Gold retreated below the $3,400 level on Wednesday, breaking a four-day rally as investors became wary with increasing U.S. Treasury yields, fresh tariff threats from former U.S. President Donald Trump, and Fed policy uncertainty. The gold metal ran into resistance at the psychological level, with pace slowing down even as geopolitics continued to remain tense and hopes were raised of a September rate cut. Weak U.S. economic indicators, such as ISM Services, and lingering inflation risks further dulled market sentiment, while rumors surrounding Fed leadership transition fuelled the defensive mood in money markets.

KEY LOOKOUTS

• Markets are closely observing for signs on a possible rate cut next month amidst conflicting economic data and political stress on the Fed.

• Trump’s new tariff threats—against pharma, semiconductors, India, and Russia—may trigger renewed trade tensions and affect safe-haven demand for gold.

• Gold is still struggling with the pivotal $3,400 level, with momentum indicators reflecting indecision and potential downside risks.

• The next nomination to fill departing Fed Governor Adriana Kugler’s seat could affect the policy tone at the Fed and cause market fluctuations.

Gold prices dipped slightly below the $3,400 level on Wednesday, ending a four-day uptrend as investors reevaluated the Federal Reserve’s policy path and responded to revived global trade tensions. The metal also encountered solid resistance near the psychological threshold, with advances capped by a firm U.S. Dollar and Treasury yield rebound before a crucial debt auction. Political risks increased after Fed Governor Adriana Kugler resigned and Trump’s hawkish tariff talk against various industries and nations. Expectations for a September rate cut remain intact, but the mix of economic uncertainty, inflation fear, and geopolitical events continues to instill a defensive trading tone for gold.

Gold took a breather, dipping below $3,400 levels as investors balanced Fed policy risks and fresh tariff threats from President Trump. Higher Treasury yields and conflicting U.S. economic data further contributed to market caution, limiting gold’s upside.

• Gold fell below $3,400 after rallying for four days, with strong resistance at the psychological level.

• U.S. Treasury yields rose, with the 10-year yield reversing from a three-month low.

• Trump ramped up tariff threats, versus pharma, semiconductors, India, and Russia, heightening geopolitics risk.

• ISM Services PMI declined to 50.1, marking stagnation in services and persisting labor market softness.

• Fed Governor Adriana Kugler stepped down, heightening uncertainty regarding the Fed’s course prior to the September policy meeting.

• Markets anticipate an 87% probability of a September rate cut, capturing anticipations of looser policy.

• Technicals indicate indecision, with gold consolidating close to support at the 50-day SMA and resistance in the region of $3,390–$3,400.

Gold prices continued to face pressure as investors became cautious amidst a jumbled array of political, economic, and monetary events. Former President Donald Trump rekindled global trade worries by using forceful tariff threats on imports of pharmaceuticals, semiconductors, and nations such as India and Russia. These remarks injected new layers of geopolitical uncertainty, and investors sat on their hands. In the meantime, U.S. economic data have provided mixed signals with the ISM Services PMI flattening in July and increasing input costs suggesting chronic inflation, further clouding the question of the strength of the U.S. economy.

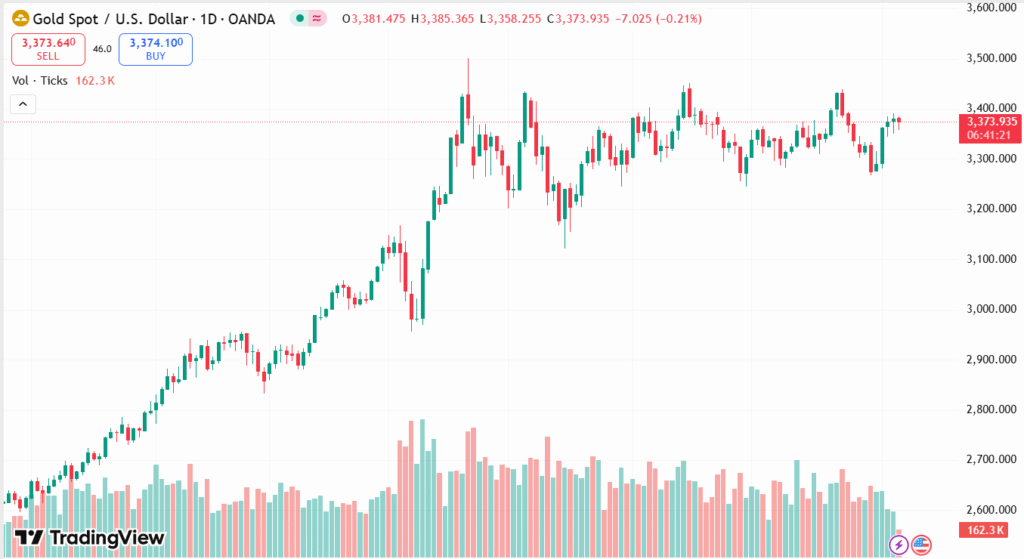

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

Aside from economic considerations, political events at the Federal Reserve have also commanded investor interest. The resignation of Fed Governor Adriana Kugler has left a key vacancy at a time of heightened market anxiety about imminent interest rate choices. Gossip regarding her replacement—plus Trump’s potential role in shaping the direction of the central bank—has served to further enhance the market’s conservative mood. With nothing significant on the horizon in terms of data releases, eyes now shift to future comments from Federal Reserve officials for possible hints at policy changes.

TECHNICAL ANALYSIS

Gold is now consolidating just above its 50-day Simple Moving Average (SMA) at $3,346, having been unable to hold the breakout above the resistance zone of $3,390–$3,400. The metal briefly broke below the lower trendline of an ascending triangle pattern last week but bounced back above the 100-day SMA near $3,282. Momentum indicators are still mixed, with the Relative Strength Index (RSI) fluctuating around the neutral 52 level, indicating a lack of strong directional polarity. The MACD is displaying initial signs of a recovery with a small bullish crossover, pointing to ebbing bearish pressure. A conclusive close above $3,400 may initiate a rally towards $3,450 or even retest all-time highs of around $3,500.

FORECAST

If gold can overcome the critical $3,390–$3,400 resistance level with solid volume, it may spark renewed buying pressure. A breakout success would tend to draw new buying interest, clearing the way toward $3,450. Continued advances above that may revisit the all-time high at about $3,500, particularly if geopolitical tensions continue and market expectations for a September Fed rate cut grow further.

On the negative side, if support at the 50-day SMA around $3,346 fails, gold could be vulnerable to further losses. Such a breach will set the stage for the retesting of the 100-day SMA around $3,282, which was a strong support level in the last week’s selloff. If bearish pressure grows stronger and prices sink below that, the subsequent targets would be close to $3,200 and $3,150, particularly if U.S. economic indicators surprise to the higher side or political uncertainty surrounding the Fed diminishes.