EUR/USD currency pair pulls back from more than two-week highs following fresh US Dollar strength and increasing uncertainty about the EU-US trade relationship as a drag on the Euro. Having seen a significant 1.3% advance in the last three days, the Euro is under pressure as concerns over possible 30% US tariffs, coupled with stalling negotiations, take their toll. At the same time, a “monster trade agreement” between the US and Japan has supported investor sentiment towards the Dollar. Through the pullback, the immediate bullish picture for the pair remains in place, with a key support holding above the 1.1720 threshold as markets look for the European Central Bank’s policy decision and EU consumer sentiment reports.

KEY LOOKOUTS

• Market attention is on the status of current EU-US trade talks, as investors are concerned about possible 30% US tariffs on EU imports from August 1.

• Investors look to the Thursday ECB monetary policy release for signals on interest rate direction and potential easing as Eurozone growth slows.

• The USD finds traction in a newly released US-Japan trade agreement, which could cap EUR/USD gains through the near term.

• The EUR/USD currency pair remains above crucial support at 1.1720; a slide below may initiate further weakness to 1.1680 and 1.1645.

The EUR/USD currency pair is under pressure after its robust three-day advance as investors respond to US Dollar’s fresh strength and increased uncertainty regarding EU-US trade relations. The Euro retreated from near two-week highs at 1.1760, trading around 1.1730 on fears that stalled trade negotiations may result in massive US tariffs on European imports on August 1. In contrast, a “massive trade deal” between the US and Japan has boosted the greenback, cutting short the Euro’s potential to advance. In spite of the correction, the pair has a near-term bullish outlook, with excellent support at 1.1720 in advance of major events like the ECB policy decision and EU consumer sentiment data.

EUR/USD drifts from latest highs as US Dollar gains on reports of a trade agreement with Japan. EU-US trade tensions, combined with future ECB policy announcements, keep investors on their toes. Key support at 1.1720 remains in force, preserving the pair’s short-term bullish momentum.

• EUR/USD falls back after surging 1.3%, weighed down by renewed US Dollar strength.

• US-Japan trade agreement gives investors more confidence in the Dollar, taking it off recent lows.

• Euro dips from 1.1760 to 1.1730, yet remains above key support at 1.1720.

• EU-US trade uncertainty continues, with concerns over 30% US tariffs on EU exports from August 1.

• ECB policy decision on Thursday is also a key market theme, with the expectation of a dovish tone.

• Consumer Sentiment Index (EC) for July releases, but not likely to change sentiment unless it surprised positively.

• Technical outlook is bullish, with attempts to the downside capped unless 1.1720 is breached.

EUR/USD is attracting investor attention due to increasing geopolitical and economic uncertainty. The Euro’s recent upsurge has decelerated as worries intensify regarding the unclamped trade talks between the United States and the European Union. With a possible 30% US tariff awaiting EU products from August 1, market sentiment remains on edge. The announcement of a new US-Japan trade agreement has also added pressure on the Euro, as the deal boosts confidence in the US Dollar and highlights Washington’s aggressive trade stance. Meanwhile, EU representatives are heading to Washington in a last-minute attempt to secure a deal and avoid retaliatory measures, keeping traders on edge.

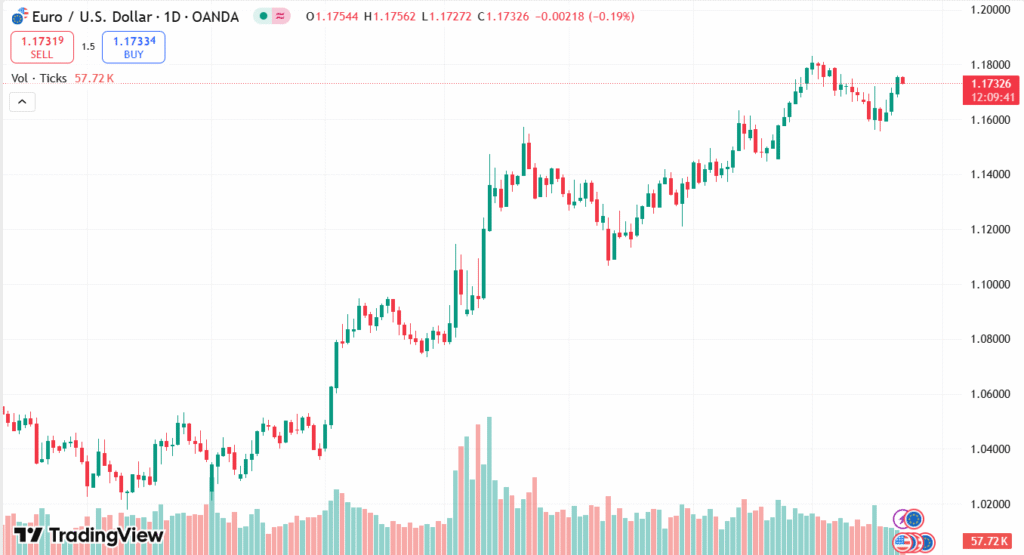

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

Adding to the subdued tone, the European Central Bank will be announcing its most recent monetary policy decision, which would influence market direction for the Euro over the next few weeks. There will be no significant shifts in interest rates, though the market will be keenly aware of any indication of the ECB’s economic outlook or upcoming policy measures. Also on the horizon is the European Commission’s Consumer Sentiment Index for July, which is expected to evidence only modest improvement and is still below the long-run average—a further indication of the Eurozone’s dud recovery. Such developments collectively highlight the wider macroeconomic and political dangers confronting the Euro.

TECHNICAL ANALYSIS

EUR/USD is still in a short-term bullish formation despite its recent retreat. The duo has found support at higher levels of 1.1720, which was earlier the level of resistance, indicating a possible base for fresh northward movement. The 4-hour Relative Strength Index (RSI) had moved into overbought levels following the recent upsurge, leading to the ongoing correction. A prolonged break below 1.1720 could pave the way for additional declines towards 1.1680 and 1.1645. On the positive side, resistance is capped at 1.1760, with a breach above the level set to reveal higher targets at 1.1790 and 1.1830.

FORECAST

As long as EUR/USD holds above the crucial support at 1.1720, the pair may return to bullish momentum. A successful bounce may propel the price back toward the immediate resistance at 1.1760. A breakdown below this level would probably open the way for a decline towards the next resistance levels at 1.1790 and possibly 1.1830, the monthly high. Encouraging news of EU-US trade negotiations or a dovish Federal Reserve could also give additional impetus to the Euro.

On the negative side, a clean break below 1.1720 might indicate further weakness in the EUR/USD pair. This would tend to provoke a test of the next support at 1.1680, with a possible decline to 1.1645 along the reverse trendline. Poor Eurozone economic data, disappointing ECB guidance, or ongoing US Dollar strength on the back of positive trade news may fuel the downward pressure.