GBP/USD rose on Tuesday, trading at 1.3485, as weaker US Dollar sentiment and positive UK labor market data underpinned the pair. The recent US CPI report revealed headline inflation remained at 2.7% YoY in July, and core CPI accelerated to 3.1%, leading markets to increase the likelihood of a Federal Reserve rate cut in September to 94% as per the CME FedWatch Tool. In the UK, high wage growth and an unexpected decline in jobless claims canceled out hints of labor market weakness, further supporting the Pound. Different monetary policy directions between the Bank of England’s dovish easing strategy and increasing Fed dovishness are one of the prime drivers behind the currency pair’s resilience before UK GDP and US jobless claims releases later this week.

KEY LOOKOUTS

• July CPI remained unchanged at 2.7% YoY, although core CPI increased to 3.1%, lifting September Fed rate cut probabilities to 94%.

• Robust wage growth and declining jobless claims supported GBP even with increased unemployment rates.

• BoE’s conservative easing stance is the reverse of increasing Fed dovishness, supporting GBP/USD rallies.

• UK GDP and US weekly jobless claims will be important for the pair’s near-term direction.

GBP/USD accelerated higher on Tuesday, hitting close to 1.3485, as a weaker US Dollar and good UK labor market data supported the pair. The US CPI report in July revealed headline inflation unchanged at 2.7% YoY, with core CPI rising to 3.1%, sending market hopes of a September rate cut by the Federal Reserve to 94%. In Britain, wage growth remained strong and unemployment claims decreased unexpectedly, which balanced fears of high levels of unemployment. The monetary policy divergence—BoE’s cautious loosening compared to the increasing dovishness at the Fed—is still being supported by the Pound, with the public now looking to future UK GDP and US jobless claims for new market directions.

GBP/USD reached close to 1.3485 on Tuesday as solid UK wages growth and less bullish US Dollar sentiment supported the pair. US CPI statistics bolstered September Fed rate reduction forecasts, while UK labor market stability underpinned Pound vigor in advance of significant GDP and jobless claims data.

• GBP/USD was close to 1.3485, 0.37% higher on Tuesday.

• US July CPI remained unchanged at 2.7% YoY; core CPI hit 3.1% from 2.9%.

• Market probability of a September Fed rate cut rose to 94% from 84%.

• UK pay growth remained firm at 5.0% YoY, as expected.

• UK unemployment claims dropped by 6,200 in July, contrary to expectations.

• BoE reduced rates to 4.00% in August but signaled a pace of gradual easing.

• Traders now look to UK GDP and US unemployment claims for new direction.

The British Pound rallied against the US Dollar on Tuesday following the issuance of critical economic statistics from both the UK and the US. In the UK, robust wage growth and a surprise fall in jobless claims tempered fears of soaring unemployment. The most recent data revealed that companies created more jobs than initially anticipated, and this has reflected the resistance of the labor market to the subtle signs of losing momentum. Conversely, the US Dollar was pressured by inflation data that reaffirmed hopes for a Federal Reserve interest rate cut in September, and increasing investor confidence in the Pound.

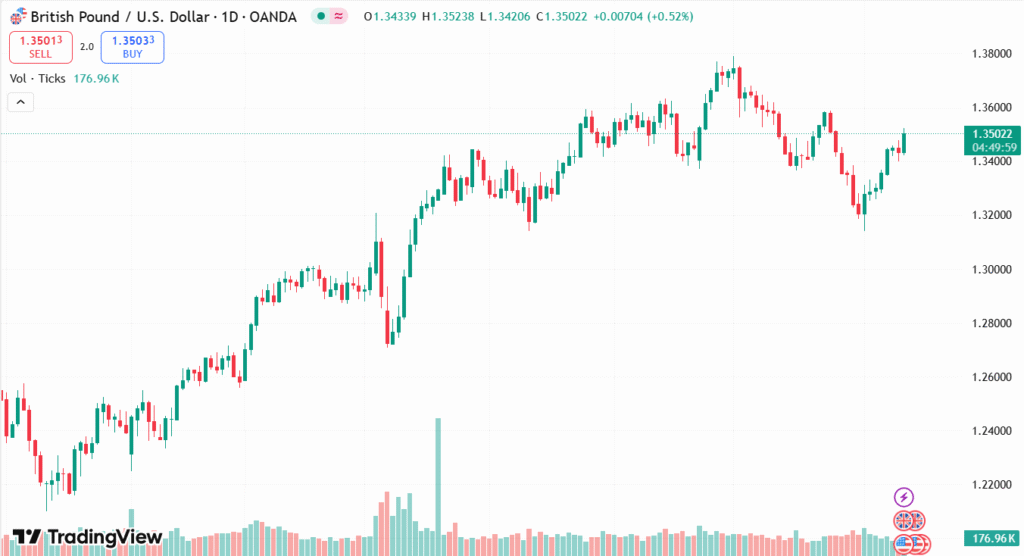

GBP/USD DAILY PRICE CHART

SOURCE: TradingView

The policy divergence between the Federal Reserve and the Bank of England continues to be a key theme for markets. While the BoE recently reduced rates but communicated a measured, gradual path to further easing, the Fed is growing increasingly likely to restart policy easing in the near future. This divergence has served to underpin sentiment for the Pound over recent sessions. Market focus then shifts to tomorrow’s UK GDP report and US jobless claims figures, which may offer additional insight into economic direction and shape investor positioning in the near term.

TECHNICAL ANALYSIS

GBP/USD is maintaining above the crucial psychological level of 1.3450, and near-term resistance is found around 1.3500, a move above which can pave the way towards the 1.3550 region. The opposite way, first support is at 1.3430, followed by a solid base around 1.3400. Momentum indicators continue to be positive, with RSI still lingering in bullish territory and price action continuing to trade above the 50-period moving average on the 4-hourly, indicating that short-term buying interest is still firm.

FORECAST

If bulls hold firm, GBP/USD may push through the 1.3500 psychological level, opening the door for a push towards the 1.3550–1.3570 resistance region. Persistent buying interest, underpinned by robust UK GDP data or dovish Fed rhetoric, may even take the pair higher towards 1.3600 in the short term. Favorable risk appetite and continuous policy divergence between the BoE and Fed would also add further fuel to the pair’s appreciation.

On the other hand, a fall below 1.3450 might unleash a corrective pullback to 1.3430, with further losses targeting the 1.3400 support. A higher-than-expected US jobless claims figure or comments from Fed officials that are more hawkish might rekindle Dollar demand and cap Pound gains. A fall through 1.3400 would switch short-term direction to a more bearish bias.