

To the downside, the pair may be supported by the nine-day EMA at 0.6621 and the lower line of the uptrend channel at 0.6570. A fall below these levels could destroy short-term bullish momentum, sending AUD/USD towards the 50-day EMA at 0.6535, particularly if US economic data surprises to the upside or Fed rate-cut hopes fade.