Australian Dollar (AUD) declined against the US Dollar (USD) on Tuesday as dismal domestic data and a resilient Greenback put pressure on the pair. Australia’s Westpac Consumer Confidence declined 3.5% in October, with ANZ Job Advertisements plummeting sharply, indicating weakening economic sentiment. In spite of increasing hopes for Federal Reserve rate reductions in the face of a record US government shutdown, the USD kept gaining strength on the back of hawkish Fed statements. In contrast, the AUD/USD pair fluctuated about 0.6610, remaining near crucial support levels as market participants look to subsequent Reserve Bank of Australia (RBA) speeches and inflation releases for further direction.

KEY LOOKOUTS

• Westpac Consumer Confidence declined 3.5% in October, while ANZ Job Advertisements reduced 3.3%, reflecting a easing labor market and tepid consumer sentiment.

• The Greenback remains solid despite increasing hopes for Fed rate reductions and persistent government shutdown ambiguity.

• Market participants expect forthcoming RBA speeches to provide insight into future monetary policy as inflation pressures continue to persist.

• AUD/USD lingers around the 0.6600 support, with resistance around 0.6707; a breach below 0.6560 may initiate fresh bearish pressures.

The Australian Dollar continued its slide versus the Greenback on Tuesday as weaker domestic indicators and a resilient US currency put downward pressure on sentiment. Australia’s Westpac Consumer Confidence dropped 3.5% in October, while ANZ Job Advertisements declined 3.3%, as economic uncertainty increased. In spite of anticipation of future Fed rate cuts during the continued US government shutdown, the US Dollar continued to strengthen on the back of hawkish comments from Fed policymakers highlighting the requirement to continue controlling inflation. While meanwhile traders wait eagerly for policy signals from Reserve Bank of Australia (RBA) officials through their speeches, the AUD/USD pair trades just beneath the support level of 0.6600 with very little bullish pressure.

Australian Dollar dipped as weak local data and a rising US Dollar pushed the AUD/USD pair. Even amid speculations of Fed interest rate cuts, the Greenback was solid during the US government shutdown. Traders now look forward to coming RBA speeches for policy guidance.

• The Australian Dollar fell as poor domestic data pushed sentiment low.

• Westpac Consumer Confidence fell 3.5% in October, the steepest decline since April.

• ANZ Job Advertisements dropped 3.3% in September, which indicated declining labor demand.

• The US Dollar continued to gain ground even as expectations increased for Fed rate cuts.

• The hawkish views of Fed officials supported optimism over US monetary policy.

• The AUD/USD currency pair is trading close to the 0.6600 support level with minimal bullish force.

• Market participants look forward to speeches from RBA officials to gain clarity on future rate levels and inflation expectations.

The Australian Dollar came under renewed pressure against the US Dollar as dismal economic data from Australia underscored increasing domestic issues. Westpac Consumer Confidence dipped 3.5% in October, the steepest fall in six months, and ANZ Job Advertisements declined by 3.3% in September, reflecting weakening household expenditures and employment prospects, which keep burdening Australia’s economic prospects. At the same time, the TD-MI Inflation Gauge indicated that price pressures continue to be ongoing, making it challenging for the Reserve Bank of Australia (RBA) to balance its inflation to within a target range.

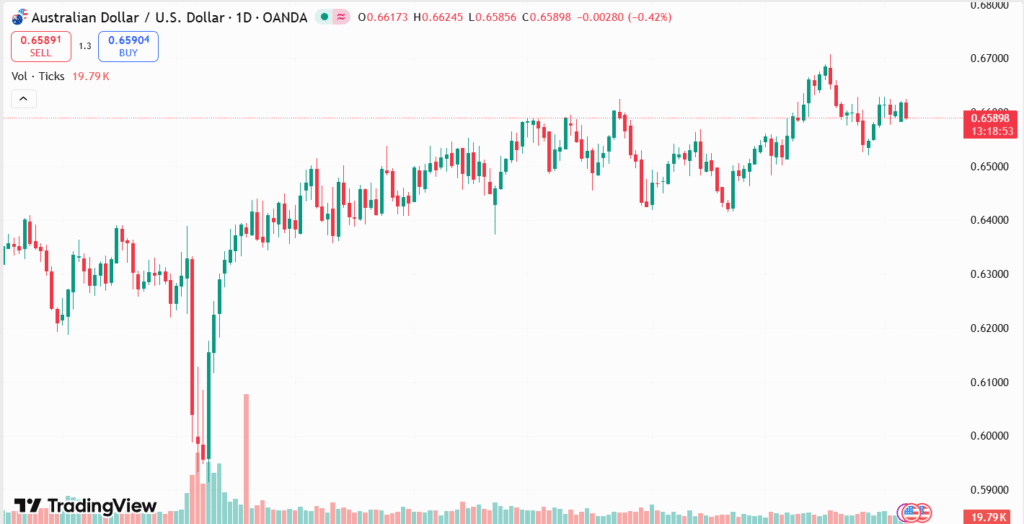

AUD/USD Daily Chart Price

SOURCE: TradingView

In international markets, the US Dollar was steadfast despite growing expectations of future Federal Reserve rate reductions. Hawkish comments from Federal Reserve officials reiterated their resolve to tame inflation, buoying the Greenback in an environment of political and economic instability brought on by the protracted US government shutdown. The prolonged shutdown has pushed forward major economic reports, further encouraging caution in the markets. Further, the news of a meeting between US President Donald Trump and Australian Prime Minister Anthony Albanese later this month has raised eyebrows, with talks regarding the Aukus defense pact potentially having implications on future trade and diplomatic relations between the two countries.

TECHNICAL ANALYSIS

AUD/USD pair is trading around the crucial support level of 0.6600, closely in line with the nine-day Exponential Moving Average (EMA) of 0.6602. The couple continues trading inside an uptrend channel, suggesting that the couple’s modest bullish tilt is still in place. The 14-day Relative Strength Index (RSI) remains above the 50 mark, also providing an argument for a possible recovery if the momentum is maintained. On the higher side, the breakout above the 12-month high of 0.6707 may pave the way to challenge the upper line around 0.6790. On the contrary, a firm break below 0.6560, around the 50-day EMA, would point to a bearish bias and put the pair at risk of further losses.

FORECAST

If sentiment in the markets improves and risk appetite resumes, the Australian Dollar may recapture favor against its American counterpart. A break above the 0.6707 resistance point on a sustainable basis would reinforce the positive picture, potentially sending the pair towards the top line of the rising channel at 0.6790. Friendly comments from RBA policymakers or higher inflation readings would also enhance hopes for a more aggressive policy approach, giving a further boost to the AUD/USD pair in the short term.

Yet, if soft domestic indicators persist to drag on confidence and the US Dollar continues to stay robust, the AUD/USD currency pair could once again attract fresh selling interest. A fall below the psychological support at 0.6600 would likely lead to further plunges towards the 0.6560–0.6410 area. Chronic worries over consumer confidence, employment market weakness, and a dovish RBA policy stance could also continue to restrict the Australian Dollar’s near-term recovery potential.