The Euro reclaimed its losses against the US Dollar on Tuesday, rising to about 1.1630 and ending a two-day losing streak following mixed US inflation reports. July’s headline CPI increased in accordance with forecasts at 0.2% MoM and 2.7% YoY, while core inflation unexpectedly beat forecasts at 0.3% MoM and 3.1% YoY. Even sturdier core readings, markets still expect a Federal Reserve rate reduction in September, aided by softening overall inflation pressures and a weaker jobs market. In the Euro area, sentiment fell sharply, with Germany’s ZEW Economic Sentiment Index down more than anticipated, although words of ECB policymakers implying that rates are still at a proper level provided some support for the common unit.

KEY LOOKOUTS

• Headline inflation eased as predicted, but core inflation surprised to the upside, providing a cautionary note for Fed policy.

• Markets continue to price in a September rate cut even after the hotter reading of core.

• German and Eurozone ZEW Economic Sentiment indicators plummeted, reflecting sustained growth difficulties.

• ECB policymakers assert interest rates are at a “very good level,” suggesting policy room during economic uncertainties.

Euro made gains against the US Dollar on Tuesday to reach about 1.1630 after conflicting US inflation data cooled recent bearish pressure. Although July’s headline CPI was as forecast and improved marginally on the year figure, core inflation unexpectedly hardened on the upside to show continued pressures. Despite this, investors are still hopeful the Federal Reserve will proceed with a September rate cut, as weaker overall inflation and a slowing labor market leave scope for policy relaxation. In the Eurozone, mood worsened significantly, with Germany’s ZEW survey indicating increased growth concerns, though assurances from ECB officials that the central bank is to stay flexible provided some support to the currency.

The Euro surged to near 1.1630 following mixed US CPI data, with markets remaining bullish on a September Fed rate cut even as core inflation was hotter. Sluggish Eurozone sentiment dragged the outlook down, but supportive comments from ECB officials contained the downside pressure.

• The Euro surged to near 1.1630, ending a two-day losing trend following mixed US inflation data.

• US July headline CPI was in line with expectations at 0.2% MoM and 2.7% YoY.

• Core CPI was above forecast at 0.3% MoM and 3.1% YoY, reflecting continued price pressures.

• Markets continue to widely anticipate the Federal Reserve to reduce rates in September even as core readings strengthened.

• German ZEW Economic Sentiment Index declined sharply to 34.7 in August from 52.7 in July.

• Sentiment across the Eurozone also declined, reflecting ongoing economic headwinds.

• ECB officials indicated rates are at a “very good level” and stressed flexibility in adapting to evolving conditions.

The Euro firmed on Tuesday as uneven US inflation data provided some respite for the currency, aiding it to rebound from recent losses. July’s headline CPI was in line with expectations at 0.2% month-on-month and 2.7% year-on-year, indicating that price growth is slowing in line with expectation. Yet, core inflation, which strips out food and energy, was a touch higher than expected, indicating that underlying price pressures persist. In spite of this, market participants still expect a September Federal Reserve rate cut as decelerating headline inflation and evidence of a softening labor market provide room for policymakers to maneuver.

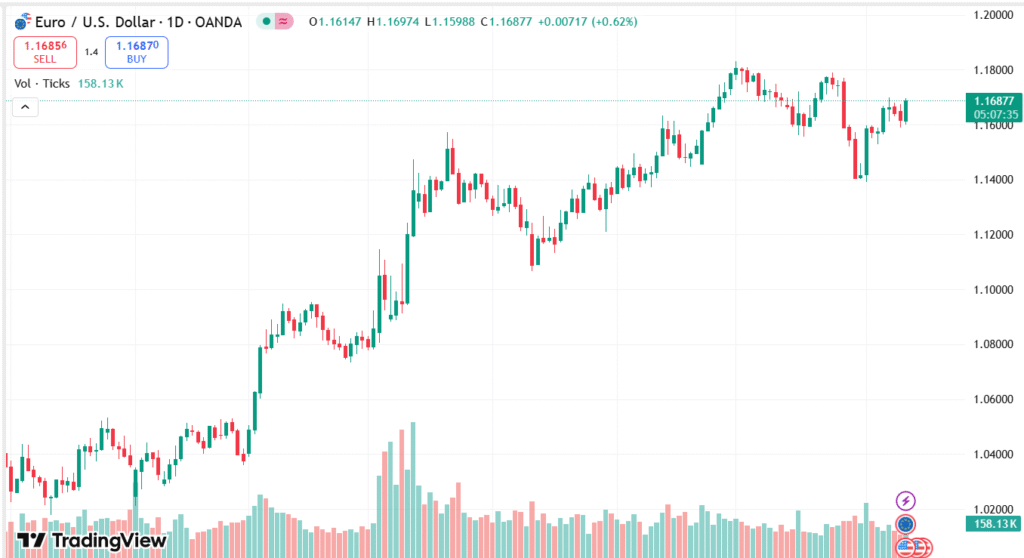

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

In Europe, the economic sentiment continued to be soft, with the recent ZEW survey indicating a sharp decline in confidence in Germany and the wider Eurozone. The fall underscores continued worries of weak growth and repeated headwinds in the bloc’s biggest economy. However, words from ECB Governing Council member Joachim Nagel, suggesting interest rates are at a “very good level” and the bank has the flexibility to adjust if necessary, gave some comfort. Although there are still uncertainties—most notably over trade tensions—the comments gave some stability to the euro’s outlook.

TECHNICAL ANALYSIS

EUR/USD bounced back to the 1.1630 area after hitting support close to recent lows, indicating short-term demand. The recovery in the pair keeps it above crucial support levels of 1.1600, while near resistance is located close to 1.1650, followed by the 1.1700 handle. A breakout above these hurdles on a sustained basis may allow further up move, while a fall below 1.1600 may lead to the next support at 1.1570. Momentum indicators are stabilizing, suggesting possible consolidation prior to the next directional shift.

FORECAST

Short term, EUR/USD may experience modest gains if sentiment continues to support a September rate cut by the Fed. A continued break above the 1.1650 resistance range should set the stage for 1.1700, with more pronounced bullish momentum likely taking it to 1.1750. Encouraging Eurozone news or dovish Fed commentary could propel the rally further.

The downside is, however, that if US economic statistics improve or Fed policymakers turn dovish on easing, the pair can expect to see fresh selling pressure. A fall below 1.1600 would bring into focus the 1.1570 and 1.1540 support levels. Poor Eurozone data or increased geopolitical tensions can fuel bearish activity in the sessions to come.