Australian Dollar (AUD) softened after the Reserve Bank of Australia’s (RBA) third interest rate cut in 2025, indicating continued attempts at taming inflation in the face of a moderate slowing labor market. As Australia’s Wage Price Index reported steady but marginally lower-than-anticipated growth, the US Consumer Price Index reported mixed inflation figures, and the subdued US Dollar somewhat contained AUD losses. The RBA highlighted a prudent, meeting-by-meeting approach to future rate action, while global events, including a temporary US-China tariff ceasefire, imbued the AUD outlook with complexity. Technical indicators indicate that the AUD/USD still hovers in an uptrend channel, with the important support around 0.6500 and the potential upside towards 0.6600, showing a market offsetting inflation fears against guardedly optimistic sentiment.

KEY LOOKOUTS

• Monitor additional indications from the Reserve Bank of Australia on whether additional rate cuts or holds are in the cards, as the central bank weighs off inflation management against economic expansion.

• Future US Consumer Price Index announcements and Federal Reserve comments will determine largely the strength of USD and, by extension, AUD/USD directions.

• Any change in the US-China tariff detente or movement in China’s economic indicators might affect Australian trade outlook and the Australian Dollar.

• Major price levels to look out for are support around the nine-day EMA at 0.6511 and resistance around the 0.6580–0.6600 level, which could influence short-term AUD/USD momentum.

The Australian Dollar is currently dealing with a complicated setup influenced by the Reserve Bank of Australia’s conservative rate-cutting policy and conflicting inflation readings of the world’s top economies. While the RBA’s third rate reduction in 2025 demonstrates the continued push to temper inflation and boost the job market, there is still uncertainty regarding the speed and magnitude of further monetary accommodation. At the same time, the recent weakness in the US dollar and a temporary truce in tariffs between China and the US give some respite to the AUD. The currency is still on the lookout for central bank statements and future economic data, though, with technical indicators indicating that the AUD/USD pair is sitting at the crossroads of key support and resistance levels, which portends potentially unsettled market action in the near future.

The Australian Dollar softened after the RBA’s third rate cut in 2025, following attempts to moderate inflation as wage growth slows down. Some support is coming from mixed US inflation reports and a truce on US-China tariffs, but the AUD is exposed to global economic trends and crucial technical levels.

• The Reserve Bank of Australia lowered interest rates by 25 basis points to 3.6%, its third rate cut in 2025.

• Australia’s Wage Price Index rose 0.8% QoQ, slightly below the previous 0.9% increase, with annual growth at 3.4%.

• The US Consumer Price Index rose 2.7% YoY in July, matching expectations but showing mixed signals with core CPI increasing to 3.1%.

• The AUD/USD pair slipped after the RBA’s rate cut but found some support from a weakening US Dollar and a tariff truce between the US and China.

• The US-China tariff truce has also been lengthened for another 90 days, currently alleviating trade tensions to the advantage of the AUD.

• Technical analysis indicates that AUD/USD is trading above the nine-day EMA at around 0.6511, with a resistance of around 0.6580 and support around 0.6490.

• Market attention continues to be directed towards future RBA rate decisions, US inflation numbers, and international trade developments influencing AUD sentiment.

The Australian Dollar was under pressure after the Reserve Bank of Australia reduced interest rates for the third time in 2025. This action shows that the central bank is supporting the decline in inflation and recognizing a marginal moderation in labor market conditions. While Australia’s Wage Price Index was growing steadily, it was slightly less than in prior quarters, indicating a conservative economic outlook. At the same time, mixed US inflation data and an extension of the tariff ceasefire between the US and China complicated the global economic situation and affected the performance of the AUD.

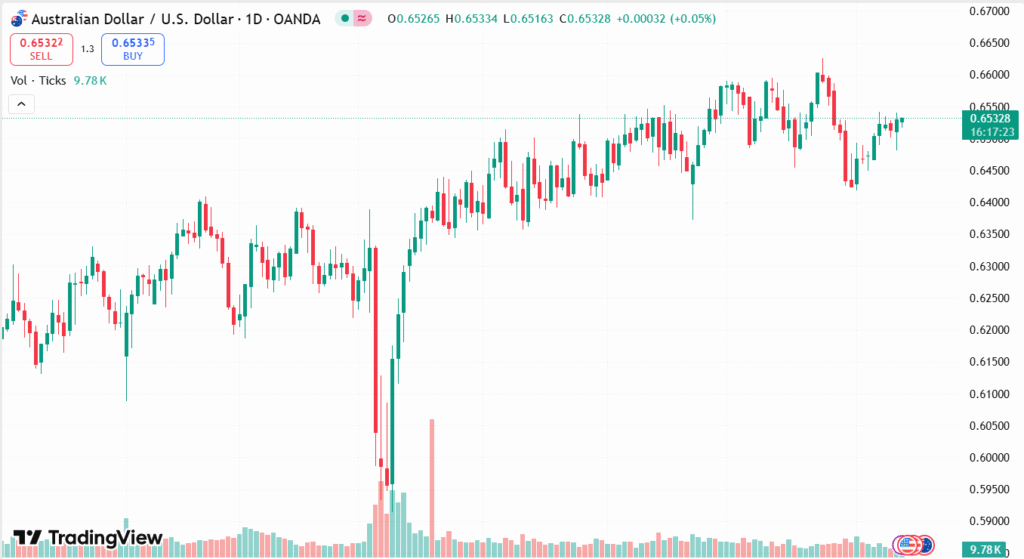

AUD/USD DAILY PRICE CHART

SOURCE: TradingView

The RBA focused on a gradual, meeting-by-meeting style of future monetary policy, underlining the uncertainty that awaits. Global events, such as the US Federal Reserve’s expectations for a rate cut and China’s stable inflation rate, are set to remain market drivers. As a key trade partner to China, Australia remains sensitive to shifts in international trade relations and economic indicators. Maintaining price stability and full employment remain the RBA’s top priorities as it navigates these challenging economic conditions.

TECHNICAL ANALYSIS

AUD/USD pair is currently trading within an ascending channel, indicating a generally bullish trend in the short to medium term. The price is still trading above the nine-day Exponential Moving Average (EMA), which implies that short-term momentum is gaining strength. The Relative Strength Index (RSI) is near the neutral 50 position, indicating a fair market with no obvious overbought or oversold levels. Key support areas are around the nine-day EMA at 0.6511 and the lower border of the channel at 0.6490, while resistance is anticipated around the upper border of the channel at 0.6580 and the psychological level at 0.6600. A break above or below these levels may indicate the next direction for the pair.

FORECAST

The Australian Dollar stands to gain potential if it can break above the higher boundary of the rising channel around 0.6580. This could enhance bullish sentiment and drive the AUD/USD currency pair to the psychological resistance level of 0.6600, and even challenge the recent nine-month high around 0.6625. Positive sentiments from Australian economic data or additional ease in global inflation pressures could also give a further boost to an upward movement.

On the other hand, if the AUD/USD cannot maintain its existing support level around the nine-day EMA at 0.6511 and drops below the lower limit of the channel at about 0.6490, the pair will have added selling pressure. Such a down scenario would see the pair test the two-month low at 0.6419 and extend to challenge the three-month low around 0.6372. Fresh fears of rising inflation, poor trade numbers, or unanticipated changes in monetary policies around the world may precipitate such losses.