Bitcoin price remains under pressure as rising geopolitical tensions in the Middle East and fresh trade uncertainties bring considerable weight down on market sentiment. Having briefly touched its all-time high earlier this week, BTC fell below $105,000 due to more than $1.15 billion liquidations throughout the crypto market. Even with some positive indicators, including continued institutional demand and large inflows into US spot Bitcoin ETFs, bearish technical signals like a fall below the 50-day EMA and a bearish MACD crossover indicate that Bitcoin may test the all-important $100,000 psychological support level if selling pressure continues.

KEY LOOKOUTS

• Ongoing conflict between Israel and Iran is continuing to drive global risk aversion, which pressures Bitcoin and other asset classes.

• Institutional demand is strong in public companies and ETFs, with more than $1.07 billion in inflows to ETFs this week providing a degree of support to sentiment at the longer end.

• Bitcoin’s fall below its 50-day EMA and bearish MACD crossover signal increased downside risk, with a retest of the $100,000 psychological figure a possibility.

• Soft inflation readings could be supportive for risk assets in the longer run, but near-term uncertainty persists given conflicting market responses.

Bitcoin remains under pressure as a mix of rising geopolitical uncertainty and unclear macroeconomic conditions sadden sentiment among investors. The Israel-Iran conflict has caused generalized risk-off flows leading to major liquidations in the cryptocurrency space. In spite of early-week optimism fueled by positive news in US-China trade negotiations and easing inflation data, Bitcoin was unable to hold onto its rally, falling below critical support levels. Strong institutional buying, especially from public firms and US spot Bitcoin ETFs, provides a hint of relief for long-term investors even as short-term bearish indicators indicate a possible retest of the $100,000 psychological threshold.

Bitcoin wrestles to maintain above $105,000 with increased Middle East tensions and risk-averse market sentiment. Even as institutional inflows remain robust, bearish technical indicators indicate that BTC would test the important $100,000 support level if sell pressure persists.

• Bitcoin price dips below $105,000 following a 4% decline in the last two days.

• Rising Israel-Iran tensions provoke more than $1.15 billion in crypto market liquidations.

• US-China trade optimism-fueled early-week gains erode under revived tariff threats.

• US inflation figures softened as anticipated, yet still couldn’t give a boost to BTC’s price short term.

• Public equities such as GameStop and Mercurity Fintech keep adding Bitcoin positions.

• US spot Bitcoin ETFs witness $1.07 billion net inflows, ending two weeks of outflows.

• Technicals suggest more downside risk with potential retest of support at $100,000.

Bitcoin remains of great interest to institutional investors and public firms even though the market is presently experiencing a cautious mood. Companies such as Mercurity Fintech Holding Inc. and GameStop have recently issued large capital raises, with part going toward accumulating or creating additional Bitcoin holdings. This emerging interest on the part of established firms reflects Bitcoin’s increasing position as a strategic asset that can provide diversification and even long-term value protection in uncertain global economies.

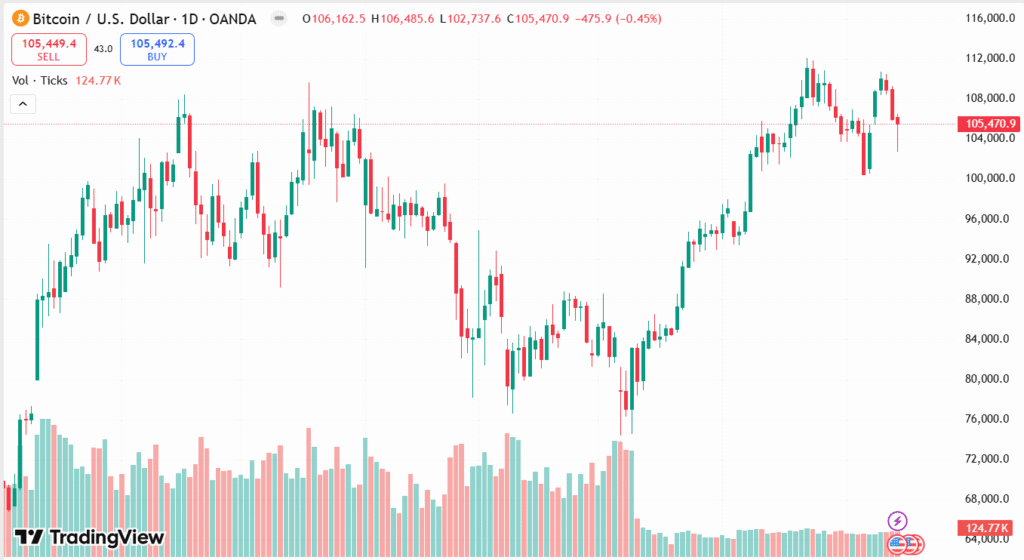

BITCOIN DAILY PRICE CHART

SOURCE: TradingView

Furthermore, US Bitcoin ETFs are demonstrating renewed vitality by logging more than $1.07 billion in inflows this week following a short stint of outflows. This uptick is indicative of unabated confidence from institutional investors that see Bitcoin as a sound investment even within the context of greater market volatility. The robust engagement of public companies and funds indicates that in spite of short-term market difficulties, long-term use of Bitcoin remains firmly entrenched.

TECHNICAL ANALYSIS

Bitcoin is showing signs of increasing bearish momentum. The price has fallen below the 50-day Exponential Moving Average (EMA) at $102,447, indicating potential for further downside. The Relative Strength Index (RSI) has slipped below the neutral 50 mark, currently reading 47, which signals weakening bullish strength. In addition, the Moving Average Convergence Divergence (MACD) line has developed a bearish crossover, creating a sell signal and indicating possible sustained pressure to the downside. If Bitcoin is unable to maintain above today’s levels of support, it could test the significant psychological level of $100,000.

FORECAST

If geopolitical risk eases and global risk appetite improves, Bitcoin could continue its positive momentum. Ongoing institutional demand, robust ETF inflows, and potential relaxation in US monetary policy as inflation cools down could aid a rebound. In this case, Bitcoin could try to retest its recent highs around $110,000 and potentially hit its all-time high of $111,980, given buying pressure remains intact.

On the flip side, if geopolitical uncertainty increases further or if wider market uncertainty continues, Bitcoin could see more selling. A breakdown below the 50-day EMA on a closing basis could pave the way for a more severe correction towards the important psychological level of $100,000. A failure to hold at this support could initiate further liquidation, taking prices even lower in the near term.