GBP/USD is ranging above 1.3450 following a three-day winning streak being snapped, as the US Dollar gained strength on the back of July’s PCE inflation report. Core PCE increased 0.3% month-on-month and 2.9% year-on-year, its best since February, while headline PCE increased 0.2% monthly, leaving the yearly rate unchanged at 2.6%. More-than-expected individual spending and consistent income expansion showcased robust consumer demand, backing the Greenback. In spite of Sterling pulling back from multi-session highs, the pair still stays firm above 1.3450, as traders find the inflation outcomes to be mostly priced in.

KEY LOOKOUTS

• GBP/USD stabilizes above 1.3450 despite ending a three-day winning run as the US Dollar picks up momentum.

• US Core PCE inflation increases to 2.9% YoY, the highest since Feb, while headline PCE remains unchanged at 2.6%.

• Personal expenditure increases by 0.5% in July, indicating strong consumer demand amidst weaker labor market conditions.

• Levels of support lie at 1.3400 and 100-day EMA at 1.3368; levels of resistance are at 1.3530 and 1.3594.

GBP/USD remains flat at 1.3450 on Friday after ending a three-day winning spree, as the US Dollar firmed up after July’s PCE inflation report came out. The statistics revealed core PCE rising to 2.9% compared to last year, its best since February, while headline PCE remained steady at 2.6%. Improved personal spending and personal income growth highlighted a buoyant consumer demand, providing additional support to the Greenback. While Sterling has retreated from recent highs, the pair’s continued trade above 1.3450 implies that much of inflation result was already priced in, leaving price action relatively subdued.

GBP/USD is consolidating above 1.3450 following US PCE inflation data generally in line with forecasts. The Dollar was supported by firmer personal spending, while Sterling remained firm, implying limited market response to the report.

• GBP/USD breaks three-day success streak but remains strong over 1.3450.

• US Core PCE inflation increased 0.3% MoM and 2.9% YoY, the highest since February.

• Headline PCE was up 0.2% MoM, maintaining the annual rate at 2.6%.

• Personal spending increased 0.5% in July, beating the forecasted 0.3%.

• Personal income increased 0.4% MoM, demonstrating consistent consumer strength.

• The US Dollar Index rose back around 98.00, supporting the Greenback’s bullishness.

• Technicals indicate support at 1.3400 and resistance at 1.3530 and 1.3594.

The British Pound is ranging above 1.3450 after shedding some speed against the US Dollar after the release of US PCE inflation figures. The report revealed that core inflation reached 2.9% year-over-year in July, its peak since February, while headline PCE remained unchanged at 2.6%. These data were mostly in line with forecasts, tempering any dramatic market reaction but solidifying the perception that inflation is sticky. Concurrently, consumer spending increased 0.5% and incomes increased by 0.4%, demonstrating US household resilience in spite of a softening labor market.

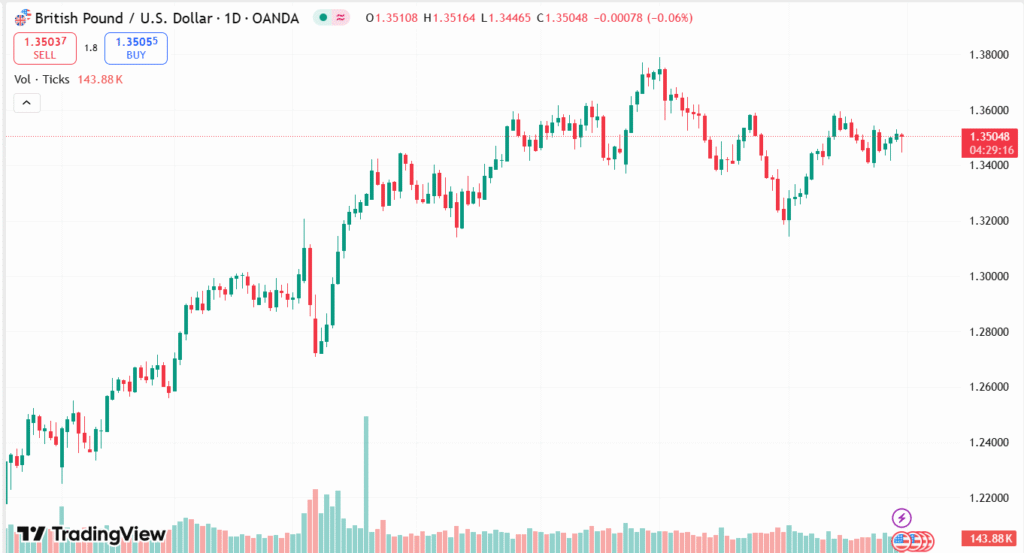

GBP/USD DAILY PRICE CHART

SOURCE: TradingView

Stronger consumer data supports the US economy’s continuation of stability and lent support to the US Dollar that henceforth dragged Sterling’s recent momentum. Though the British Pound has retreated from recent highs, that it has held firm is a testament to the truth that most of the inflation figures were already factored into markets. Generally, the lackluster reaction is a signal that investors are now looking to future US employment figures as well as central bank policy cues for clearer guidance.

TECHNICAL ANALYSIS

GBP/USD is being supported around the 1.3450 level, with firmer downside support at 1.3400 and the 100-day Exponential Moving Average (EMA) at 1.3368. On the upside, the first resistance is at 1.3530, followed by the August 14 high at 1.3594. A clear break above these levels would leave the way open for another bout of bullish pressure, whereas inability to hold 1.3400 might cause deeper corrective pressure towards lower support levels.

FORECAST

If GBP/USD is able to stay above 1.3450 support and continues to gain traction, the pair may test the 1.3530 resistance area again. Breaking above this level successfully might lead the way towards 1.3594, August mid-month high, which indicates more bullish potential. Better risk appetite or weaker US data in subsequent sessions might give Sterling more strength against the Dollar.

Conversely, if bears strengthen and push GBP/USD below 1.3450, the subsequent major support is at 1.3400, then the 100-day EMA around 1.3368. A move below these would mark bearish influence and could leave the pair vulnerable to further corrective activities. Better US Dollar demand on the back of economic robustness or hawkish Fed sentiment could continue to keep Sterling pressured in the near term.