EUR/USD pair is trading within a tight range near recent highs as weak US services sector data and renewed stagflation fears weigh on the US Dollar. While the Euro has gained ground following disappointing US Nonfarm Payrolls and PMI figures, it struggles to find strong support amid soft Eurozone retail sales and declining German factory orders. Market sentiment remains cautious, with investors closely watching upcoming remarks from Federal Reserve officials and potential political developments, including speculation over new Fed leadership appointments and tariff threats from former President Trump. Though short-term gains, the overall bearish trend of EUR/USD continues to be in place below the 1.1600 resistance line.

KEY LOOKOUTS

• Statements by Federal Reserve officials could provide important guidance on September’s monetary policy choice in light of soft US data and growing stagflation fears.

• Market responses could become more pronounced if Donald Trump publicly nominates candidates for the Fed Governor position or makes suggestions of replacing Jerome Powell, which can potentially erode confidence in the Fed’s autonomy.

• Weak retail sales and factory orders highlight sluggish momentum in Europe’s economy, limiting upside potential for the Euro.

• The EUR/USD pair faces strong resistance at the 1.1600 level; a breakout could shift momentum higher, while failure to hold above 1.1530 risks a deeper pullback.

EUR/USD pair is currently consolidating near recent highs as disappointing US services data and rising fears of stagflation continue to weigh on the US Dollar. Although the Euro has benefited from the greenback’s weakness, lackluster Eurozone retail sales and a further drop in German factory orders have limited its upside momentum. Traders are still in wait-and-see mode as they look for new hints from the future speeches of Federal Reserve officials and prospective policy changes, especially in light of rumors over Donald Trump’s role in future Fed nominations. Technically, the pair is still capped below the major resistance at 1.1600, maintaining the larger bearish trend for the time being.

EUR/USD trades sideways near recent highs as weak US data pressures the Dollar, but soft Eurozone figures limit the Euro’s strength. Markets await Fed officials’ comments and political developments for direction, with key resistance seen at 1.1600.

• EUR/USD trades near 1.1580, consolidating gains from last week’s US NFP-driven rally.

• US Services PMI fell to 50.1, signaling near-stagnant growth and raising stagflation concerns.

• Eurozone retail sales increased merely 0.3%, missing forecasts and demonstrating subdued consumer demand.

• German factory orders fell 1%, adding further evidence of economic softness in the region.

• Speculation regarding Trump’s Fed nominees adds political risk, dampening USD confidence.

• Technical resistance around 1.1600 is a significant hurdle; a break higher may spark fresh upside momentum.

• Investors watch Fed speakers for hints on future interest rate action in the wake of weakening US data.

The EUR/USD currency pair is steady as investors are weighing weak macroeconomic reports from the United States and the Eurozone. The US Dollar has been pressured in the wake of disappointing services PMI readings, indicating weakening activity, falling employment, and increasing prices—reviving stagflation worries in the world’s largest economy. Meanwhile, market sentiment is also wary of speculation regarding possible Federal Reserve leadership changes, with former President Donald Trump said to be looking to replace mainstays at key roles, a move that may cast doubt on the central bank’s independence.

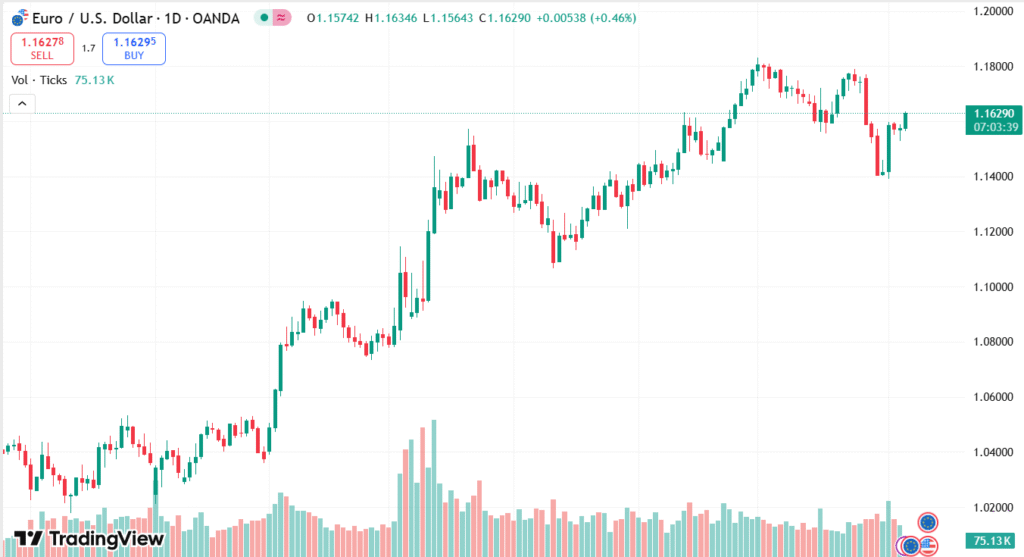

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

On the Continent side, the Euro has not seen much support despite the Dollar’s weakness. Retail sales data in the Eurozone was weaker than expected, while German factory orders declined for the second consecutive month, signaling continued economic troubles in the region. Traders are closely watching the bigger picture of politics and economics, such as global trade tensions and yet-to-be-said comments from Federal Reserve officials, which may push investor mood and market direction in the coming days.

TECHNICAL ANALYSIS

EUR/USD is ranging narrowly just below the crucial resistance level at 1.1600, which has been capping upside efforts since the first week of August. The pair is still in a larger bearish trend that started in mid-July, with momentum indicators like the RSI and MACD becoming flat, indicating market indecision. A break above 1.1600 can have the EUR/USD test the 1.1700–1.1710 range, then trendline resistance at 1.1750. On the other hand, support is at 1.1530, with the further downside potentially targeting 1.1460 and 1.1400 if bear pressure resumes.

FORECAST

If EUR/USD can break and hold above the crucial resistance at 1.1600, the pair has a good chance to develop bullish momentum and aim for the next upside zone at 1.1700–1.1710, where former support levels could now serve as resistance. Another push through this region could see a test of the trendline resistance at 1.1750, particularly if further US economic data disappoints and Federal Reserve officials indicate a dovish bias.

Meanwhile, a failure to overcome 1.1600 may continue to leave the pair under stress, with early support at 1.1530. A fall below this level could spark a more significant correction to 1.1460, then the 1.1400 region, seen in early August. Rising US Dollar strength, a hawkish tone from the Fed, or increased Eurozone economic weakness may promote the downside acceleration.