GBP/USD currency pair is trading near 1.3300 levels, with short-term momentum neutral as it moves close to the nine-day Exponential Moving Average (EMA). Nevertheless, the 14-day Relative Strength Index (RSI) is still greater than 50, a sign that the bullish tendency still lingers. A breakout above the near-term resistance at 1.3303 would set the stage for a push up to the psychological level of 1.3400 and higher. But a failure to hold above the present levels would bring attention on the downside, with the 50-day EMA level of 1.3054 being the critical level of support. A break below this level would precipitate further losses down to the April and March lows, indicating a potential change in medium-term sentiment.

KEY LOOKOUTS

• A clear breakout above the nine-day EMA would reinforce short-term positive momentum and set the stage for a challenge of 1.3400.

• A fall below this mark might signal diminishing medium-term momentum and would leave the pair vulnerable to further declines.

• This remains to indicate a bullish bias, but any fall below this level may see sentiment move to neutral or bearish.

• The key resistance at 1.3445 (April high) and support at 1.2708 (April low) and 1.2577 (March low) are still important for assessing the broader directional trends.

GBP/USD pair is at a decisive point, trading around the 1.3300 level with near-term resistance at the nine-day EMA of 1.3303. The breakdown above this level may boost short-term bullish strength, pushing the pair to the psychological 1.3400 level and April high of 1.3445. But if the pair fails to break higher, it could trigger fresh selling pressure, especially if it plummets below the 50-day EMA of 1.3054, a major medium-term support. Even with the 14-day RSI holding above 50, bearish sentiment remains in view for now, although traders need to keep a close eye on price movements near these technical levels for more definitive directional signals.

GBP/USD remains around 1.3300, resisting at the nine-day EMA level of 1.3303. A breakout may reach 1.3400, and support at 1.3054 continues to be important in keeping the bullish momentum intact. The RSI value above 50 continues to indicate a bullish bias.

• GBP/USD remains around 1.3300 in the Asian session, indicating consolidation after the recent rise.

• The nine-day EMA level of 1.3303 is the initial important resistance level.

• The 14-day RSI is still above 50, reflecting underlying bullish momentum.

• A break above 1.3303 may see a test of 1.3400 and potentially the April high of 1.3445.

• Initial support is at the 50-day EMA of 1.3054, a key level for medium-term momentum.

• A break below 1.3054 may see the pair fall to the April low of 1.2708 and the March low of 1.2577.

• The short-term trend is still neutral, waiting for a clear break above resistance or below support to determine direction.

GBP/USD currency pair continues to remain stable around the 1.3300 level, showing cautious optimism among traders. Market players are still keen on observing wider economic trends and policy cues from both the US and the UK, which may determine the next leg of the currency pair’s trajectory. Faith in the British economy, along with prevailing expectations regarding interest rate moves, is crucial in sustaining the pair’s present tone.

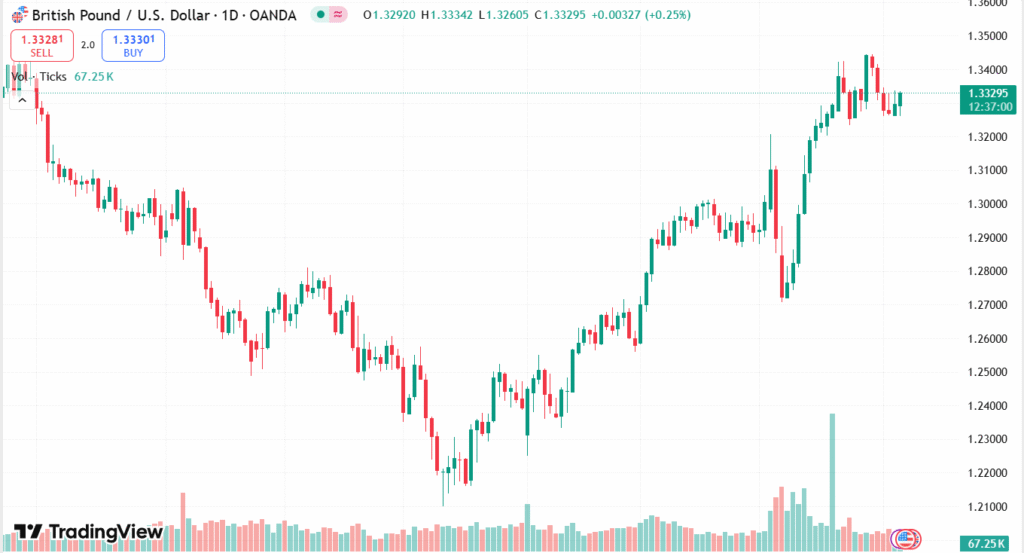

GBP/USD DAILY PRICE CHART

CHART SOURCE: TradingView

On the international front, investors are keeping a close eye on geopolitical events, inflation reports, and central bank rhetoric, all of which drive broad market sentiment. The GBP/USD is still responsive to changes in risk appetite and macroeconomic direction, with traders looking for clarity before taking firm directional positions. Stability in both economies and policy clarity in the near term will be critical in deciding the pair’s next direction.

TECHNICAL ANALYSIS

GBP/USD currency pair is steady as investors look towards overall economic and geopolitical trends that may shape market sentiment. Issues like forthcoming economic releases, policies by central banks, and worldwide risk appetite are dominating investor expectations. Investors are remaining wary and waiting for stronger indications from the UK as well as the US economies before taking stronger stances. Consequently, the currency pair remains trading in a relatively stable range, indicating a wait-and-see attitude in global financial markets.

FORECAST

If market sentiment continues to be positive and economic indicators in the UK remain resilient, the GBP/USD pair may pick up momentum and move above key resistance levels. A continued rise could move the pair toward the psychological barrier of 1.3400, with additional potential to touch the recent high around 1.3445. Favorable news like improved UK GDP growth, softening U.S. inflation, or dovish tones from the Federal Reserve are all potential drivers of further strength in the pair.

Conversely, if the pair fails to hold support or if the bearish news arises—e.g., poor UK economic data, increasing U.S. yields, or escalated geopolitical tensions—GBP/USD may once again face pressure. A fall below key support levels would set the stage for a movement towards 1.3050 and progressively test lower ranges witnessed earlier in the months, e.g., 1.2708 or even 1.2577. Any move in the direction of a more hawkish U.S. monetary policy would also hit the pound hard, making further downside even more likely.