Gold (XAU/USD) is consolidating below its all-time high of $3,578.50 as traders take profits and the US Dollar remains firm, tempering recent bullish momentum. Despite the respite, safe-haven demand is supported by softening US Treasury yields, tranquil global bond markets, and expectations of a Federal Reserve rate cut in September. With investor attention now on the ADP Employment report and upcoming Nonfarm Payrolls, labor market data will be crucial in determining near-term direction for Gold prices.

KEY LOOKOUTS

• ADP Employment and Nonfarm Payrolls will be instrumental in deciding Gold’s next move.

• Markets price in high probability of a September rate cut, supporting safe-haven demand.

• A firm Dollar and softening bond yields continue to shape Gold’s short-term path.

• Calmer conditions in Japan and the UK lower safe-haven rush but support amid persistent fiscal risks.

Gold prices are taking a breather below record highs as investors weigh profit-taking against persistent safe-haven demand. While the US Dollar’s firmness is weighing on sentiment, softer Treasury yields and tranquil global bond markets are helping to cushion the downside. With the Federal Reserve widely anticipated to cut rates in September, attention now shifts to US labor market data, including the ADP Employment report and Nonfarm Payrolls, which are poised to guide Gold’s near-term direction.

Gold is consolidating below its record high as traders wait for key US labor market data. Softening Treasury yields and Fed rate cut expectations support safe-haven demand, while the US Dollar’s firmness caps upside momentum.

• Gold reached a record high of $3,578.50 before consolidating around $3,540.

• Profit-taking and a firm US Dollar are weighing on sentiment.

• Softening US Treasury yields are helping to cap downside pressure.

• Tranquil global bond markets lower safe-haven rush but still support Gold.

• Markets are pricing in a September Fed rate cut, supporting bullish bias.

• Investor attention shifts to ADP Employment data and Nonfarm Payrolls for labor market cues.

• Key support is at $3,500–3,450, while resistance remains at the record high of $3,578.

Gold is taking a breather after a record-breaking run that pushed prices to new record highs, with investors looking to the next US labor market data for direction. The yellow metal remains supported by hopes of a Federal Reserve rate cut in September, as cheaper borrowing makes it more attractive as a safe-haven asset. Softer global bond markets and declining US Treasury yields have also supported sentiment, keeping bullion demand well supported despite light profit-taking.

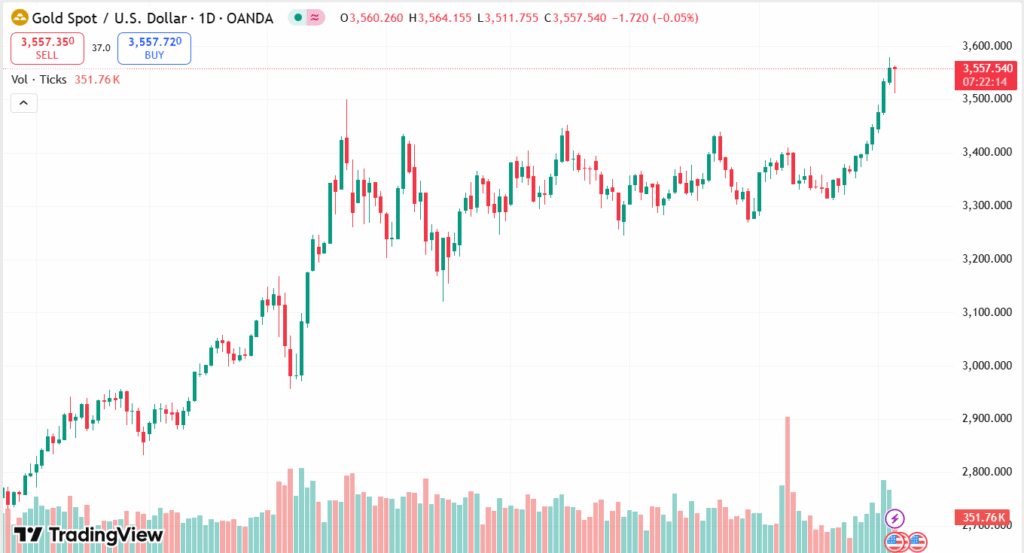

XAU/USD DAILY CHART PRICE

SOURCE: TradingView

The overall environment for Gold remains supportive as economic uncertainty, global trade tensions, and fiscal credibility concerns in major economies continue to underpin its status as a risk hedge. With markets already fully pricing in policy easing from the Fed, investors are now looking to the ADP Employment report and Friday’s Nonfarm Payrolls, which are expected to dictate the direction of Gold’s next move. Meanwhile, the safe-haven theme continues to underpin the precious metal.

TECHNICAL ANALYSIS

Gold (XAU/USD) is consolidating after its record high of $3,578.50, with momentum indicators pointing to a potential cooling phase. The Relative Strength Index (RSI) is still in overbought levels above 70 but is trending lower, indicating room for a pause or pullback. Prices are also testing the upper Bollinger Band at $3,543, indicating stretched bullish momentum and the potential for a retreat to the 20-day moving average at $3,398 if profit-taking intensifies. Immediate support is at $3,511 and $3,500, while resistance is at the $3,578 peak, with a breakout opening the way to the $3,600 level.

FORECAST

If US labor market data is softer than anticipated, Gold may regain strong bullish momentum as hopes for a September Fed rate cut intensify. A sustained break above the record high of $3,578 would open the way for a move to the psychological $3,600 level, with further potential for upside if safe-haven demand picks up pace amid continued global economic and fiscal uncertainties.

Conversely, more robust US jobs data or a more resilient US Dollar may provoke more aggressive profit-taking, sending Gold lower in the near term. Critical support levels are at $3,511 and the $3,500 psychological level, with a further drop potentially reaching the $3,450 area. A breakdown below these levels could indicate a more extensive correction, although the long-term bullish bias is still in place.