EUR/USD currency pair is further falling below the 1.1800 mark as the US Dollar strengthens on the back of solid economic data and a cautious note from Federal Reserve Chairman Jerome Powell. A steep increase in US JOLTS Job Openings and higher-than-anticipated ISM Manufacturing PMI data have restored investor sentiment in the US economy, upholding the Greenback. On the other hand, dovish comments from European Central Bank (ECB) officials and a surprise rise in Eurozone unemployment have dragged the Euro lower. With markets looking forward to the ADP Employment Change and Nonfarm Payrolls news, bearish technical indicators indicate more downside risk for EUR/USD.

KEY LOOKOUTS

• Markets are waiting for the ADP Employment Change report for June, due to report a 95K increase in jobs, and which will determine the tone before Thursday’s Nonfarm Payrolls.

• Investors will be watching ECB President Christine Lagarde’s comments at the Sintra Summit closely for any new policy indications with creeping Eurozone unemployment.

• EUR/USD is gaining more bearish momentum on the 1-hour chart, with a Head & Shoulders setup looking to target support at 1.1690–1.1650.

• Robust US data and Powell’s conservative “wait-and-see” stance remain in favor of the USD, lowering short-term rate cut prospects.

EUR/USD currency pair is bearish as the US Dollar strengthens on the back of a robust set of economic data and conservative statements by Federal Reserve Chairman Jerome Powell. After briefly recovering above 1.1800, the Euro has turned back, buried by the surprise increase in Eurozone unemployment and dovish rhetoric from ECB officials. Conversely, the US labor market remains resilient, with both JOLTS Job Openings and ISM Manufacturing PMI beating forecasts. While markets shift their attention to the next big events such as the ADP Employment Change and ECB President Lagarde speech, bearish technical indications point toward potential further EUR/USD decline.

EUR/USD extends losses as the US Dollar strengthens on positive job data and Powell’s dovish attitude. Higher Eurozone unemployment and dovish ECB news increase pressure on the Euro. Markets now look to the ADP Employment report and Lagarde’s speech for new direction.

• EUR/USD trades below 1.1800, reversing from recent multi-year highs at 1.1830.

• US Dollar gathers strength on positive JOLTS Job Openings and ISM Manufacturing PMI data.

• Fed Chair Jerome Powell is also conservative in tone, stressing a “wait-and-see” stance on rate cuts.

• Eurozone unemployment rose unexpectedly to 6.3%, weighing on the Euro.

• Dovish statements by officials such as Rehn and Centeno on the ECB suggest possible further easing.

• Bearish Head & Shoulders formation on the EUR/USD 1-hour chart directs the focus toward a decline to 1.1690–1.1650.

• Attention turns to next US ADP report and ECB President Lagarde’s speech for further guidance.

The EUR/USD currency pair is under renewed bearish pressure with economic divergence between the Eurozone and the United States being increasingly highlighted. The Euro is negatively influenced by a surprise increase in Eurozone unemployment to 6.3%, in addition to dovish comments from European Central Bank officials who remain worried about chronically low inflation. While German production figures revealed some relief and Eurozone CPI flattened, these were not enough to boost sentiment due to investors’ expectations of a more conservative ECB policy course in the near term.

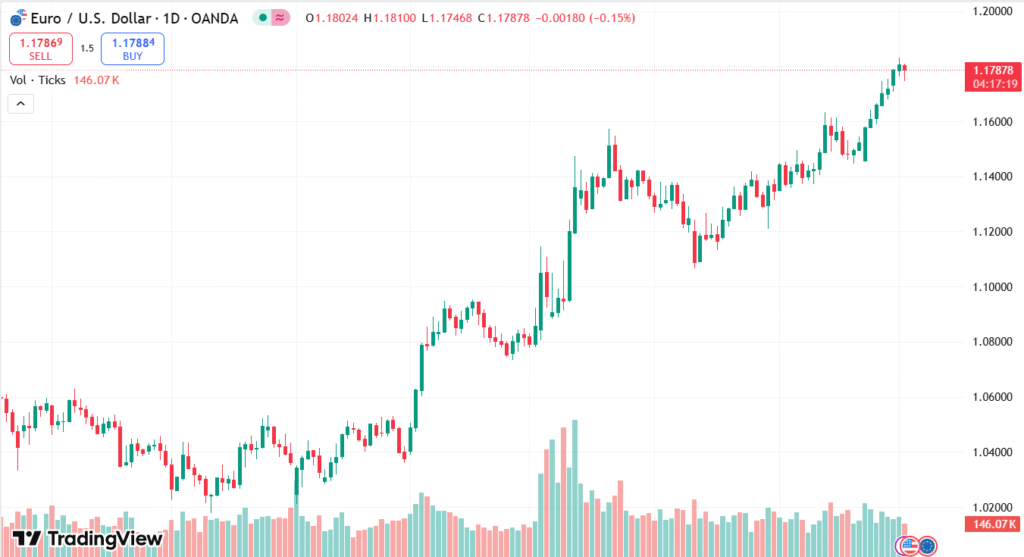

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

In contrast, the US Dollar is strengthening on recent figures that reinforce the solidity of the US economy. Solid job opportunities and a recovery in the ISM Manufacturing PMI have been timed with Federal Reserve Chairman Jerome Powell’s dovishness at the ECB Forum in Sintra, where he invoked caution to follow data closely prior to making any policy action. With strong labor market data and steadfast inflation indications, the Fed is likely to stay patient on rate cuts, providing the USD with a steady tailwind. Focus then shifts to the ADP Employment report and Nonfarm Payrolls, which may offer more insight into the outlook for the US economy.

TECHNICAL ANALYSIS

EUR/USD is seen gathering bearish momentum following its inability to hold above the 1.1800 mark. The pair has broken below the Head & Shoulders neckline on the 1-hour chart and is now poised for a trend reversal. The Relative Strength Index (RSI) is falling lower into negative ground, supporting the bearish view. A confirmed decline below Tuesday’s low at 1.1760 would leave the door open toward the pattern’s measured target at 1.1690. Below that, focal support is between Tuesday’s June 27 low at 1.1680 and Monday’s June 26 low at 1.1650. On the positive side, there is resistance at 1.1810 and 1.1830 and stronger resistance at 1.1850 indicated by the 261.8% Fibonacci extension.

FORECAST

Should EUR/USD be able to stay above the 1.1760 level and recover bullish strength, the pair may try to retest the 1.1800 psychological level. A break above 1.1810 and sustained would reveal the recent high at 1.1830. Additional bullish pressure may drive the pair to the 1.1850 resistance, indicated by the 261.8% Fibonacci extension of the June 26–30 rally. A positive change in Eurozone fundamentals or dovish US labor statistics can serve as a catalyst for higher highs.

On the negative, inability to hold the 1.1760 support would speed the bearish correction. Breaking below this level would affirm the Head & Shoulders formation and aim for the next significant support at 1.1690. Ongoing pressure selling might take EUR/USD towards the 1.1680–1.1650 region, where buyers might intervene to stabilize the pair. Poor Eurozone economic data or better-than-anticipated US labor statistics would tend to strengthen the downward path.