Gold continued its record-breaking run, spiking above $3,900 as safe-haven demand mounted in the wake of the persistent US government shutdown and political instability in France and Japan. XAU/USD hit a new all-time high of $3,949 before settling near $3,930, its eighth week in a row in the black. Investor sentiment is further underpinned by hopes of further Federal Reserve interest rate reductions this year, as a softer Japanese Yen and ongoing geopolitical tensions remain to fuel non-yielding Bullion demand. By and large, Gold’s market tone remains resolutely bullish, supported by robust ETF inflows, central bank buying, and increased market risk aversion.

KEY LOOKOUTS

• Ongoing funding gridlock and possible widespread job losses may continue to fuel safe-haven demand for Gold.

• Markets are pricing in two additional interest rate cuts during the year, underpinning non-yielding Bullion.

• Political changes in Japan and France are spurring volatility in the Yen and Euro, impacting the appeal of Gold.

• The $3,900 level serves as crucial support, while a breakout above $3,949 would propel Gold towards the $4,000 psychological barrier.

Gold maintains its record run, trading well over $3,900 as investors take cover from the US government shutdown and political instability in France and Japan. XAU/USD rose to a new high of $3,949 before stabilizing around $3,930, backed by anticipations of additional Federal Reserve rate cuts and a weakening Japanese Yen. Ongoing geopolitical tensions, constant central bank purchases, and increasing ETF inflows are maintaining safe-haven demand firm, supporting a short-term bullish case for Bullion.

Gold jumped above $3,900 as safe-haven demand increased on the US government shutdown and global political uncertainties. XAU/USD rose to a record high of $3,949, as expectations of more Fed rate cuts and ongoing geopolitical tensions fueled the rally.

• Gold (XAU/USD) continued its rally above $3,900, hitting an all-time high of $3,949.

• Safe-haven demand increased on account of the persistent US government shutdown.

• Political uncertainties in France and Japan buoyed Gold’s appeal.

• Markets are factoring in two additional Federal Reserve interest rate reductions this year.

• A depreciating Japanese Yen further boosted Bullion.

• The $3,900 level is present support, with $4,000 being an important psychological target.

• Increasing ETF inflows and central bank buying continue to support Gold’s bullish momentum.

Gold remains in the spotlight as it moves above $3,900, driven by increased safe-haven demand in the wake of global uncertainty. The current US government shutdown has caused market unease, while political developments in France and Japan have further increased risk aversion. These developments, coupled with the hopes of more Federal Reserve rate cuts, are enticing investors to rush into non-yielding assets such as Gold, propelling it to its spectacular rally.

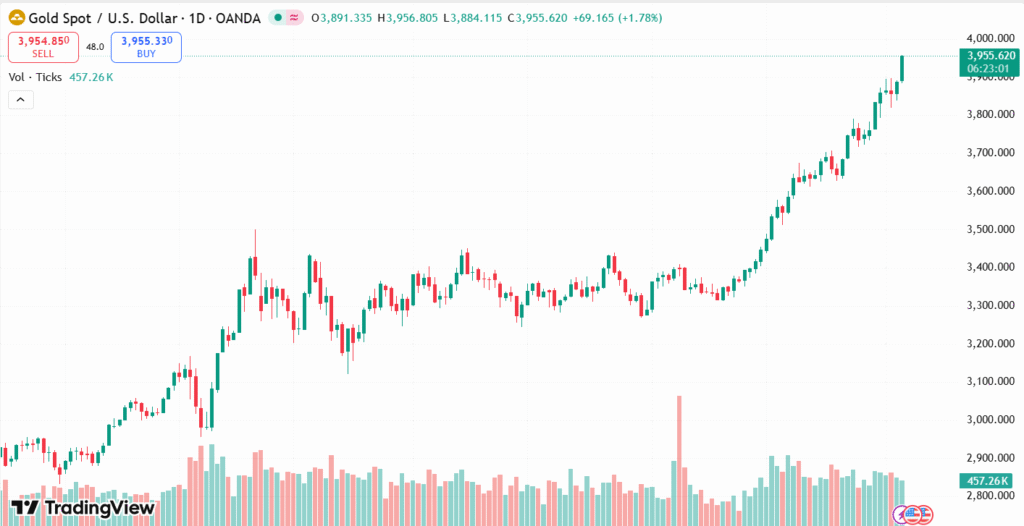

XAU/USD Daily Chart Price

SOURCE: TradingView

Aside from economic and political issues, investor sentiment is being underpinned by consistent central bank buying and increasing ETF inflows. The persistent buying shows Gold’s value in times of volatility as a store of value. With the world still wary in markets, Bullion continues to take advantage of its age-old position as a hedge against economic and geopolitical risks to remain a focus of traders and long-term investors.

TECHNICAL ANALYSIS

Gold (XAU/USD) continues to be in a solid bullish framework after a break above the $3,900 level, which now serves as the important support. The 21-period SMA of $3,879 and the 50-period SMA of $3,826 serve as extra floors, supporting the rally. XAU/USD hit a new record high of $3,949 briefly, and a break above this level on a sustained basis could make way for the psychological $4,000 level. The Relative Strength Index (RSI) is also at 69, below the overbought level, indicating that while short-term consolidation can take place, the overall bullish momentum is still in place.

FORECAST

Gold is expected to continue its bullish trend in the near term due to persistent safe-haven demand, more Federal Reserve rate cuts anticipated, and geopolitical tensions. Continued breaking above $3,949 could drive XAU/USD to the $4,000 psychological mark, drawing more buying interest from investors and traders.

Nonetheless, possible pullbacks cannot be eliminated. Any breakthrough in the US government shutdown, resolution of French or Japanese political tension, or a more-than-expected US Dollar strength might initiate short-term corrections. For that case, nearest support is in the area of $3,900, then the 21-period SMA at $3,879, and the 50-period SMA at $3,826, which might be floors for a coming rebound.