GBP/USD currency pair remains firm above mid-1.3500s as investors wait for pivotal economic events, such as the UK CPI data and the forthcoming monetary policy announcements of both the Bank of England (BoE) and the US Federal Reserve (Fed). While dovish BoE hopes and recent weaker UK economic figures press on the British Pound, the US Dollar is also capped by increasing speculation of a September Fed rate cut. With recent mixed fundamentals and increased market risk aversion, the pair remains in a tight range, as investors hold back from taking firm positions in anticipation of such significant risk events.

KEY LOOKOUTS

• Inflation data will be carefully observed for guidance on the BoE’s future policy action. A lower print would reinforce rate cut bets.

• Market attention remains on whether the BoE hints at a rate cut trajectory in light of recent developments of economic slowdown in the UK.

• Any dovish message or confirmation of a September rate cut can pressure the USD and underpin GBP/USD.

• Continued Middle East tensions and global trade uncertainties could drive safe-haven demand for the US Dollar.

The GBP/USD pair is stuck in a range above the mid-1.3500s as traders prepare for a week of high-impact economic events. The next UK inflation figures and the Bank of England’s policy meeting should provide pivotal guidance for the British Pound, particularly in light of rising bets on a rate cut in light of soft economic data. At the same time, the US Federal Reserve’s rate decision will dictate the near-term direction of the US Dollar, which has come under pressure from anticipation of September easing. With mixed signals and general geopolitical worries, market participants are being cautious, holding the pair in a narrow trading range.

GBP/USD hovers in a tight range over the mid-1.3500s as markets wait for the UK CPI and central bank action. BoE rate reduction hopes and dovish Fed sentiment keep both USD and GBP action contained. Traders sit on the sidelines in anticipation of significant event risks this week.

• GBP/USD maintains its position above mid-1.3500s, without apparent intraday direction.

• The pair is close to a three-year high, consistent with recent GBP strength.

• Wednesday’s UK CPI data will be an important guide for BoE policy expectations.

• BoE is likely to turn dovish in the face of dismal UK economic statistics.

• Fed policy announcement on Wednesday can influence USD action heavily.

• Market is expecting a possible Fed rate cut by September, capping USD advances.

• Increasing Middle East tensions underpin USD’s safe-haven demand but limit volatility.

The GBP/USD currency pair is in a period of consolidation as investors wait for a string of important economic events this week. Market participants are most keenly interested in the publication of the UK’s consumer price index (CPI) figures and the Bank of England’s monetary policy meeting, both of which should give important clues about the direction of interest rates in the UK. Recent evidence of UK economic contraction has grown speculation on the BoE’s potential to cut policy stance ahead of schedule, shaping sentiment towards the British Pound.

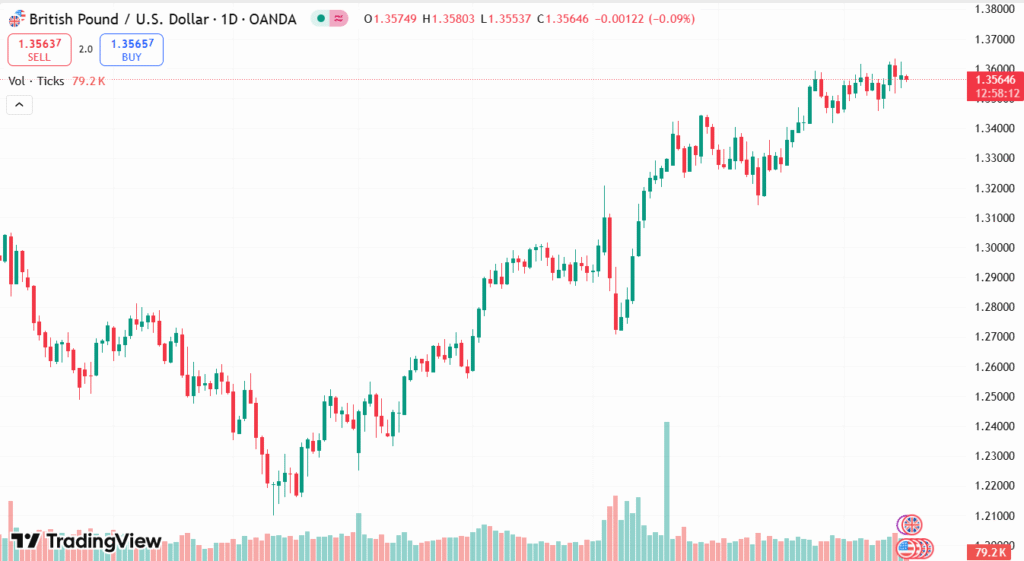

GBP/USD DAILY PRICE CHART

SOURCE: TradingView

Conversely, the US Federal Reserve policy release is also under scrutiny, as market players seek directions regarding when possible rate cuts would be implemented later in the year. Although the US Dollar is held up by safe-haven appetite amidst geopolitical risks, hopes that the Fed would shift towards more accommodative policies are holding back aggressive bullish pressure. The overall market is reflecting a defensive tone as traders hold back from placing big bets until there is greater clarity from these crucial central bank events.

TECHNICAL ANALYSIS

GBP/USD remains in a very tight consolidation range just above the mid-1.3500s with a lack of strong momentum. The pair is still near its recent multi-year high, reflecting underlying bullishness, but the failure to break suggests indecision on the part of traders. Support is near the 1.3550 level and resistance near the recent high at 1.3600. A continued advance above this resistance would potentially set the stage for more upside, while a breakdown below support may indicate short-term weakness in front of the Fed and BoE announcements.

FORECAST

If the coming UK CPI data suprises to the higher side or the Bank of England takes a less dovish tone than anticipated, the British Pound might pick up speed. Moreover, anything the Federal Reserve suggests that there is a longer horizon before rate cuts would act to reinforce GBP/USD upside as well. Under these circumstances, the pair may break through recent highs and aim for levels above 1.3600, provided global risk sentiment should revive.

On the other hand, a softer-than-anticipated UK inflation reading or definite indications of future rate reductions by the BoE will heavily burden the Pound. Should the Fed hold a relatively aggressive stance or geopolitical tensions escalate, US Dollar demand might be elevated, pushing GBP/USD down. A breach of the 1.3550 support will potentially usher in further losses towards the 1.3500 psychological level and maybe even lower.