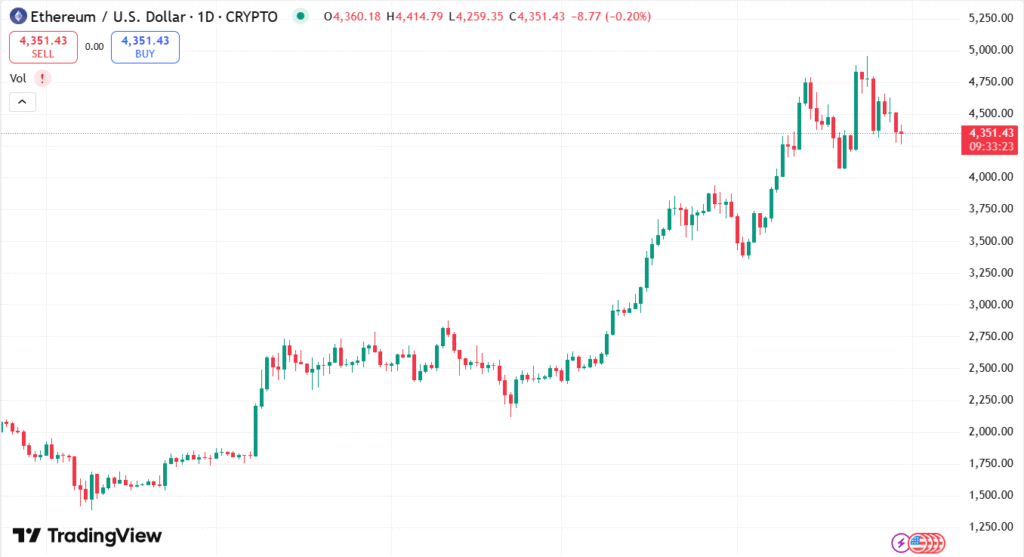

Ethereum (ETH) is hovering close to $4,340 after falling below $4,400 despite record network usage fueled by the Dencun and Pectra upgrades. The number of transactions and active addresses are at multi-year highs while fees are low, fueling ecosystem engagement and DEX trading volumes. Solid buying by digital asset treasuries and ETFs has underpinned ETH’s price, but increasing profit-taking threatens the downside. ETH is currently testing a significant ascending trendline support, a potential downfall to $4,000 if it fails, or a turnaround above $4,500 could revive bullish pressure toward fresh highs.

KEY LOOKOUTS

• Ethereum’s active addresses and transaction count have reached multi-year peaks, indicating healthy ecosystem expansion.

• The Dencun and Pectra upgrades have maintained transaction fees at lows amid record usage, increasing scalability.

• ETH is approaching an uptrend trendline; a breakdown will push the price towards $4,000 or lower.

• A resolute break above $4,500 may clear the way for Ethereum to revisit its all-time high.

Ethereum (ETH) is going through a pivotal moment as it trades at around $4,340, challenging an ascending trendline support that has also worked as a robust demand zone in the past. Despite this recent decline, the network has seen historic growth in activity, with transaction volumes and active addresses reaching multi-year peaks. Dencun and Pectra upgrades have been instrumental in maintaining low fees, a far cry from earlier bullish cycles when mounting activity triggered pricey trades. Although ETF and digital asset treasury accumulation still serves as a buffer for prices, increasing profit-taking among investors poses fears of a possible correction. ETH needs to reclaim the $4,500 level to spark bullish momentum again, or else a breakdown to $4,000 is possible.

Ethereum trades at approximately $4,340, probing a crucial trendline support after falling below $4,400. Encouraging network development and low fees underpin the bullish argument, but growing profit-taking increases the danger of correction to $4,000. A reversal above $4,500 is important for ETH to target new highs.

• Ethereum price is near $4,340, falling short of the $4,400 level.

• Network activity peaks, as transaction volumes and active addresses reach multi-year high.

• DEX volumes and TVL are nearing 2021 highs, indicating robust ecosystem engagement.

• Dencun and Pectra upgrades guarantee minimal fees even during highest usage, enhancing scalability.

• ETFs and digital asset treasuries currently own around 5% of ETH’s circulating supply, providing demand.

• Increasing profit-taking pressure may prompt a correction towards the $4,000 psychological marker.

• ETH must retake $4,500 in order to regain its bullish momentum and target new all-time highs.

Ethereum continues to demonstrate impressive strength within its ecosystem as network activity sets new records. The transactions count has reached new records, with the 14-day SMA crossing 1.7 million for the first time, while active addresses have reached a three-year high. Such broad-based participation is a sign of good distribution of activity between users, backed by increasing decentralized exchange (DEX) volumes and a total value locked (TVL) that is nearing its all-time bull cycle highs. Such an increase indicates continued activity within the Ethereum network, substantiating its status as a pillar of decentralized finance and blockchain innovation.

ETHEREUM DAILY PRICE CHART

SOURCE: TradingView

One of the drivers behind this momentum is the efficiency brought about by recent advancements, specifically Dencun and Pectra, which have decreased transaction fees considerably even during high usage. This enhancement has enabled Ethereum to surmount one of its biggest historical hurdles, offering smoother and cheaper usage. The firm accumulation by digital asset treasuries and exchange-traded funds has also further bolstered Ethereum’s fundamentals, demonstrating increased institutional faith. With sustained demand and innovative upgrades defining its ecosystem, Ethereum is primed to sustain long-term growth and adoption across sectors.

TECHNICAL ANALYSIS

Ethereum is now testing key rising trendline support that has remained strong since late June, serving as a significant zone of demand in earlier pullbacks. The price has already fallen beneath the $4,400 level, increasing the risk of more losses if the trendline is broken. Significant support is found around the $4,000 psychological level, supported by the 50-day SMA lying immediately below. Momentum gauges like RSI trending lower and Stochastic Oscillator approaching oversold levels indicate bearish pressure building but also promise a rebound if buyers enter the picture. On the upside, ETH must retake the $4,500 resistance to reinitiate bullish momentum and reopen the way for new all-time highs.

FORECAST

If Ethereum is able to maintain its rising trendline support and bounce back strongly, it may recover the $4,500 resistance level, which is crucial to resuming bullish momentum. A breakout above this level may set the stage for ETH to retest its recent highs and even establish a fresh all-time high. Strong network activity, low fees, and institutional buying in the form of ETFs and treasuries are expected to propel this move higher.

Conversely, if Ethereum is not able to hold its current support, the price may fall towards the $4,000 psychological level, which is also supported by the 50-day SMA. A fall below this level is expected to attract more bearish pressure, pulling ETH towards $3,470, where the next significant support is available. Increasing profit-taking and weakening momentum indicators further increase the risks to the downside, which means that investors need to exercise caution in the near term.