Australian Dollar remains under pressure even with robust domestic PMI data due to the resilience of the US Dollar in anticipation of the release of key ISM Services PMI data. Better economic news from both Australia and China has had little effect in pushing the AUD higher, with wider market sentiment being dampened by speculation of a Reserve Bank of Australia rate cut and international trade tensions. Developments in the US, such as weak jobs reports, inflation worries on the increase, and political interference in economic institutions, have contributed to uncertainty but seen the USD’s relative strength maintained.

KEY LOOKOUTS

• The market is following closely on this point of data for new indications of the US economy’s strength and direction of Fed policy in the future.

• The anticipation of 25 bps of rate cutting will weigh further on the Australian Dollar if it materializes.

• Even with inferior job numbers and political turmoil, the USD is still supported, affecting AUD/USD momentum.

• A surprise spike in China’s Caixin Services PMI could provide some limited upside to the AUD, considering the trade relations of Australia with China.

The Australian Dollar is bearish despite positive domestic and Chinese PMI readings, as general market sentiment remains bullish on the US Dollar prior to the ISM Services PMI announcement. Although Australia’s S&P Composite and Services PMIs recorded significant advances in July, hopes of a possible rate cut from the Reserve Bank of Australia continue to weigh down investor sentiment. Meanwhile, the US Dollar remains steadfast with increasing political uncertainty, poor jobs data, and ever-present trade tensions driving the bearish sentiment for the AUD/USD pair.

Australian Dollar remains soft despite positive PMI numbers, with the US Dollar holding steady prior to the ISM Services PMI release. Hopes of an RBA rate cut, alongside global trade tensions, continue to bear down on AUD/USD sentiment.

• Australian Dollar softens despite positive S&P Global Composite and Services PMI readings for July.

• China’s Caixin Services PMI sharply higher at 52.6, indicating firmer regional demand.

• US Dollar strong pre-ISM Services PMI, keeping AUD/USD under pressure.

• RBA to cut rates by 25 basis points next week as inflation eases and unemployment rises.

• Fed Governor Kugler resignation allows Trump to exert early control over the central bank, sparking fears of Fed independence.

• US NFP data is a letdown with only the addition of 73,000 jobs in July and a marginal increase in the unemployment rate.

• Technical perspective of AUD/USD remains bearish with the pair trading below significant moving averages and RSI below 50.

The Australian Dollar continues to suffer despite robust economic data from both Australia and China. Australia’s S&P Global Composite PMI and Services PMI in July both reported significant improvement, which is indicative of ongoing private-sector growth and the best expansion since early 2022. China’s Caixin Services PMI also increased strongly, indicating more robust service-sector activity in the region that would generally underpin Australian export demand. But these encouraging data points have not yet resulted in significant gains for the AUD, given that market sentiment overall is overshadowed by central bank expectations and geopolitical events.

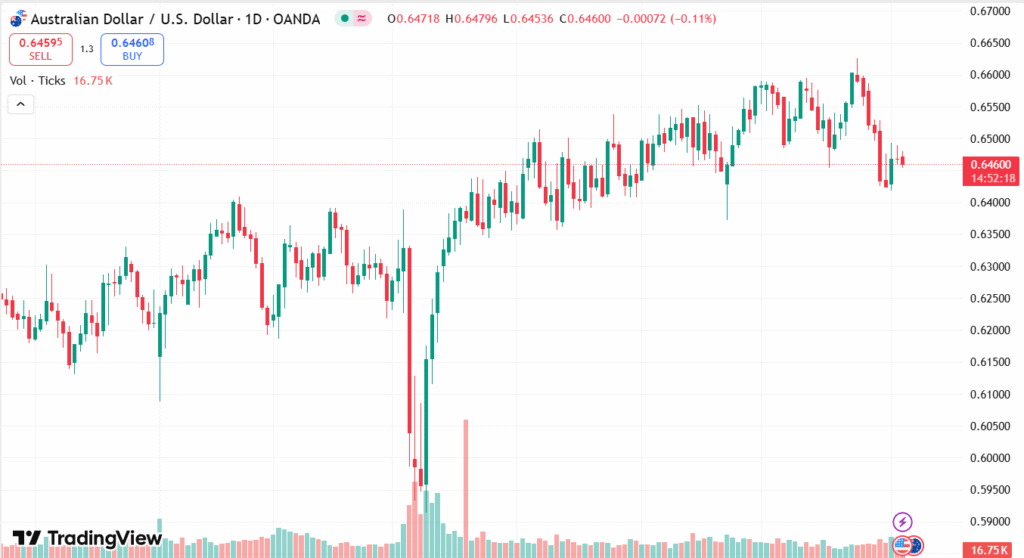

AUD/USD DAILY PRICE CHART

SOURCE: TradingView

In the US, political and economic developments are dictating the market narrative. The surprise resignation of Fed Governor Adriana Kugler provides President Trump with the opportunity to shape the Federal Reserve sooner than expected, raising questions regarding the independence of the institution. Moreover, recent moves like the removal of the BLS Commissioner and the introduction of fresh tariffs have added to the uncertainty. In spite of a softer jobs report, the US Dollar has remained resilient, with investors waiting for more clarity from the forthcoming economic data and Fed policy moves.

TECHNICAL ANALYSIS

AUD/USD pair continues to have a bearish bias, trading below important short-term moving averages. 14-day Relative Strength Index (RSI) continues to be below the level of 50, which suggests poor momentum. The pair is now trading around 0.6470 levels, with the immediate support coming at the recent low of 0.6419. A close below this point would see further weakness to the next significant support of 0.6372. To the upside, resistance comes in at the 9-day EMA of 0.6485 and the 50-day EMA of 0.6494; a firm break above these might encourage a switch to short-term positive sentiment.

FORECAST

If later US data, specifically the ISM Services PMI, is weaker than anticipated or reflects economic deceleration, the US Dollar may lose some of its vigor, providing scope for recovery in the Australian Dollar. Also, any unexpected move by the Reserve Bank of Australia to keep rates unchanged rather than cut them may sustain a bounce in AUD/USD. A breach above resistance levels of 0.6485 and 0.6494 might set the stage towards the 0.6625 level, particularly if risk appetite picks up and global trade tensions subside.

On the negative side, if ISM Services PMI numbers surprise higher or if US yields increase even more, the US Dollar can continue to advance, and place further pressure on the AUD. Confirmation of the RBA cutting rates next week would also support bearish sentiment towards the Australian Dollar. From a technical perspective, a clear fall below 0.6419 might sustain losses, and the pair could slide towards the next significant support around 0.6372, seen late last June.