Gold (XAU/USD) has rallied above the $3,300 level after it reached a one-month low, fueled by fresh safe-haven demand with heightened global trade tensions on the back of the August 1 tariff deadline. The rally follows as the US Dollar weakens from recent highs and markets respond to President Trump’s tough tariff moves on nations such as India and Brazil. At the same time, uncertainty over trade deals, especially with China, and dovish hints from the Federal Reserve have left market sentiment weak. In spite of the Fed not raising rates, declining bond yields and robust institutional appetite, as captured in World Gold Council data, have also aided gold’s rebound.

KEY LOOKOUTS

• Markets wait for final US tariff announcements, which can greatly influence risk sentiment and safe-haven investment into gold.

• Investors watch the Core PCE Price Index and Initial Jobless Claims for new clues on inflation and the policy direction of the Fed.

• XAU/USD continues to be stuck between $3,250 and $3,450, and a break above $3,350 or break below $3,250 will most likely determine the next trend.

• Ongoing institutional buying, particularly through gold ETFs and central bank reserves, will be important in maintaining bullish momentum.

Gold is trading around $3,306 after recovering from a one-month low, buoyed by fresh safe-haven demand as global trade tensions increase ahead of the August 1 deadline for US tariffs. President Trump’s aggressive tariff policies against India, Brazil, and other countries have spooked markets, while a softer US dollar and falling Treasury yields are also helping gold’s rebound. Investors are now waiting closely for major US inflation data and Fed remarks for additional guidance. Gold continues to be stuck in a range from $3,250 to $3,450, even with recent volatility, with institutional buying and central bank demand still offering underlying support.

Gold is recovered above $3,300 as safe-haven demand rises and trade tensions escalate. Markets are waiting for August 1 tariff announcements and important US inflation numbers for additional guidance. The metal is stable between $3,250 and $3,450.

• Gold recovers to $3,306 after falling to a one-month low of $3,268 due to renewed safe-haven demand.

• US deadline for tariffs approaches August 1, with markets anticipating last-minute announcements from President Trump.

• Aggressive trade actions are a 25% tariff on Indian imports and higher duties on Brazilian products.

• Fed leaves rates unchanged at 4.25%–4.50% with no evident timeline for possible cuts as pressures build regarding inflation.

• Bond yields fall, reducing the pressure on gold even as the Fed is taking a hawkish stance.

• Gold demand increased 3% YoY as ETF inflows and central bank buying drove H1 2025 performance.

• XAU/USD is range-stuck in between $3,250 and $3,450 with no clear momentum for breaking out.

Gold is gaining increasing popularity with investors as tensions regarding the trade and geopolitics rise internationally. The focus has remained with the impending August 1 tariff deadline, with President Trump to reveal last-minute actions against nations such as India, Brazil, and others. This action has increased uncertainty in the market and restored demand for safe-haven investments in gold. Furthermore, the US has completed trade agreements with a number of countries, including South Korea, Japan, and the European Union, but talks with China are ongoing, contributing to the general sense of uncertainty.

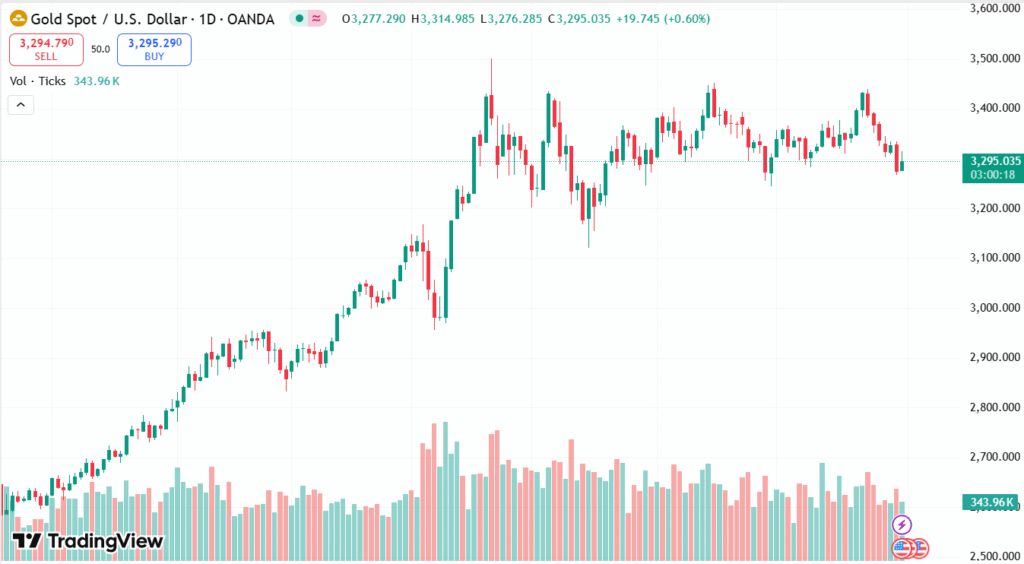

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

At the same time, macroeconomic numbers and central bank rhetoric are adding to the allure of gold. The Federal Reserve has recently left interest rates unchanged and signaled vigilance on future policy action, citing ongoing risks from inflation. Investors are also keeping a close eye on several imminent US economic releases, including the PCE Price Index and jobless claims, which are likely to affect sentiment. Gold’s function as an inflation and uncertainty hedge remains popular among retail and institutional investors alike, as evidenced by the robust flows into gold ETFs and ongoing central bank demand.

TECHNICAL ANALYSIS

Gold (XAU/USD) is trading in a clearly established sideways channel between $3,250 and $3,450, suggesting market indecision. The $3,250 level is solid support after having witnessed substantial buying interest in the past, and nearest resistance is at $3,350, which coincides with the 20-day Simple Moving Average as well as the middle Bollinger Band. The Relative Strength Index (RSI) is at 44, reflecting neutral to mildly bearish momentum, and the very low Average Directional Index (ADX) reading of 11.28 indicates weak trend. Unless there’s a clear breakout above resistance or breakdown below support, gold is likely to remain range-bound in the short term.

FORECAST

If the trade tensions further intensify and the US Dollar drops on negative economic data, Gold may break above the resistance level of $3,350. A clear break above this region may set the stage for the higher zone around $3,450, and if the momentum picks up, a retest of the all-time high around $3,500 may be possible. Increased gold ETF inflows, increasing geopolitical tensions, and dovish changes in Fed sentiment may also contribute to a sustained upside.

On the flip side, if future US economic data makes the case for extended higher interest rates or trade-related threats dissipate through diplomatic agreements, Gold can lose safe-haven demand. Breaking below the $3,250 support will set off additional losses towards $3,150, which can serve as the next support cushion for buyers. Further, picking up Treasury yields and an uptick in the US Dollar will push gold prices down in the near future.