EUR/USD remained firm above 1.1660 on Friday following the most recent US Personal Consumption Expenditures (PCE) data, which was in line with forecasts and indicated continued inflation and strong consumer spending. Core PCE increased 0.3% month-on-month and 2.9% year-on-year, its highest level since February, while headline PCE advanced 0.2% on the month and remained at 2.6% year-on-year. Better-than-anticipated consumer spending and stable income growth upheld the US Dollar, although subdued market response prevented the pair from consolidating in recent areas. EUR/USD, despite near-term pressures, is still poised to close out August with about 2% monthly appreciation, as hopes for a September interest rate cut cap the Greenback’s gains.

KEY LOOKOUTS

• Core PCE climbed 0.3% MoM and 2.9% YoY, highest annual rate since February.

• Personal expenditure surged 0.5% in July, topping projections, while earnings increased 0.4%.

• The US Dollar Index regained traction around 98.00, keeping EUR/USD at 1.1660.

• Sticky inflation and decelerating hiring underpin expectations of a 25 bps Fed rate reduction in September.

EUR/USD stabilized above 1.1660 on Friday after latest US PCE inflation data met expectations, highlighting persistent price pressures and robust consumer demand. Core PCE advanced 0.3% on the month and 2.9% on the year, the highest since February, while headline PCE climbed 0.2% on the month but remained unchanged at 2.6% on the year. Personal income and consumption growth also beat forecasts, which favored the US Dollar, though the market response was subdued. With inflation remaining above the Fed’s 2% target and hiring momentum weakening, prospects for a September rate cut still put a lid on the Greenback’s rally, keeping EUR/USD in consolidation mode.

EUR/USD remained flat above 1.1660 as US PCE inflation came in line with expectations, with core prices increasing 2.9% year-on-year. Solid consumer spending benefited the US Dollar, but hopes for a September Fed rate cut kept EUR/USD in consolidation mode.

• EUR/USD leveled higher above 1.1660 following US PCE inflation data coming in in line with expectations.

• Core PCE increased 0.3% MoM and 2.9% YoY, the highest since February.

• Headline PCE was up 0.2% MoM, with the yearly rate remaining unchanged at 2.6%.

• Personal spending climbed 0.5% in July, beating the expectation of 0.3%.

• Personal income increased 0.4% MoM, in line with expectations and higher than June’s 0.3%.

• US Dollar Index regained strength around 98.00, capping Euro’s recovery.

• Hopes of a September 25 bps Fed rate cut place the Dollar’s upside under pressure.

The recent US PCE inflation report indicated a blend of ongoing price pressures and sticky consumer demand. Core PCE, the Federal Reserve’s desired measure of inflation, climbed 0.3% on the month and 2.9% year-on-year, its highest since February. In contrast, headline PCE rose 0.2% on the month, leaving the annual rate unchanged at 2.6%. To go along with this, personal spending was up by a better-than-expected 0.5% in July, as personal income rose 0.4%, indicating stable household consumption underpinned by higher incomes.

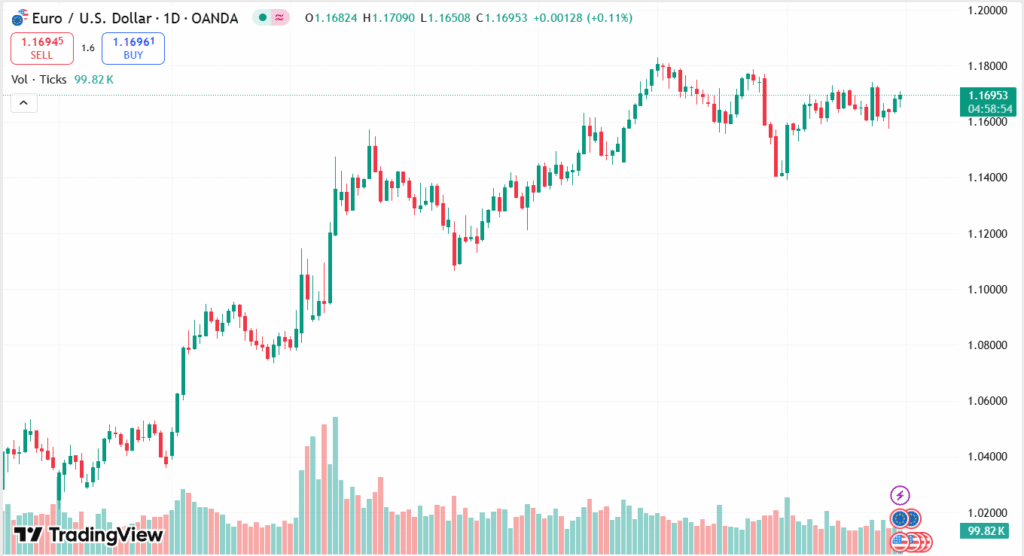

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

These numbers highlight the Fed’s continued dilemma of how to keep sticky inflation at bay while finding indications of decelerating economic momentum. While consumer spending is holding up, the fact that core inflation continues above the 2% threshold indicates ongoing price pressures within the economy. Market players now expect the Federal Reserve may go ahead with a limited rate reduction in September, as policymakers try to weigh inflation management against maintaining more general economic stability.

TECHNICAL ANALYSIS

EUR/USD is stabilizing above the 1.1660 support region, demonstrating strength in the face of pressure from the bullish US Dollar. A continued hold here maintains the pair in a short-term neutral band, with resistance within the 1.1700–1.1720 range. Breaking above here may set the stage for more upside, while a fall below 1.1660 would leave the next support around 1.1620 vulnerable. Overall, price action indicates consolidation with a defensive bias as investors wait for further direction from future Fed moves.

FORECAST

If EUR/USD is able to hold its gains above 1.1660 support, buyers may target the 1.1700–1.1720 resistance in the near term. A clear break above the zone might initiate further advances to 1.1760, provided there is optimistic market sentiment around a September Fed rate reduction. Buoyant consumer spending numbers may cap Euro strength short-term, but softening inflation outlook or dovish Fed rhetoric might aid an upside thrust.

Conversely, failure to stay above 1.1660 may encourage fresh selling pressure, with the next support at 1.1620. A fall below this might initiate further losses towards 1.1580. Sticky inflation and US Dollar resilience may drag the Euro down in the near term, with the bearish risks still present unless new catalysts improve the dynamics of the single currency.