Bitcoin rose close to 10% this week, trading at around $103,000 as bullish sentiment gains traction based on better market sentiment, institutional inflows, and pro-crypto state laws. The rally came amid a recently announced US-UK trade agreement and forthcoming talks with China, which have relieved global trade tensions and increased risk-on appetite. Institutional investors kept on infusing money into US spot Bitcoin ETFs, recording almost $600 million worth of inflows, while businesses such as Strategy and Semler Scientific increased their BTC holdings. With positive technical signals and increasing adoption at the state and corporate levels, Bitcoin is now looking to reach $105,000 as its next target before challenging its all-time high.

KEY LOOKOUTS

• Bitcoin is getting closer to the major psychological resistance of $105,000; breaking above this can set the path towards re-testing its all-time high of $109,588.

• The weekend trade negotiations between the US and China could have a crucial influence on the sentiment in markets—favorable results may also continue to validate Bitcoin’s upwards trend.

• Ongoing inflows from institutions into US spot Bitcoin ETFs will be an excellent sign of ongoing demand and long-term support for prices.

• With the Relative Strength Index (RSI) above 70, traders should watch for signs of a potential pullback or consolidation before further upward movement.

Bitcoin eyes the $105,000 level, investors should closely monitor several key factors that could influence its next move. The outcome of the upcoming US-China trade talks this weekend may significantly impact market sentiment, potentially fueling further gains if tensions ease. Institutional demand continues to be the prime mover, and ongoing inflows into US spot Bitcoin ETFs continue to back long-term bullish momentum. But with the Relative Strength Index (RSI) now overbought, a short-term pullback or consolidation cannot be ruled out. A conclusive breakout above $105,000, the next level of resistance, could pave the way for Bitcoin to retest its all-time high of $109,588 in the near future.

Bitcoin’s next significant test is at the $105,000 resistance level, with solid institutional inflows and trade optimism driving the rally. But overbought technicals indicate a potential short-term pullback before a push to the all-time high of $109,588.

• Bitcoin jumped almost 10% this week, steadying at $103,000 and close to the crucial $105,000 resistance level.

• The US-UK trade agreement softened global tariff tensions, improving risk-on sentiment and crypto market optimism.

• Weekend US-China trade negotiations may further dictate market direction based on their results.

• Institutional demand is strong, with close to $600 million in inflows into US spot Bitcoin ETFs this week alone.

• Institutional players such as Strategy and Semler Scientific keep on stockpiling BTC, reflecting expanding mainstream acceptance.

• Crypto projects at the state level in Arizona and New Hampshire reflect escalating US government involvement with digital assets.

• Technical analysis reflects bullish strength, yet overbought RSI hints at possible short-term correction or consolidation.

Bitcoin is maintaining its upward momentum as good news in international trade and institutional adoption fuels renewed investor optimism. The news of a US-UK trade deal has eased market uncertainty, providing a better environment for risk assets such as Bitcoin. Moreover, the expectation of positive trade talks between the US and China this weekend contributes to the positive sentiment in the market. These geopolitical trends have distracted attention from issues over tariffs and instead focused on increased economic collaboration, underpinning wider market stability.

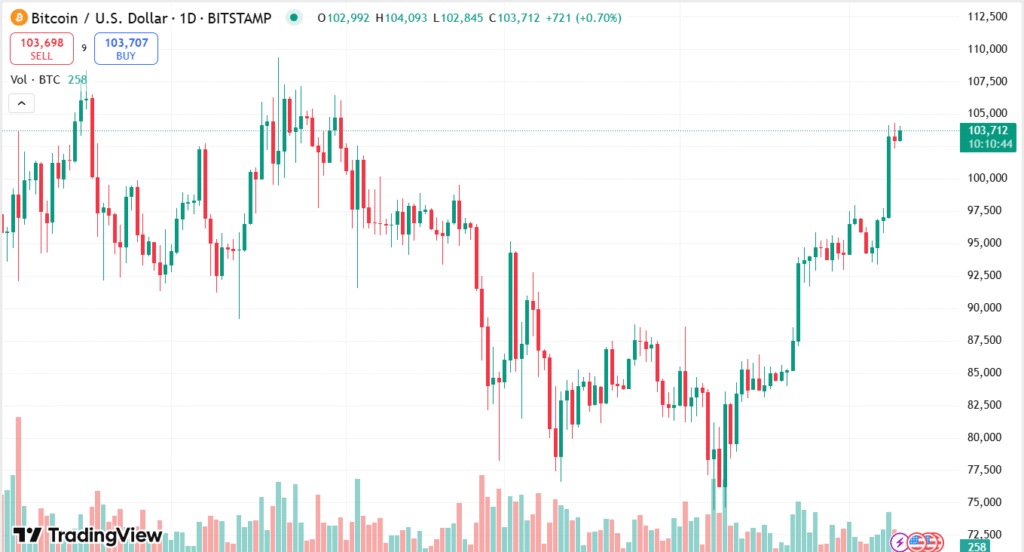

BITCOIN DAILY PRICE CHART

CHART SOURCE: TradingView

Institutional demand for Bitcoin is still healthy, with US spot Bitcoin ETFs seeing some $600 million of inflows in the one week alone. Companies like Strategy and Semler Scientific are also growing their positions in Bitcoin, a sign that confidence in it as a strategic asset over the long term continues to grow. While that is happening, US states such as Arizona and New Hampshire are taking legislative action to implement and govern digital assets, pointing towards a larger push towards mainstream integration of crypto. All these aspects combined point to an increasingly strong foundation for further growth and acceptance of Bitcoin both in public and private sectors.

TECHNICAL ANALYSIS

Bitcoin has displayed solid bullish momentum, surging past the critical resistance mark of $97,700 and settling at $103,000. The intraday Relative Strength Index (RSI) is currently above 70, which reflects overbought levels, usually before a short-term consolidation or correction. Nevertheless, the extended price action above resistance and a recent bullish MACD crossover indicate that the buyers are still in command. If the momentum persists, Bitcoin may test the next psychological resistance level of $105,000, with a possible trajectory towards its all-time high of $109,588.

FORECAST

Bitcoin has strong upside potential, fueled by a positive macroeconomic backdrop, increasing institutional demand, and friendly legislation at the state level. The current inflows into US spot Bitcoin ETFs and ongoing corporate buying indicate a strong demand base. If optimism persists, particularly after the US-China trade talks outcome, Bitcoin may breach the $105,000 mark. A decisive move above this psychological barrier may pave the way for a retest of its all-time high around $109,588, with the momentum likely to take it even further in the mid-term.

In spite of the positive outlook, caution is advisable since technicals are indicating overbought conditions, and hence the chances of a short-term correction or consolidation are high. Traders will take profits following the recent upsurge, and any negative news from the US-China trade talks may reduce sentiment. Further, unforeseen macroeconomic events or regulatory developments might induce volatility. In this case, Bitcoin could retreat to significant support levels at $97,700 or lower before trying to move further up.