Bitcoin has broken below its key support level of $116,000, putting an end to a 16-day period of consolidation and leaving doubts about whether this is the beginning of a deeper correction or a brief fakeout. In the face of a solid macroeconomic environment, including the Federal Reserve’s move to leave interest rates unchanged, BTC lost 3.4% this week. Traders currently wait for important data such as the US Nonfarm Payrolls for more indications. Meanwhile, encouraging news in the form of White House regulatory clarity, the SEC’s ETP approval, and the JPMorgan–Coinbase agreement can underpin long-term bullish sentiment despite short-term technicals being bearish.

KEY LOOKOUTS

• Observe if BTC holds below $116,000 or recaptures it soon — this will decide if the move is a real breakdown or a fleeting fakeout.

• Friday’s employment data may propel short-term volatility in BTC by affecting risk sentiment and expectations of interest rates.

• RSI dipping below 50 and a bearish MACD crossover indicate downward pressure; a retest of the 50-day EMA near $112,951 should be expected.

• White House crypto policy, SEC ETP decision, and the JPMorgan–Coinbase collaboration might provide support in the long term even if there is short-term skepticism.

Bitcoin’s recent fall below $116,000 support level has put an end to 16 days of consolidation, raising concerns of a deeper correction in the midst of mixed macro and regulatory cues. Although the Federal Reserve’s decision to leave interest rates unchanged reflects a dovish economic approach, bearish technical signals such as RSI and MACD suggest increasing downside momentum. Yet long-term sentiment is cautiously upbeat with clearer regulatory guidance from the White House, the SEC approval of in-kind ETP transactions, and JPMorgan’s alliance with Coinbase suggesting heightened institutional adoption and infrastructure support for digital assets.

Bitcoin has fallen beneath its 16-day range at $116,000, raising fears of a more substantial pullback. Bearish technical indications suggest further weakness, but regulatory clarity and institutionally-driven moves provide longer-term support.

• Bitcoin fell below its lower consolidation line, ending a 16-day range and triggering potential bearish sentiment.

• Price action indicates prudent sentiment even in the absence of significant adverse macroeconomic developments.

• Interest rates are still 4.25%–4.50%, but no rumors about cuts put more pressure on risk assets such as BTC.

• RSI falls below 50 and MACD indicates a sell-off, highlighting possible further downside.

• Traders look forward to Friday’s US jobs report for new market guidance.

• White House issues its initial crypto policy, calling for clarity and innovation in digital assets.

• JPMorgan–Coinbase alliance and SEC’s reforms of ETPs indicate long-term bullish potential.

The market environment for Bitcoin this week was as much dictated by regulatory and geopolitical events as by straightforward price action. A big step toward achieving clarity in the U.S. crypto regulatory environment was taken with the White House issuing its first virtual asset policy. The authoritative 160-page report also made suggestions on how to streamline regulation, foster innovation, and determine acceptable banking activities around stablecoins and tokenized assets. This action was deemed a positive development for long-term institutional investment and market sophistication, although the near-term market response was subdued.

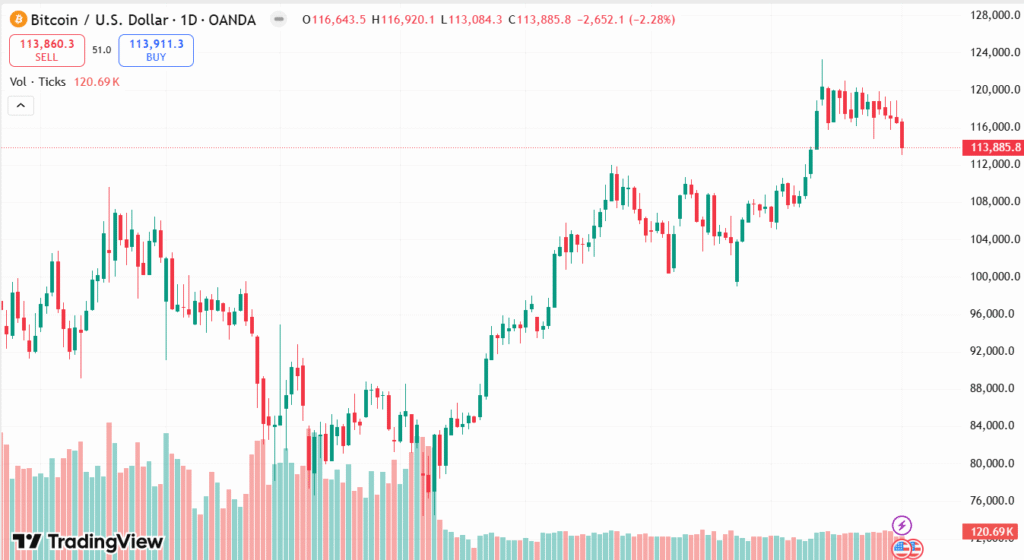

BITCOIN DAILY PRICE CHART

SOURCE: TradingView

Furthermore, the cooperation between JPMorgan and Coinbase is a sign of increased convergence between legacy finance and digital assets. With intentions to connect bank accounts directly with crypto wallets, the alliance underscores the continued mainstream adoption of cryptocurrencies. At the same time, continuing global trade tensions — Trump’s recent announcement of drastic tariffs on primary imports among them — have added a degree of uncertainty, though markets have remained resilient. Taken together, these moves suggest a solidifying infrastructure for Bitcoin and other digital currencies, despite near-term volatility.

TECHNICAL ANALYSIS

Bitcoin’s recent fall below the support level of $116,000 indicates fading bullish momentum and a possible reversal towards a bearish trend. The Relative Strength Index (RSI) has also fallen below the middle level of 50, signaling increasing selling pressure, while the Moving Average Convergence Divergence (MACD) has indicated a bearish crossover since July 23, supporting the downward trend. Further, the rising red histogram bars on MACD signal indicate that bearish momentum is growing. If the price keeps falling, a retest of the 50-day Exponential Moving Average (EMA) around $112,951 may be the next support level to look out for a potential bounce or further fall.

FORECAST

If Bitcoin can retake the $116,000 level and get back into bullish mode, it might aim for a short-term rebound to $118,500 and even retest its recent all-time high at $123,218. Positive drivers in the form of ongoing institutional demand, supportive regulatory trends, and robust ETF demand might be the driver for this rally. A macro environment conducive to support, such as dovish Fedhawkish Fed signals or better-than-expected economic data, would also fuel renewed risk-taking in the crypto space and maintain supportive price action for BTC’s upside potential.

Conversely, not holding current levels can see Bitcoin continue its pullback to the 50-day EMA at $112,951 or even lower support levels of about $110,000. Continuing bearish technical cues and eroding investor sentiment might make the correction deeper. Also, any disappointment in future macro reports such as the Nonfarm Payrolls or escalating geopolitical tensions—particularly trade tariff tensions—might deteriorate risk appetite, seeing higher selling pressure and plunging Bitcoin into an even more extended downtrend.