EUR/USD currency pair closed the week almost 1% up, boosted by increased hopes for a US-EU trade deal before the August 1 deadline. All the while, even as weak US economic data, such as a precipitous decline in Durable Goods Orders, dampened the mood, it was softened by robust jobless claims and waning concerns about aggressive Fed policy. Concurrently, the European Central Bank left rates unchanged, affirming a prudential, data-driven approach. As financial markets look ahead to next week’s critical Federal Reserve gathering, as well as major US and EU economic reports, the EUR/USD hovers in the 1.1750 region, with sentiment still cautiously bullish.

KEY LOOKOUTS

• Markets are looking for the Fed to leave rates unchanged; any surprise change in tone would ignite volatility in EUR/USD.

• Major indicators such as Q2 GDP, Core PCE, and Nonfarm Payrolls will provide new information about the US economic landscape and inflation trend.

• Future releases will contribute to expectations of future ECB actions and eurozone economic stability.

• Any news or delays in the proposed trade deal may have a direct bearing on market mood and the strength of the euro.

The EUR/USD currency pair closed the week higher by almost 1% on increasing optimism over the prospects of a US–EU trade deal and subdued expectations of Fed-inspired monetary tightening. Although US Durable Goods Orders plummeted, improving jobless claims data and evidence of robust core business investment cushioned sentiment. On the European side, the ECB left rates unchanged, echoing a defensive, meeting-by-meeting stance in the face of internal dissent. With the pair converging close to 1.1750, traders now focus on a high-impact week of activity ahead, highlighted by the Fed’s policy rate decision, significant US economic releases, and inflation and GDP numbers out of the eurozone.

EUR/USD closed the week on a high note, fueled by trade optimism and steadfast labor market statistics in the US. The pair now looks to the Fed’s next rate decision and major economic indicators from both areas. Market sentiment remains cautiously bullish as traders search for new directional signals.

• EUR/USD gained close to 1% this week, closing at about 1.1741, on the back of trade optimism despite mixed US economic figures.

• US Durable Goods Orders fell by 9.6%, but solid jobless claims and core investment numbers softened the negative effect.

• The ECB left interest rates steady at 2%, sticking to a data-driven, meeting-by-meeting strategy despite policy discord.

• Trade sentiment soared after news of possible US–EU agreement prior to the August 1 deadline boosted demand for the euro.

• US President Trump estimated a 50-50 possibility of a deal with the EU, although threats of higher tariffs still remain.

• Technical analysis indicates EUR/USD consolidating around 1.1750 with resistance at 1.1800 and support at 1.1714.

• The important events for next week are the Fed rate decision, US Q2 GDP, Core PCE, Nonfarm Payrolls, and EU inflation and GDP data—all expected to dictate market direction.

The EUR/USD currency pair finished the week stronger, supported by hope for a future US–EU trade deal and a generally stable macroeconomic environment. Expectations for a breakthrough in trade talks picked up steam after reports indicated that both parties are close to a deal before the August 1 deadline. Encouraging remarks by US President Donald Trump, along with previous reports of a completed trade agreement with Japan, worked to fortify market confidence. Meanwhile, even in the face of some disappointing US economic releases—like the plunge in Durable Goods Orders—investor morale proved to be resilient, partly due to firm jobless claims and ongoing indicators of the strength of the labor market.

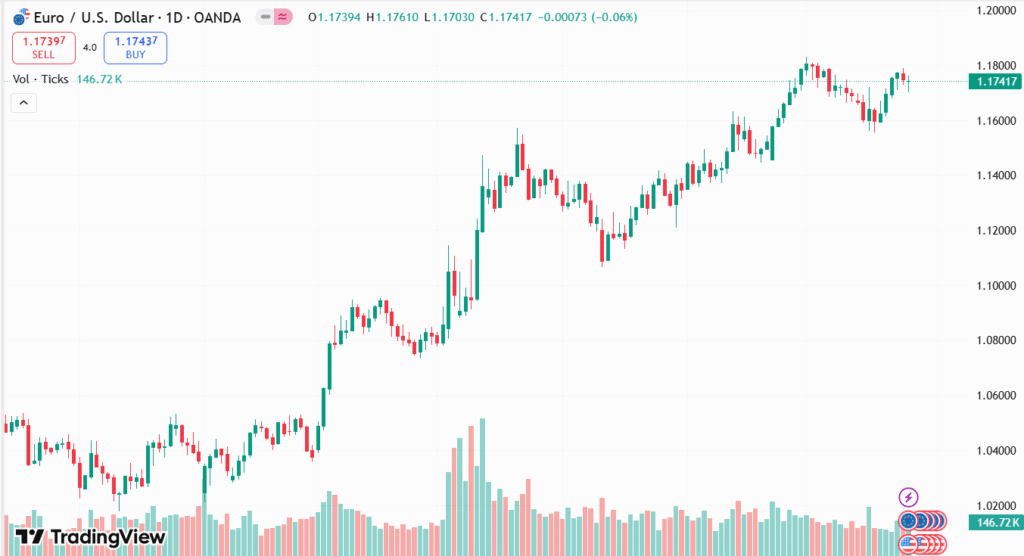

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

In the Eurozone, interest rates were held as forecast by the European Central Bank, as they stressed a data-dependent, meeting-by-meeting stance. Central bankers seem torn on the direction of monetary policy going forward, a nod to uncertainty in the wider economic environment. As for the eurozone economic calendar, it was relatively tranquil this week but will be busier in the days ahead with marquee data releases in store, including inflation and GDP readings from large economies such as Germany and Spain. These events, together with the much-anticipated Federal Reserve meeting in the US, are expected to dictate investor expectations and determine the near-term trend of the euro.

TECHNICAL ANALYSIS

EUR/USD is consolidating in the region of 1.1750 following a weekly high of 1.1788, just short of the critical psychological resistance of 1.1800. The Relative Strength Index (RSI) is still bullish but at risk of losing further momentum as it heads into neutral levels. A fall below the 20-day Simple Moving Average (SMA) level of 1.1714 may lead to a move towards the 1.1700 support, with additional loss exposing the 50-day SMA level of 1.1556. On the higher side, a strong break above 1.1800 would target the year-to-date high of 1.1829, followed by possible resistance at 1.1850.

FORECAST

If the positive momentum is sustained, especially bolstered by positive results from the forthcoming US–EU trade talks and sound economic data from the eurozone, EUR/USD may break above the 1.1800 resistance level. A successful break-through might open the way for a test of the year-to-date high at 1.1829. Apart from that, additional bullish extension may aim at the subsequent resistance level of 1.1850, particularly if the Federal Reserve indicates a pause or even a dovish direction at its July 30 decision. Better eurozone GDP and inflation readings may also underpin long-term upward pressure.

Conversely, should trade negotiations break down or US indicators like GDP and Nonfarm Payrolls surprise to the higher side, bolstering the US Dollar, EUR/USD may face fresh selling pressure. A decline below the 1.1714 20-day SMA would likely expose the 1.1700 psychological support. Further weakness may take the pair down to the 50-day SMA around 1.1556. Also, any Fed hawkish turn or any disappointing economic data from the eurozone can further favor the bears in sentiment in the short term.