Bitcoin price is trapped in a six-day consolidation period, unable to overcome the resistance of the 20-day exponential moving average (EMA) at approximately $105,300. Following its recent jump from $100,700 to an all-time high of $112,000, price has lost momentum, leading price to trade in a very narrow range between major Fibonacci support and resistance levels of $106,400 and $103,100. Since Relative Strength Index (RSI) shows weak momentum and price has not managed to re-take the 20-day EMA, near-term direction favors continued downside risk. A clear break above $106,400 is essential for bulls to bring back uptrend, while a fall beneath $103,100 may bring on heightened selling pressure.

KEY LOOKOUTS

• Observe whether Bitcoin manages to break and sustain above this key moving average that has arrested recent attempts at a rebound.

• A breakout above this resistance with success may indicate a bullish continuation towards the all-time high of $112,000.

• This level has consistently drawn in buyers; a breakdown here can initiate heightened selling pressure.

• Observe the RSI, particularly the reading on the 4-hour around 44, as a consistent move upwards can signal fresh buying strength, while further decline indicates ongoing bearish bias.

Bitcoin price action is in a precarious state as it hovers in consolidation below the 20-day EMA, indicating market indecision following its recent sharp bounce. The cryptocurrency is caught in between solid resistance at $106,400 and key support around $103,100, with momentum gauges such as the RSI indicating limited upside. This lateral motion indicates that the market is holding back for a definite catalyst to initiate the next move, with a close above the 20-day EMA and the 50% Fibonacci level required to revive bullish impetus. Alternatively, a breakdown below support could lead to lower levels, keeping the short-term outlook in doubt and highly susceptible to key technical levels.

Bitcoin remains trading sideways, rejections at the 20-day EMA and supports around $103,100. The absence of momentum and level RSI indicates indecision, and a break above $106,400 would be required to bring back bullishness. Otherwise, bearish risks are in the limelight.

• Bitcoin is ranging for the sixth consecutive day, between resistance at $106,400 and support at $103,100.

• The 20-day EMA at $105,300 is forming a solid resistance, limiting all recent bounce efforts.

• Price flashed a minor rally during the Asian session but could not maintain gains, reversing lower around $104,500.

• RSI on the 4-hour chart is approximately 44, reflecting weak bullish buying pressure and possible downside bias.

• A breakdown below $104,300 may result in a retest of $103,100, a major Fibonacci support level.

• A strong breakout above $106,400 is required to resume the larger uptrend toward the record high of $112,000.

• Deflated funding rates and recent long liquidations indicate the market could be resetting before a possible breakout.

Bitcoin’s recent price action is indicative of a phase of uncertainty within the market as investors swallow recent profits and reconsider direction. Following a robust start to May, the momentum has tapered, with players seemingly holding back for new signals before opening new positions. This lull follows a wider sense of uncertainty among the global financial system, as macroeconomic considerations and sentiment increasingly influence short-term trading.

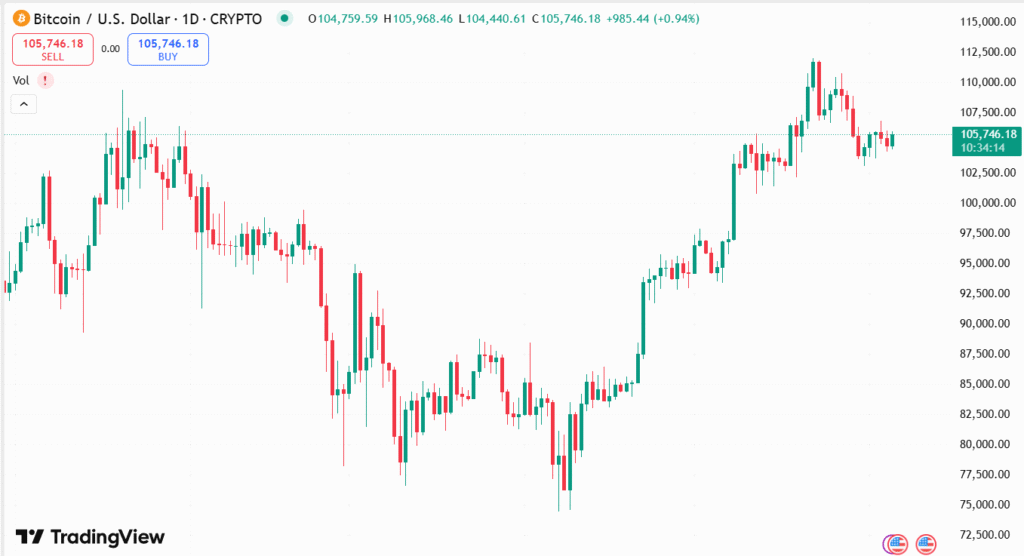

BITCOIN DAILY PRICE CHART

CHART SOURCE: TradingView

Throughout this consolidation phase, activity has been range-bound, implying that buyers and sellers are in a cautious mood. The muted action reflects a transient equilibrium in which neither has managed to prevail. To investors and observers, this type of situation tends to lead to a more forceful move in either direction, as the market accumulates pressure for a more definitive breakdown or breakthrough in the coming days.

TECHNICAL ANALYSIS

Bitcoin is encountering firm resistance at the 20-day exponential moving average (EMA) level of about $105,300 that has consistently checked upward efforts. The price continues to be stuck in a defined range with $106,400 as the 50% Fibonacci retracement level of the recent rally and a key resistance level. Support, on the other hand, comes in at $103,100, which aligns with the 0.786 Fibonacci retracement. The Relative Strength Index (RSI) on the 4-hour scale is fluctuating near 44, showing weak momentum with no distinct bullish strength. As long as Bitcoin fails to break convincingly above the 20-day EMA and $106,400, the technical setup is inclined towards further consolidation or a potential retest of lower support zones.

FORECAST

If Bitcoin is able to break through the 20-day EMA and the $106,400 resistance level, then it may unleash fresh bullish momentum and make way for a push towards the previous all-time high at $112,000. Such a breakout will reflect a change in short-term sentiment and prompt new buying interest and perhaps even attract institutional investors into the market. A close above $106,400 would also invalidate the present consolidation pattern, implying that the larger uptrend from $100,700 would resume.

On the negative side, not being able to hold above $104,300 would add to selling pressure and drive Bitcoin into the important support of $103,100. A firm break below this would potentially encourage a deeper correction and potentially draw additional liquidation from leveraged longs. If the support does fail to hold, bearish momentum could extend, extending the retracement to lower psychological levels, eroding recent gains and turning market sentiment more defensively.