Gold continued to rise on Wednesday, propelled by speculation of further US Federal Reserve rate cuts and heightened geopolitical tensions. The metal drew dip-buyers despite a limited recovery in the US Dollar, which limited some upside following overbought conditions. Increased tensions surrounding the Russia-Ukraine conflict and heightened tensions in the Middle East strengthened gold’s safe-haven attract. Traders now look to a series of important US economic indicators, such as New Home Sales, Q2 GDP, Durable Goods Orders, and the Personal Consumption Expenditure (PCE) Price Index, due to impact near-term price action. In general, however, the least resistant path for gold is still higher, although resistance around the $3,800 level may challenge bullish pressure.

KEY LOOKOUTS

• Traders are monitoring US Federal Reserve signals closely, with markets hoping for possible rate cuts in October and December.

• Rising tensions in Ukraine and the Middle East are continuing to underpin gold as a safe-haven asset.

• Such important releases as New Home Sales, Q2 GDP, Durable Goods Orders, and PCE Price Index can impact gold and USD price actions.

• Gold encounters short-term resistance at the highest level of $3,800, with support of $3,710 to $3,750, which could dictate the future course of action.

Gold is still clinging to its gains as speculation of further US Federal Reserve rate cuts and sustained geopolitical tensions support the safe-haven metal. Even with a slight recovery in the US Dollar, gold attracted dip-buyers, solidifying its northbound push from the $3,750 area. Traders continue to eye important forthcoming US economic releases, such as New Home Sales, Q2 GDP, Durable Goods Orders, and the Personal Consumption Expenditure (PCE) Price Index, which may shape near-term price action. Despite strong bullish sentiment, resistance at the $3,800 level and support in the region of $3,710–$3,750 will be decisive in setting the direction of XAU/USD’s next move.

Gold is underpinned by hopes for Fed rate cuts and escalating geopolitical tensions, drawing dip-buyers despite a small USD recovery. Important resistance at $3,800 and support at $3,710–$3,750 will determine short-term prices.

• Gold moves further higher on US Federal Reserve rate cut hopes.

• Russia-Ukraine and Middle East conflict tensions enhance safe-haven demand.

• The modest US Dollar recovery could limit short-term XAU/USD upside.

• Gold is drawing dip-buyers in the $3,750 area.

• The $3,800 resistance level is poised to challenge bullish support.

• Levels of support range from $3,710 to $3,750, providing a solid foundation for dips.

• Near-term gold catalysts include the following US economic reports: New Home Sales, Q2 GDP, Durable Goods Orders, and PCE Price Index.

Gold is still gaining momentum as investors act on anticipations of more US Federal Reserve rate cuts and increased geopolitical uncertainty. Recent fighting in Ukraine and the Middle East has strengthened the attractiveness of gold as a haven asset, attracting the interest of purchasers wanting to hedge against uncertainty. The market is focused on Fed cues, with speculators expecting possible monetary easing later this year, which is bolstering gold’s underlying demand.

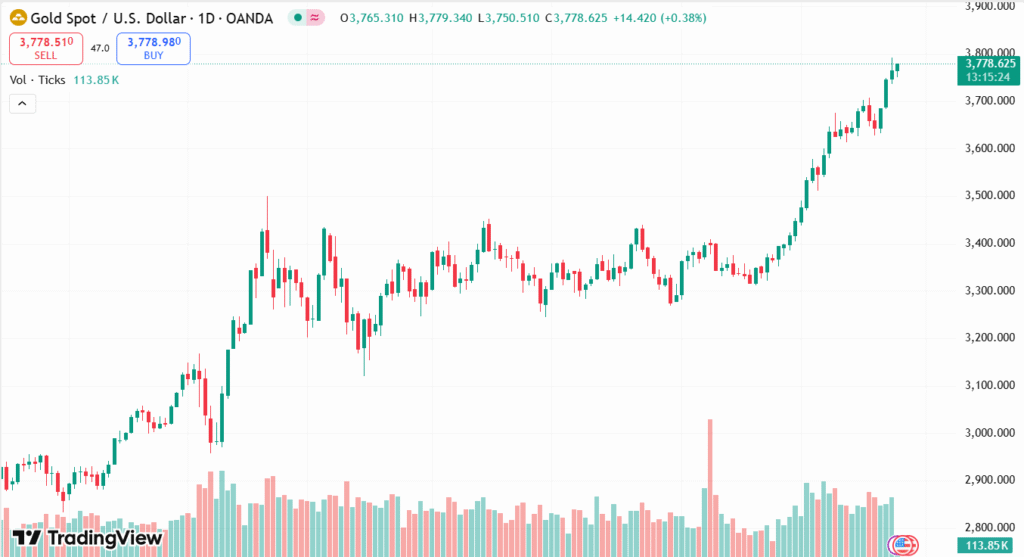

XAU/USD DAILY CHART PRICE

SOURCE: TradingView

Aside from geopolitical and monetary policy considerations, the coming US economic numbers would also shape sentiment. The New Home Sales, Q2 GDP, Durable Goods Orders, and Personal Consumption Expenditure (PCE) Price Index reports are eyed by market participants. In general, the mix of policy expectations, geopolitical tension, and major economic indicators is maintaining high interest in gold as a safe haven in times of uncertainty.

TECHNICAL ANALYSIS

Gold (XAU/USD) is floating above the $3,750 level of support, reflecting sustained bullishness in the near term. The short-term charts reflect overbought levels, and higher movements can be expected to encounter resistance near the $3,800 zone. A clear break above this mark can pave the way for further upsides, but a fall below the $3,750 region can probe support around $3,710–$3,700. On the whole, the technical configuration is looking cautiously bullish, with the main levels providing cues for prospective entries and exits for the traders.

FORECAST

Gold is likely to continue its upward trajectory as long as Fed rate cut expectations and geopolitical tensions remain supportive. A sustained move above the $3,800 level could attract further buying interest, potentially extending gains toward new highs in the near term. Strong demand from safe-haven seekers may reinforce bullish momentum, especially if upcoming US economic data remains soft or below expectations.

On the negative side, gold may come under pressure if the US Dollar hardens or Fed cues imply a reduced rate cut pace. A breakdown below the $3,750 support area may lead to follow-through selling, which can bring out the $3,710–$3,700 area. These important support levels need to be monitored closely by traders, as a strong break may open the doors to more severe corrective moves.