Gold prices slipped on Monday even as geopolitical risk rose after coordinated US airstrikes on Iran’s nuclear sites. The military attack, code-named “Operation Midnight Hammer,” hit major targets and evoked strong world reactions, including Iranian warnings to block the Strait of Hormuz, a vital world oil transit route. While geopolitical volatility usually supports safe-haven assets such as Gold, prices continue to be capped below the $3,400 level due to strengthening US Dollar and investor prudence in the face of key monetary policy testimony by Federal Reserve Chair Jerome Powell.

KEY LOOKOUTS

• Iran’s possible decision to close the critical oil chokepoint can destabilize global energy supply and increase risks to inflation.

• Markets look to Fed Chair Jerome Powell’s congressional testimony for hints regarding future interest rate policy in the face of inflation fears.

• XAU/USD refuses to overcome the $3,400 psychological level despite increased geopolitical tensions.

• Any Iranian retaliatory measures or escalation of conflict in the region might further increase safe-haven demand for Gold.

Gold prices are in a tight range beneath $3,370 as geopolitical tensions rise after the US military attacks on Iran’s nuclear complex. Although in the generally favorable setup for safe-havens, the precious metal can’t make headway owing to the stronger US Dollar and market risk aversion ahead of major economic events. Iran’s warning to shut the Strait of Hormuz has contributed to inflationary pressures by driving Oil prices up, potentially making global monetary policy choices more difficult. Traders are watching events in the Middle East closely and Jerome Powell’s upcoming testimony before Congress for additional market guidance.

Gold is holding below $3,370 even amid escalating geopolitical tensions following US attacks on Iran. Investor attention now turns to the Strait of Hormuz closure threat and Fed Chair Powell’s next policy testimony.

• Gold is trading lower below $3,370 as tensions between US and Iran escalate following US coordinated airstrikes on Iranian nuclear facilities.

• Operation Midnight Hammer involved major facilities in Fordow, Natanz, and Isfahan and received global condemnation and threats of retaliatory strikes.

• Iran threatens to shut the Strait of Hormuz, a key oil supply channel, with energy disruption and inflation concerns.

• Oil prices recover, backing safe-haven buying but not sufficiently to propel Gold beyond the $3,400 barrier.

• US Dollar strengthens, limiting Gold’s rally even amidst geopolitical tensions and risk aversion.

• Investors watch for cues on future interest rate policy from Fed Chair Jerome Powell’s testimony as inflation risks escalate.

• Gold’s major technical levels are resistance at $3,400 and support at $3,342, with a possible downside to $3,245 in case support is broken.

Middle East tensions escalated at the weekend after the United States mounted a coordinated attack on Iran’s nuclear facilities, raising global concerns about regional stability and energy security. The operation, which was confirmed by President Trump and code-named “Operation Midnight Hammer,” was aimed at key Iranian nuclear facilities, provoking withering criticism from world powers and raising the threat of retaliation from Iran. Iran’s parliament has voted to shut down the Strait of Hormuz—a critical shipping route for almost 20% of the world’s oil supply—ratcheting up the possibility of a wider geopolitical and economic crisis.

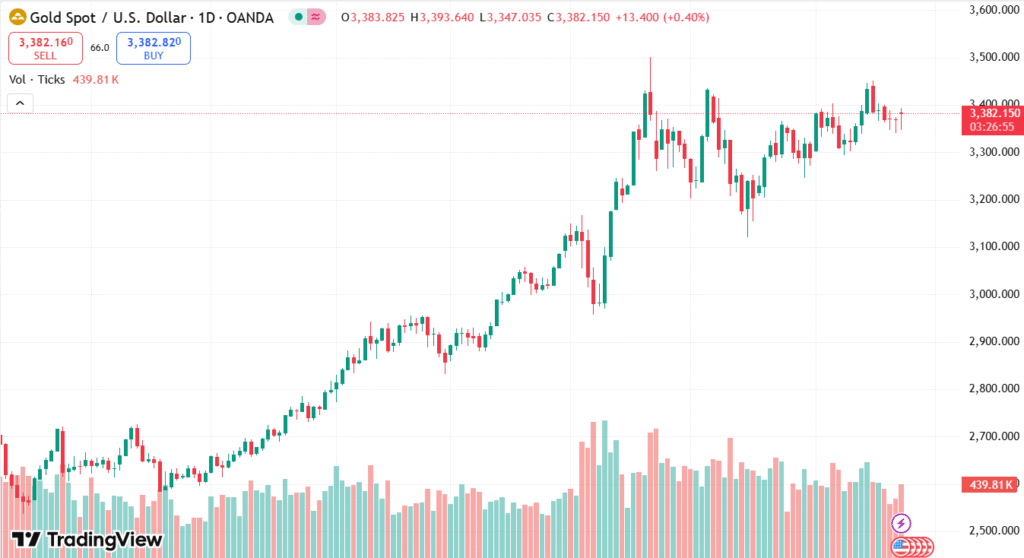

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Global markets are on tenterhooks as diplomatic fallout grows, with responses coming from the United Nations, China, and regional players. Though Iran has termed the strikes a sovereignty breach, its response is unclear, and investors closely follow the events. The heightened geopolitical tension has surged demand for safe-haven assets such as Gold, and inflation threats increase with the potential supply disruption in oil. Global policymakers, meanwhile face the mounting pressure to control inflation, now entwined with geopolitical tensions in the emerging situation.

TECHNICAL ANALYSIS

Gold XAU/USD is stuck below the strong psychological and structural barrier of $3,400. Until now, immediate support comes at $3,342, which also represents the 23.6% Fibonacci retracement of the February to April run. A break below this level can expose more downside to $3,321 (50-day SMA) and $3,245 (38.2% Fibonacci). A breakout above $3,400 on the upside can initiate fresh bullish momentum, aiming for the June high of $3,452 and even the all-time high around $3,500. Momentum indicators imply a neutral-to-caveat position as markets wait for clearer guidance.

FORECAST

If geopolitical tensions keep on rising—especially if Iran proceeds with its threat to shut down the Strait of Hormuz—Gold may witness fresh buying pressure as investors pour into safe-haven assets. A spike in Oil prices because of supply shocks could also fuel inflationary concerns, and this may keep central banks from cutting rates, boosting Gold’s popularity. At such a time, a move above the $3,400 level of resistance would pave the way for an advance to the June high of $3,452 and even test the record high at about $3,500.

On the flip side, if tensions start to ease through diplomatic means or Iran holds back on retaliatory moves, market anxieties could ease, cutting down on the need for safe-haven assets such as Gold. A stronger US Dollar, fueled by hawkish Fed rhetoric or positive economic data, may also pressure Gold prices. In such a scenario, a fall below the $3,342 level of support could see prices head lower towards $3,321 and even $3,245, depending on whether inflation worries ebb and rate-cut speculation gains ground.