Gold prices are still in the doldrums even after a fleeting one-month high, due to optimism over a just-announced US-Japan trade agreement suppressing safe-haven buying. Despite positive global risk appetite and a small recovery in the US Dollar, anxiety regarding the Federal Reserve’s cut-rate trajectory and its autonomy remains supportive. Traders are waiting, however, for leading US housing figures and global PMI prints for further guidance. Technically, recent advances above the $3,400 mark indicate bull momentum is still in place, although further consolidation is likely to be seen close to important resistance levels.

KEY LOOKOUTS

• Hopes for the US-Japan trade deal continue to drive risk sentiment higher, lowering demand for traditional safe-haven assets such as gold.

• Uncertainty regarding the direction of Federal Reserve interest rates and fears regarding its autonomy are weakening the US Dollar, lending some support to gold prices.

• Gold’s short-term support is at around $3,400, with resistance established around $3,438–3,452. A breakout above would pave the way for retracing the all-time high of $3,500.

• Market players are looking at US Existing Home Sales and world flash PMIs for guidance on economic resilience and possible direction in the XAU/USD currency pair.

Gold prices are muted as a positive backdrop to the US-Japan trade agreement continues to improve global risk appetite, making safe-haven assets less attractive. In spite of this, concerns over the Federal Reserve’s interest rate trajectory and whether it can maintain its independence remain supportive of the precious metal. Though the US Dollar displays signs of a modest revamp, its general weakness in the face of diverging economic indicators restricts gold’s downside. The traders now wait for crucial data releases such as US Existing Home Sales and world PMIs for new cues that may have an impact on the subsequent directional movement in the XAU/USD pair.

Gold price is still in pressure due to positive sentiment from the US-Japan trade agreement lowering safe-haven demand. Uncertainty over the Fed rate-cut trajectory and a weaker US Dollar, however, continue to provide support. Market players now look to crucial economic data for new directional signals.

• Gold price fell after reaching a one-month high during the Asian session, dragged down by better risk appetite.

• US-Japan trade deal hopes have improved sentiment, lowering demand for havens such as gold.

• US Dollar registers a small rebound from two-week lows, imposing pressure on gold in early trading.

• Fears about the independence of the Fed and rate-cutting uncertainty are limiting aggressive gains in USD, supporting gold.

• Technical breakout above $3,400 indicates underlying bullish momentum in spite of intraday pullbacks.

• Resistance is immediate at $3,438–3,452, with scope for a push toward the $3,500 all-time high should it break.

• Market participants look to upcoming US housing data as well as global PMIs for new market direction and sentiment guidance.

Gold prices continue to come under pressure following the announcement of a wide-ranging US-Japan trade agreement, with the deal, including mutual tariffs and increased market access for major industries like autos and agriculture, having allayed investor concerns and diverted attention from safe-haven assets like gold. The change in sentiment is indicative of increasing enthusiasm regarding global trade stability and calls for investors to explore higher-risk opportunities.

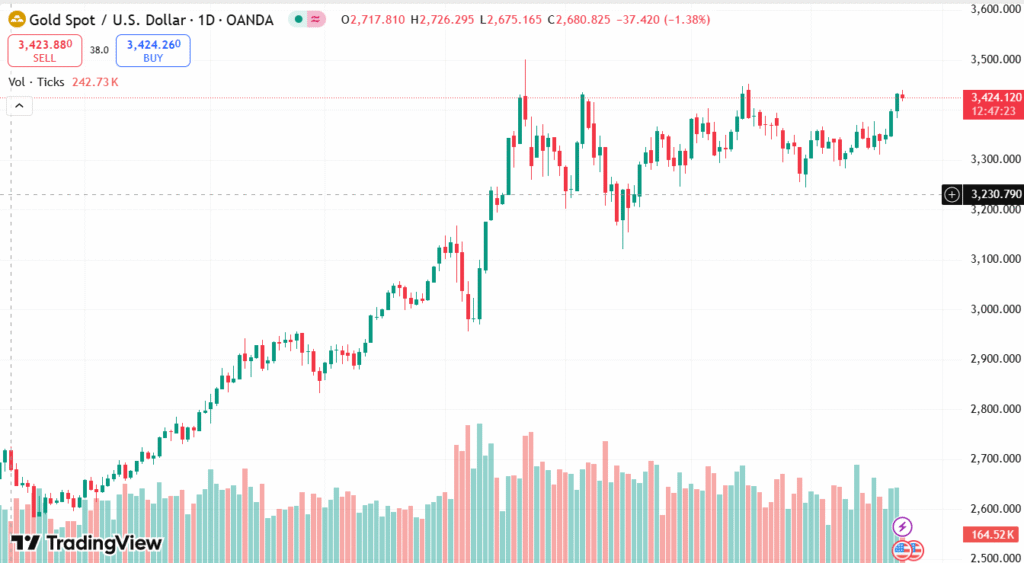

XAU/USD DAILY PRICE CHART

SOURCE: TradingView

The political tensions in the United States, however, continue to affect market dynamics. President Trump’s frequent demands for reduced interest rates and attacks on Federal Reserve Chair Jerome Powell had rekindled fears over the independence of the central bank. The uncertainty further increases with the pressure from Treasury Secretary Scott Bessent for an internal review of the Fed. All these advances have kept the US Dollar subdued, providing some underlying support to gold in spite of the brightening global atmosphere. Market players now seek shelter in key economic indicators to get further details on the overall outlook.

TECHNICAL ANALYSIS

Gold recently broke above the important horizontal resistance at $3,370 and passed the psychological $3,400 marker, which pointed towards bullish strength. Daily chart oscillators are still positive and bear no signs of overboughtness, which implies the possibility of further gains. The nearest resistance is located at $3,438–3,452, with a continuation past that likely setting the stage for the all-time high at $3,500. On the negative, the $3,400 level is now a solid support, followed by the $3,370 zone, which can cap any further pullback unless intense selling pressure surfaces.

FORECAST

If the bullish impetus holds good, gold may try to stage a new rally towards the near-term resistance levels of $3,438–3,452. The breakout above this area would most likely trigger further buying interest, paving the way for a move towards the psychological level of $3,500 — seen in April. Any further weakness in the US Dollar, dovish Fed speak, or new geopolitical tensions may serve as major catalysts triggering this positive move.

Conversely, inability to hold above the $3,400 level of support could induce short-term profit-taking and drive gold back to the $3,370 region — which has since become a key support-turned-resistance. A breakdown here could herald a more pronounced corrective cycle, potentially sending the price to the $3,340 level or below. Yet ongoing uncertainty regarding Fed policy and global risk factors might serve to cushion any significant decline in the immediate future.