GBP/USD currency pair is somewhat lower below the 1.3500 level in wait of the highly awaited US Personal Consumption Expenditure (PCE) Price Index data. Against intraday pressure fuelled by a relatively small USD appreciation, the medium-term tone is bullish because market sentiment diverges between the Federal Reserve’s probable cuts in 2025 and the Bank of England’s probable June pause. Technical levels around 1.3425-1.3415 present buy interests, and a fall through key Fibonacci points could provide access to further losses down to 1.3300. To the contrary, a maintained strength of more than 1.3500 would reflect renewed buying momentum, which could take the pair back towards the 1.3600 cap. Investors should wait for the US inflation report before entering new positions.

KEY LOOKOUTS

• This vital inflation data will significantly impact USD strength and could unleash high GBP/USD volatility.

• Directional bias will be determined by market expectations of a Bank of England standstill against potential Federal Reserve cuts in 2025.

• This area is key for the bulls to hold; a breakdown through here could see further decline towards 1.3300.

• Continued advances above 1.3500 could sustain bullish momentum, the 1.3540-1.3600 area being next resistance.

Traders need to keep a close eye on the next US PCE Price Index release, as the key inflation gauge is set to fuel short-term GBP/USD volatility. The different monetary policy expectations—where the Bank of England should delay rate hikes in June while the Federal Reserve can cut rates in 2025—will remain a market driver. Technically, the 1.3425-1.3415 support area is key to sustaining the bullish trend, and a breakdown from there may clear the way towards 1.3300. On the other hand, a breakout above the psychological level of 1.3500 may inspire new buying interest, paving the way for a test of resistance around 1.3600.

Watch for the release of the US PCE Price Index, which has the potential to trigger GBP/USD volatility in light of differing Fed and BoE policy expectations. Support at 1.3425-1.3415 remains key, while a move through 1.3500 would indicate resumed bullish pressure to 1.3600.

• GBP/USD is hovering below 1.3500 in light of conservative USD purchasing in advance of the US PCE inflation report.

• Divergent policies at central banks: BoE likely to freeze rate increases, whereas the Fed is expected to cut rates in 2025.

• Traders are expected to wait for new positions until the US PCE Price Index announcement provides clarity on inflation trends.

• Support at 1.3425-1.3415 is technical and presents opportunities to buy for bulls.

• A break below here may bring further losses towards the 1.3300 level, just below the 61.8% Fibonacci retracement.

• Unwavering strength over 1.3500 may prompt renewed bullish pressure targeting 1.3600 resistance.

• The 1.3540-1.3600 area is the critical hurdles for bulls to breach to reinstate the longer-term uptrend.

GBP/USD is posting cautious action before the widely awaited US Personal Consumption Expenditure (PCE) Price Index release, an important inflation gauge whose release could have a considerable bearing on market mood. Market players are on their guard as anticipation varies between the Federal Reserve, which is expected to weigh reducing interest rates in 2025, and the Bank of England, which will probably delay additional rate action for the time being. These contrasting outlooks are helping to balance the currency pair’s performance and limit any major shifts.

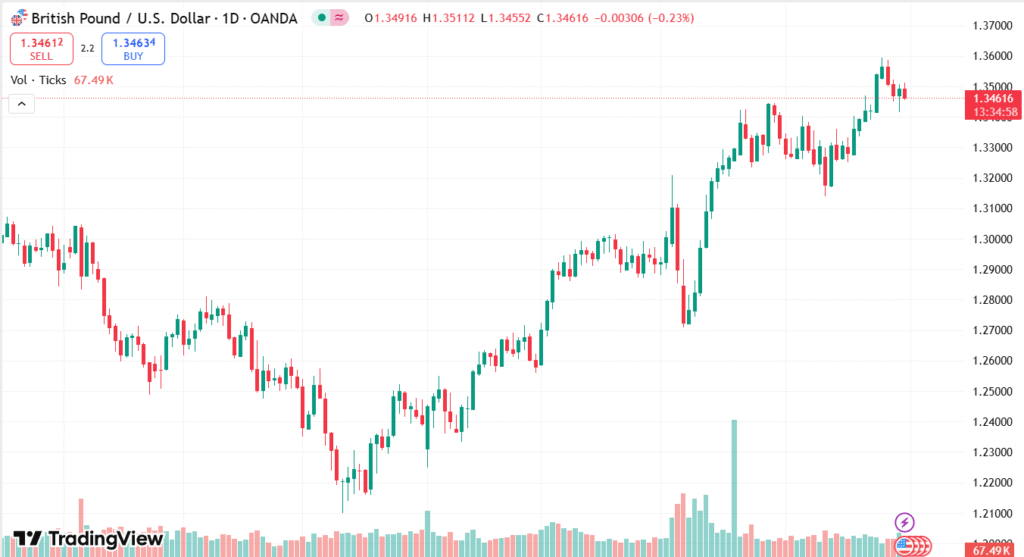

GBP/USD DAILY PRICE CHART

CHART SOURCE: TradingView

Market participants are expected to adopt a wait-and-see approach until the US inflation data is released, given its potential to influence the US dollar’s trajectory. The general tone implies a guarded optimism for the British Pound, underpinned by the Bank of England’s more tempered approach relative to the Fed’s longer-term prospects of easing. With investors hedging their bets on future economic events, the GBP/USD is still vulnerable to changes in US inflation direction and central bank attitudes.

TECHNICAL ANALYSIS

GBP/USD is presently moving around crucial support and resistance levels that are determining its short-term trajectory. Although short-term momentum indicators indicate some downward pressure, the pair is underpinned by significant retracement levels that have been historical zones of purchase. A conclusive break through the 1.3500 psychological level would be a sign of strength and should stimulate new buying interest, at least to take the pair higher. On the other hand, a fall below major support levels would leave the way open for more losses, underlining the significance of these technical levels in determining trader choice in the face of overall market indecision.

FORECAST

GBP/USD succeeds in holding above the major 1.3500 level, it might set the stage for more increases to the 1.3600 region. This is likely to draw new buying interest, as investors regain optimism in the British Pound as they believe the Bank of England will stick to its current policy stance for a longer period than the Federal Reserve. Further Pound strength could also be underpinned by any softer-than-actual US inflation figures, weakening the US Dollar and stoking a broader GBP/USD rally.

On the flip side, failure to stay above the support zone around 1.3425-1.3415 may see enhanced selling pressure, pushing GBP/USD down toward the level of 1.3300. Breach below this region would be an indication of a change in market sentiment, potentially signaling more robust US Dollar demand prior to the release of the US inflation report or anxiety about the UK economy. In that case, investors may get risk-averse, and the pair may come under additional pressure before any meaningful recovery is observed.