EUR/USD continues to struggle near two-week lows at 1.1600 as investors look for Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium for guidance on the central bank’s monetary policy stance. The Euro is subjected to further bearish pressure after Germany’s GDP was lowered, raising fears of Eurozone growth, while the US Dollar excels under risk-off market sentiment with mixed US data. While weaker jobless claims and soft labor indicators preserve hopes for September rate cuts, Fed officials are still at odds, prompting markets to tread warily before Powell speaks.

KEY LOOKOUTS

• Markets are looking for cues on whether the Fed will be concerned with inflation risks or a weakening labor market in formulating monetary policy.

• The more abrupt-than-expected Q2 GDP decline puts further pressure on the Euro and hints at greater Eurozone economic worries.

• Stronger PMIs juxtapose against increasing jobless claims, leaving alive uncertainty about the Fed’s rate trajectory.

• Level support is around 1.1560–1.1530, whereas resistance is observable around 1.1625–1.1635, with a wider capping level at around 1.1710.

The EUR/USD currency pair is trading near two-week lows as prudent market mood and US Dollar resilience prevail ahead of Jerome Powell’s highly awaited address at the Jackson Hole Symposium. The Euro continues to struggle after Germany’s GDP was downwards revised, indicating deeper economic weakness in the Eurozone’s biggest economy. In the meantime, confusing US data—strong PMIs offset by rising jobless claims—has left market participants at a loss on how policy is developing at the Federal Reserve. With Fed policymakers having differing opinions regarding growth and inflation, traders are expecting the tone of Powell to determine near-term directions, with the Euro remaining soft while the Dollar maintains its safe-haven appeal.

EUR/USD remains soft at two-week lows as traders wait for Powell’s Jackson Hole speech for policy cues. Downward revision in German GDP weakens the Euro, while conflicting US data and uncertainty over the Fed keep market sentiment guarded.

• EUR/USD hovers at two-week lows near 1.1600 due to US Dollar demand.

• Markets look to Fed Chair Jerome Powell’s speech at Jackson Hole for monetary policy cues.

• German GDP was revised to a more severe 0.3% contraction in Q2, putting additional pressure on the Euro.

• US PMIs surprised to the upside amid signs of recovery in the manufacturing sector.

• On a weekly basis, US Jobless Claims increased to 235,000, demonstrating the softness in the labor market.

• Fed policymakers presented conflicting opinions on growth and inflation, leaving policy direction unclear.

• Technical support is visible at 1.1560–1.1530, while resistance appears at 1.1625–1.1635.

The Euro continues to be in a downtrend as investors await Jerome Powell’s comments at the Jackson Hole Symposium that will offer important clues regarding the Federal Reserve’s policy direction. Market sentiment has been influenced by divergent US economic data, ranging from better-than-anticipated PMIs to increasing jobless claims, confusing traders regarding the priorities of the Fed between keeping the labor market afloat and off-setting inflation risks. Such a risk-averse climate has fueled safe-haven demand for the US Dollar and depressed the Euro.

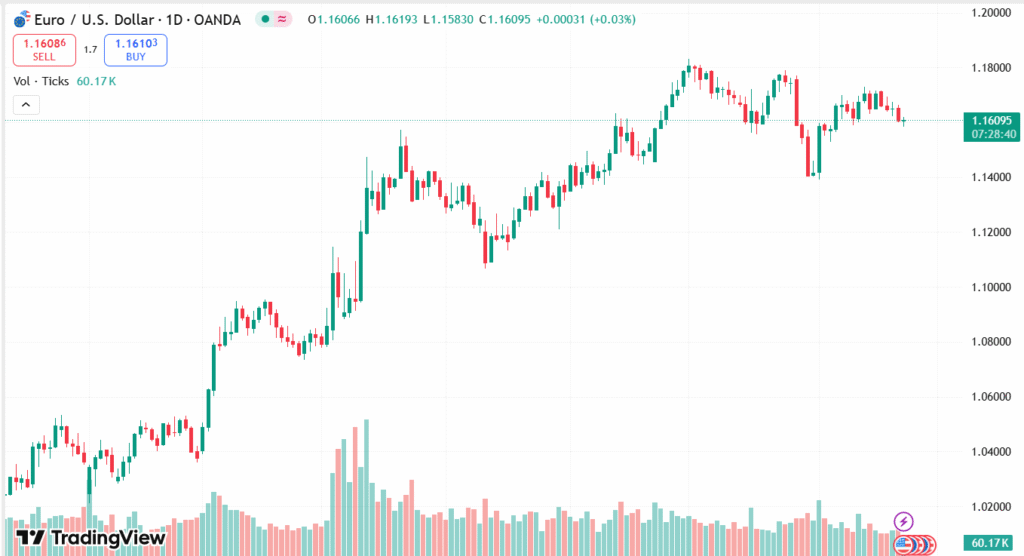

EUR/USD DAILY PRICE CHART

SOURCE: TradingView

Surmounting the woes of the Euro is Germany’s second-quarter GDP, which was revised to indicate a more severe contraction, further raising alarm over the health of the Eurozone’s biggest economy. The poorer economic prospects in Europe and the still indeterminate policy stance of the Fed have left investors looking forward to Powell’s words for direction. Market players are especially interested in whether Powell will highlight patience on policy or hint at rate-cut tolerance in September, a choice that will influence global risk sentiment in the coming weeks.

TECHNICAL ANALYSIS

EUR/USD has pierced below the weekly range floor at 1.1620, reinforcing the termination of its latest bullish cycle. The currency pair is currently testing support at 1.1590, with the 50% Fibonacci retracement of the August advance coming in at 1.1560 as the next likely cushion. A more precipitous decline might aim at the 1.1520–1.1530 area, where the 61.8% retracement joins the August 5 nadir. On the topside, the 1.1625–1.1635 area now serves as resistance, followed by 1.1673 and 1.1693, with stiffer resistance near the falling trendline at 1.1710.

FORECAST

If Jerome Powell takes a guarded approach and signals patience before rate cuts, EUR/USD can see some short-term relief, with the pair trying to climb back above the 1.1625–1.1635 resistance zone. A more aggressive rebound could go up towards 1.1670–1.1690, with the 1.1710 trendline serving as the next major hurdle. Positive cues from the Fed in terms of the labor market or any easing in inflation worries would boost risk appetite and place a marginally downward pressure on the Dollar, giving the Euro some room for recovery.

Conversely, if Powell does focus on inflation concerns and discourages near-term rate cut expectations, the US Dollar should continue to strengthen, pulling EUR/USD down. A breakdown below 1.1590 may pave the way towards the 1.1560 Fibonacci level, and further weakness should target the stronger 1.1520–1.1530 support area. Eurozone weakness, especially from Germany, may also further fuel bearish momentum and keep the Euro pressured in the near term.